Should CEO Pay Be Capped? A Vote May Make It So; Swiss Proposal Aims to Rein In Executive Compensation

November 15, 2013 Leave a comment

Should CEO Pay Be Capped? A Vote May Make It So

Swiss Proposal Aims to Rein In Executive Compensation

NEIL MACLUCAS

Nov. 14, 2013 6:38 p.m. ET

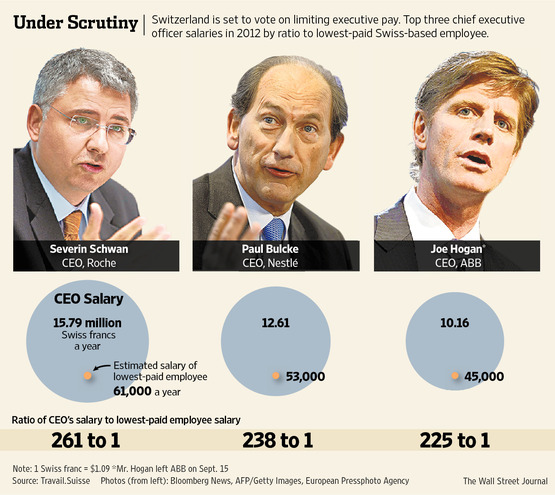

ZURICH—Switzerland will vote next week on a proposal limiting executive pay to 12 times that of a company’s lowest paid worker, the second time this year the country will use the ballot box in an attempt to rein in corporate compensation. On Nov. 24, voters will be asked to approve or reject the 1:12 Initiative for Fair Pay, which organizers say would address a growing wealth gap in Switzerland. The initiative is premised on the idea that no one in a company should earn more in a month than others earn in a year.“Switzerland’s wealth is very unfairly distributed,” said David Roth, president of the youth wing of the Swiss Socialist Party, which gathered the 100,000 signatures needed to launch the ballot. “While top Swiss managers earn millions, more than 300,000 people in Switzerland have to work for a mere pittance.”

The 1:12 initiative has set off a storm of controversy in Switzerland, where voters approved in March a set of measures that gives shareholders broad control over corporate pay, including binding votes on compensation and bans on many types of bonuses.

Critics say the 1:12 initiative, if passed, will make Switzerland, regularly ranked among the most competitive economies in the world, a less attractive place to do business.

The latest poll released Wednesday, which was conducted between Nov. 1 and Nov. 8 by polling group gfs.bern for Swiss television, shows 36% of respondents in favor of the initiative, 54% against and 10% still undecided.

The group’s previous poll in October showed 44% in favor, 44% against and 12% undecided.

The initiative needs a simple 50% approval rate to be adopted, and is then automatically written into the country’s constitution. It doesn’t require any subsequent parliamentary approval.

Executives at some companies, including commodities giant Glencore XstrataGLNCY -0.47% PLC and freight forwarder Kuehne + Nagel International AG, have said they would consider leaving Switzerland if the initiative, which is part of Switzerland’s long tradition of direct democracy, passed.

“We have to do everything we can to continue to attract companies to come to Switzerland and create new jobs,” said Patrick De Maeseneire, the chief executive of Glattbrugg, Switzerland-based Adecco SA, ADEN.VX +0.43% the world’s largest staffing company by revenue.

He added that each job at corporate headquarters creates between seven and 11 jobs in the broader economy, which helps Switzerland maintain a low unemployment.

Public anger over corporate paydays reached a peak in February, when news broke thatNovartis AG NOVN.VX +0.42% was planning to pay departing Chairman Daniel Vasella an exit package worth 72 million Swiss francs ($79 million). The company later scrapped the plan for a more modest package worth about 5 million francs, including cash and shares.

Outrage over the incident led to the March passage of the Minder Initiative—named after Thomas Minder, the politician who supervised it—that will require a binding shareholder vote on executive salaries at all publicly traded companies incorporated in Switzerland when the law is finalized. It will also ban a range of bonuses, require more transparency on loans to executives and provide for penalties, including jail time, for violators.

Switzerland’s government has cautioned that passage of the 1:12 Initiative might lead to a shortfall of 600 million francs a year for pensions and unemployment insurance funds because of an expected fall in social-security contributions.

A study by the University of St. Gallen forecast tax revenues would fall by about 1.5 billion francs per fiscal year if the initiative passed because it would affect the salaries of the top 2%, which pay around 47% of direct federal taxes.

“Social harmony can’t be achieved by government interference in setting salaries,” Johann Schneider-Ammann, head of the Swiss department of the economy, education and research, said at a press briefing in September. “We have a taxation system and other social checks to achieve this.”

The Swiss have grown more concerned about wealth disparity as the gap between a wealthy executive class and everyday workers grows. The gap between the average highest and mid earners at blue-chip companies listed on the Swiss Market Index grew from 13-to-1 in 1998 to 43-to-1 in 2011, according to data from the Swiss Trades Union Association, even though it isn’t as big as it is in some other countries.

According to a 2011 report by the Organization for Economic Cooperation and Development, income inequality in Switzerland is lower than in the U.S. and the U.K., and even lags the OECD average.

Still, the 1:12 initiative has struck a chord with everyday Swiss.

“Something has to be done about some of the salaries and bonuses paid, particularly in the Swiss financial sector,” said Anja Schmid, a mother of two who works at a Zurich insurance company, and who said she’ll vote for the initiative. “Someone needs to protest about these pay excesses.”