China’s Party Platter of Reforms: Will China’s Leaders Save the Economy From Itself?

November 9, 2013 Leave a comment

China’s Party Platter of Reforms: Will China’s Leaders Save the Economy From Itself?

ALEX FRANGOS

Updated Nov. 7, 2013 11:24 p.m. ET

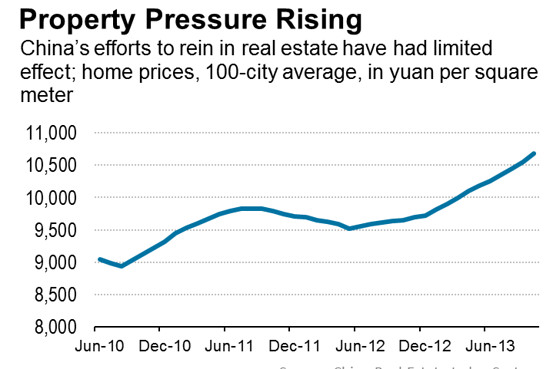

China’s Communist Party leaders are great talkers, and they’ll do plenty of gabbing behind closed doors this weekend at their “third plenum” in Beijing. The question is whether the talking at this potentially pivotal meeting turns into political momentum needed to save China’s economy from itself. The urgency is high. The economy continues to be driven by a dangerous combination of high debt, overinvestment and distortions in the way the country’s deep pool of savings is allocated toward state-owned companies and away from households.A key symptom of these problems: property prices, which Beijing can’t seem to get a handle on. Despite rounds of administrative controls and a national campaign of affordable home building, prices keep rising, up nearly 11% in October from a year earlier, according to China Real Estate Index System, a data provider. Curbs such as limits on second-home buyers in some cities to mortgages of no more than 30% of a purchase price miss the underlying cause. This is that Chinese savers have little choice in where to put their money outside property.

There is hope that the plenum, an important meeting in the life cycle of each five-year Party Congress, could bring real change in this area. Reform-minded leaders head the central bank, the finance ministry and the national development and reform commission, a powerful hub of state control of the economy. These forces could move, for instance, toward fully market-determined interest rates. Beijing has loosened controls on lending rates but sets deposit savings rates more or less by fiat.

Letting banks compete with higher deposit rates would shift income toward households, and reduce the mania for property by creating a safe investment return that beats inflation. And they would instill discipline in the banking system and among its big state-owned borrowers, who now get credit doled out on policy criteria rather than market factors.

There are a laundry list of other reforms on the table, including giving rural households title to land, liberalizing energy prices, freeing the currency, and shifting wealth and influence away from state-owned companies.

President Xi Jinping telegraphed he wants his third plenum to make an impact, promising last month a coming “master plan” of reforms. A 1978 third plenum marked the de facto end of Mao’s reign and the opening up to the West. A 1993 version launched “market socialism” and led to the creative destruction of bloated state factories and companies. A 2003 plenum has been all but forgotten except as an example of plenums that accomplished little.

Investors shouldn’t expect a new set of policies on Tuesday when the plenum ends. Any published plan will include general ideas, and it will be up to Mr. Xi to deliver by holding vested interests, especially state-owned enterprises that live off the current system, at bay. Changes in policy will happen in tiny increments, and the more ambitious reforms will likely only come into focus years from now.

One measure of success may ironically be slower growth, seen as a necessary byproduct of making hard choices. Lower property prices would be welcome, too. The 1978 and 1993 meetings were followed by tough transitions, decelerations in growth, and then boom years when reforms paid off.

If China is indeed to move to a consumption-led economy from an investment-driven one, the decisive first steps may have to come in the next few days.