Pay-TV Industry Loses More Subscribers; Evidence Grows on TV Cord-Cutting

November 13, 2013 Leave a comment

Pay-TV Industry Loses More Subscribers

Worst 12-Month Stretch Adds to Evidence that Consumers Are Cutting the Cord

SHALINI RAMACHANDRAN

Nov. 12, 2013 4:55 p.m. ET

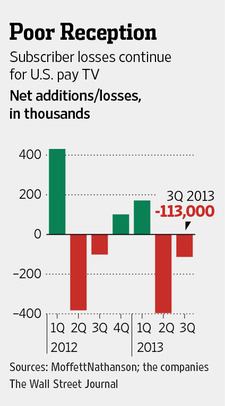

The pay TV industry continued to lose subscribers in the third quarter, analysts estimated on Tuesday, providing further evidence that some consumers are dropping their pay TV subscriptions, or cutting the cord. The industry as a whole lost 113,000 subscribers in the quarter compared with 101,000 in the year ago-period, according to a report by Wall Street research firm MoffettNathanson LLC, issued on Tuesday after Dish Network Corp. DISH +6.00% released its quarterly report. Dish was the last of the publicly traded pay TV providers to report for the quarter. MoffettNathanson’s estimate includes a calculation for performance of privately-held distributors. The firm estimates that total pay-TV subscribers shrank 0.2% over the 12 months ended Sept. 30.MoffettNathanson analyst Craig Moffett concluded that “the pay TV industry has reported its worst 12 month stretch ever,” based on estimates that the industry lost more subscribers in the past four quarters overall than in any comparable 12-month period. After years of steady growth, the pay-TV industry began stagnating in the past few years.

The latest subscriber numbers are likely to intensify the debate in the TV industry about the competitive impact of cheap online video services on pay television. Also likely to play into that debate are statements from some pay TV providers on Tuesday and last week that they’re seeing a growing preference among their customers for subscribing only to broadband, rather than a package of broadband and TV.

On Tuesday, Verizon Communications Inc.VZ +0.40% ‘s Chief Financial Officer Fran Shammo told an investor conference that Verizon was seeing “that less people are taking” television, focusing instead on higher broadband speeds. “And if you look at the demographics, I mean 30 and below don’t care if they have linear TV. They’re looking at getting their content through other means.”

Last week Tom Rutledge, chief executive of cable operator Charter Communications Inc.,CHTR +1.12% said he was surprised by the number of customers opting to take Internet broadband service only.

The brunt of the pay TV subscriber losses are being borne by cable operators, with phone companies Verizon and AT&T Inc. T +0.40% continuing to increase their market share. In the latest quarter, the satellite operators also posted stronger results than they did a year ago, gaining 174,000 customers compared with 48,000, MoffettNathanson reported.

Dish reported Tuesday that it added 35,000 video customers in the quarter, a marked improvement to the loss of 19,000 it saw a year ago. Meanwhile, Dish Chairman Charlie Ergen told analysts on a conference call that he’s “cautiously optimistic” that Dish will reach a new agreement for carriage of Walt Disney Co. DIS -0.83% ‘s channels, including ESPN.

The two companies have been negotiating for several months. Mr. Ergen added that the negotiation is addressing not just fees, but also “where the technology is going and what the world might look like in several years.” Disney is among several media companies that are suing Dish over its “Hopper” digital video recorder, which has a feature that makes ad-skipping much easier. Mr. Ergen made clear that “we’re not going to negotiate on giving up a customer experience we think is important.”

Late last week, Disney Chief Executive Robert Iger said on a conference call that “progress is being made” in the Dish talks.

Evidence Grows on TV Cord-Cutting

SHALINI RAMACHANDRAN

Updated Aug. 7, 2012 9:02 p.m. ET

The most intense debate in television today—whether the lure of Netflix and YouTube is causing viewers to disconnect their cable-TV service—is likely to intensify after new figures showed a slight decline in overall pay-TV subscribers in the second quarter.

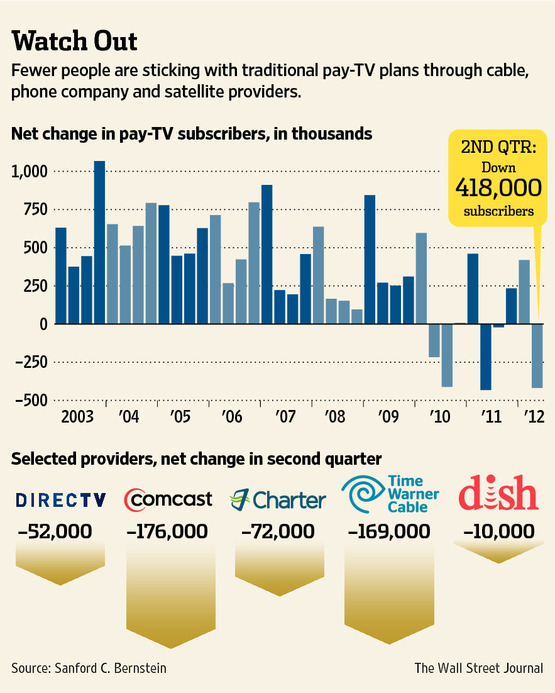

Publicly traded cable, satellite and phone companies had a combined net loss of about 200,000 subscribers in the quarter, earnings reports showed, about 0.2% of the roughly 100 million pay-TV subscribers. Sanford C. Bernstein estimates the overall industry shed more than 400,000 subscribers during the period when results for closely held operators are included.

A sustained decline in the number of people subscribing to pay TV has ramifications for pay-TV operators and for TV channels, most of which share in the fees paid by subscribers. Big entertainment companies generate much of their profits from subscription fees paid to TV channels.

TV executives so far are divided on cord-cutting. Some, such as Dish Network Corp.DISH +6.00% Chairman Charlie Ergen, acknowledge that people are switching to cheaper alternatives. He even cites his own children’s behavior as proof. Others, particularly on the entertainment side, dismiss the idea. The debate has influenced negotiations between pay-TV operators and channel owners over fees, such as the recent blowup betweenDirecTV DTV -0.23% and Viacom Inc., VIAB -0.29% as operators warn that demands for higher fees could fuel cord-cutting.

The second-quarter numbers won’t conclusively settle the argument. The April-through-June quarter is traditionally a weak period for pay-TV operators, as college students disconnect their service, typically returning in the fall, companies say. Last year, and in 2010, the pay-TV industry made up for declines in the second and third quarters with gains in the first and fourth quarters. Both years posted net growth of about 200,000 subscribers.

Even so, Craig Moffett, an analyst at Sanford C. Bernstein, points out that the year-on-year growth rate is below the level at which new households are being formed, suggesting “there are homes that are cutting the cord.”

In the past few years, the number of free or inexpensive online video options have grown rapidly. Amazon.com Inc. AMZN -1.37% ‘s Prime service and Netflix Inc. NFLX -1.24%offer old episodes of some popular TV shows. Google Inc. GOOG +0.12% ‘s YouTube has made a big push to invest in creating channels of original content associated with celebrities like Jay-Z. And several TV channel owners, including Viacom, put full episodes of certain shows on their own websites and on Hulu’s online video portal.

Prior to 2010, the pay-TV industry never saw a quarterly subscriber decline. Since then, declines have surfaced in five different quarters, according to Bernstein research, startling an industry that for decades had added customers at a brisk clip. The proportion of households subscribing to pay television increased to about 86% currently, from 61% in 1992, according to the National Cable & Telecommunications Association.

Satellite-TV and phone companies have been encroaching on cable operators’ turf for several years, but they too are being affected by the overall market slowdown. In the latest quarter, DirecTV lost subscribers in the U.S. for the first time in its history.

Verizon Communications Inc. VZ +0.40% ‘s FiOS and AT&T Inc. T +0.40% ‘s U-Verse, both of which are newer in providing pay-TV services than cable or satellite, continued to add subscribers—but the rate of growth fell 30% from a year earlier.

Comcast Corp. CMCSA -0.78% , Time Warner Cable Inc., TWC -0.64% Cablevision Systems Corp. CVC -2.02% and Charter Communications Inc. CHTR +1.12% have lost a combined total of more than 400,000 subscribers in each second quarter since 2010, more than double the less-than-200,000 losses between 2002 and 2008, Bernstein’s data shows.

In addition, video revenues declined for several cable operators in the latest quarter. For most of the past few years, cable companies were able to boost video revenues despite declining subscriber numbers by selling remaining video subscribers extra services like digital video recorders or premium channels.

Cable operators are still enjoying growth in their Internet-access broadband business. Time Warner Cable said last week that the number of Internet-only subscribers increased 28% from a year earlier.

Charter Chief Executive Tom Rutledge said on Tuesday that the company has about a million customers—out of about five million total—who subscribe to broadband only. He said he sees the potential to sell that group more products as a “big opportunity.” In contrast, “there’s a lot of inertia in the video business,” he said.

Charter reported 5% total revenue growth, driven by a 10% growth in broadband revenue.

For satellite companies, which don’t provide Internet access or phone service, slowing growth in their core video service is more worrisome, and has companies looking for new revenue streams. DirecTV is leaning more on its fast-growing Latin American arm, as well as higher prices and extras like pay-per-view in the U.S.

Dish, which reports its second-quarter earnings on Wednesday but has already disclosed its subscriber decline, is attempting to diversify into wireless to reduce its reliance on traditional TV.