Soured deals: Just a handful of companies have taken goodwill write-downs this year on past acquisitions that have soured. Low premiums, high stock prices and new accounting rules may be letting more firms avoid or delay the charges

November 12, 2013 Leave a comment

Companies Get More Wiggle Room on Soured Deals

EMILY CHASAN and MAXWELL MURPHY

Nov. 11, 2013 8:15 p.m. ET

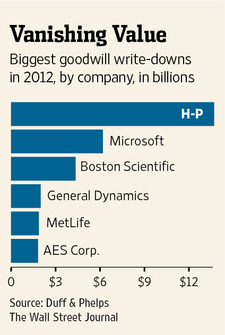

Last year U.S. companies slashed the value of their past acquisitions by $51 billion because the deals didn’t pan out as expected, according to a study set for release Tuesday. That was the highest yearly total for such write-downs since the financial crisis. This year, however, there have been only a handful of big corporate mea culpas. Suitors are paying the lowest premiums for target companies in nearly 20 years, stocks are trading near records, giving companies cover to avoid write-downs on the value of their assets, and new accounting rules may be allowing more of them to delay the charges.“There could be less stress on values now than there was in prior years,” said Gary Roland, a managing director at Duff & Phelps, the financial advisory firm that led the study.

Write-downs of soured acquisitions jumped 76% last year from 2011, but remained far below the $188 billion in charges recorded in 2008, as the recession bit down.

Nearly half last year’s write-downs came from three deals gone bad. Hewlett-Packard Co.HPQ +1.58% took the biggest—$13.7 billion—thanks largely to the vanishing value of its 2011 acquisition of software firm Autonomy, which H-P said it was duped into buying at an inflated price. Autonomy’s former chief executive has denied the allegation.

Microsoft Corp. MSFT -0.50% took a $6.2 billion write-down largely on its 2007 purchase of online-advertising company aQuantive, and Boston Scientific Corp. BSX +1.43% shaved off another $4.35 billion, mostly related to its problem-plagued 2006 takeover of medical-device maker Guidant. In all, 235 companies erased value from prior deals last year. That’s up from 227 the year before but down from 502 in 2008.

Last year’s list also included Cliffs Natural Resources Inc. CLF +0.11% ‘s roughly $1 billion charge on its 2011 purchase of Consolidated Thompson Iron Mines.

When one company acquires another it calculates the value of the target’s assets, including property, equipment, trademarks and licenses. If the purchase price is higher, the acquirer carries the difference on its books as so-called goodwill.

At least once a year, companies must verify the value of what they bought. If the acquired company had a product recall, for example, the value of some of its assets might have to be discounted.Goodwill write-downs don’t affect cash flow, and so are often ignored by investors, but they could indicate the acquiring company’s management botched its evaluation and overpaid.

“There’s a reason you put goodwill on the books. Yes, it’s a noncash charge, but at the end of the day, it’s a measure of whether we have been able to derive the value we said we would from those assets,” said Judy Brown, chief financial officer of Perrigo Co.PRGO +0.58%

Perrigo, a drug manufacturer and distributor, expects to book $1.19 billion of goodwill on its acquisition of Irish biotech company Elan Corp. DRX.DB +0.19% , according to a regulatory filing. “Ultimately, it’s a measure of whether you put your shareholders’ money to work in an effective way,” Ms. Brown said.

There is a risk, of course, that a run-up in interest rates or a drop in the stock market could spark an increase in goodwill write-downs. Companies in the S&P 500 index are still carrying a total of $2 trillion in goodwill on their books. They include AT&T Inc., T -0.40%Bank of America Corp. BAC +0.56% , Procter & Gamble Co. PG -0.30% , Berkshire Hathaway Inc. BRKB -0.20% and General Electric Co. GE -0.15% , which each have more than $50 billion in goodwill on their balance sheets, according to S&P Capital IQ.

Boston Scientific, for example, has written down goodwill in five of the past six years for a total of $9.9 billion in charges, including $423 million this year. The company said in a recent regulatory filing that another roughly $1.36 billion of its $5.55 billion in remaining goodwill is at “higher risk” of a write-down.

“They clearly overpaid” in buying Guidant for $28.4 billion, said Tau Levy, an analyst at Wedbush Securities. Part of the reason was a bidding war with Johnson & Johnson,JNJ +0.26% but part was because Boston Scientific’s prior top managers “underestimated the problems going on with Guidant,” Mr. Levy said.

A Boston Scientific spokeswoman declined to “speculate on the reasons for past decisions.”

Only a handful of other large companies have taken hefty goodwill charges this year. U.S. Steel Co. X -1.41% took a $1.8 billion write-down, and Best Buy Co. BBY +4.53%recorded an $822 million charge. Cardinal Health CAH +1.06% slashed the value of its pharmacy business by $829 million.

In a separate Duff & Phelps survey this summer, more than two-thirds of the 115 companies participating said they don’t expect goodwill write-downs this year. Only 10% of the public companies polled said they expected such a charge, down from 17% in last year’s survey.

Corporate boards are showing more discipline in approving acquisitions, despite favorable borrowing conditions and a soaring stock market. U.S. buyers this year are paying an average premium of 19% to the target’s share price the week before the deals are announced, according to Dealogic. That’s the lowest average premium since at least 1995, as far back as Dealogic’s records go. Historically, premiums have averaged 30%.

Rising stock prices also provide a buffer. Companies can more easily justify goodwill balances when Wall Street values the company above book value, or the total of its assets, including goodwill, less total liabilities.

What’s more, companies may be able to avoid write-downs in some cases.

Last year was the first year in which companies could use a new Financial Accounting Standards Board rule that lets them judge on a qualitative basis whether they need to perform traditional quantitative tests on their asset values.

Because the new rule makes the decision more subjective, optimistic executives may be able to stave off a potential write-down, says PJ Patel, a managing director at Valuation Research Corp. which advises companies on goodwill accounting.

So far only 30% of public companies are using the simpler qualitative test, according to Duff & Phelps, but more could adopt it in future years.

“Companies like to have something that’s more black and white,” Mr. Patel said. “There are more gray areas in the qualitative analysis…but we’re finding companies and their auditors are getting more comfortable with the idea.”