“Bubble” In Riskiest Credit Exceeds 2008 Peak

November 20, 2013 Leave a comment

“Bubble” In Riskiest Credit Exceeds 2008 Peak

Tyler Durden on 11/18/2013 19:48 -0500

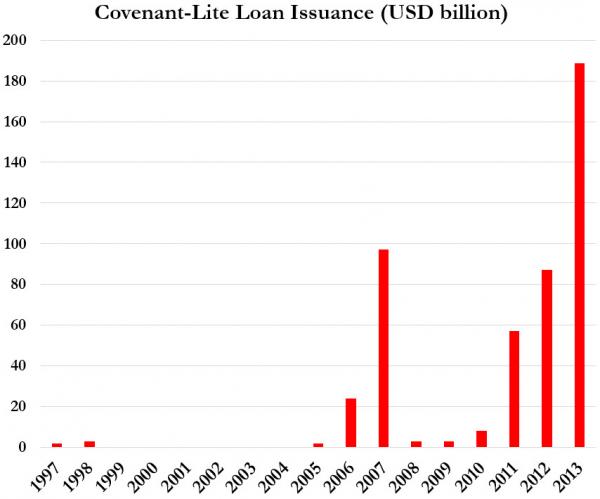

As we warned two months ago, the bubble in credit markets (which if you ask anyone at the Fed, except Jeremy Stein, does not exist) is nowhere more evident than in the explosive growth of so-called cov-lite loans. While total volumes of cov-lite loans are already at record, as the FT reports, we now have 55% of new leveraged loans come in “cov-lite” form, far eclipsing the 29% reached at the height of the leveraged buyout boom just before the financial crisis. LBO multiples have reached record highs and demand for secutizations of these levered loans (CLOs) has surged on the back of the Fed’s repressive push of investors into more-levered firms and more-levered instruments.Last updated: November 18, 2013 2:49 pm

Riskier loan slices hit record levels

By Tracy Alloway in New York

Riskier “covenant-lite” loans, which offer fewer protections to lenders, are making up record levels of the debt packages sold to investors amid resurgent lending markets and a thirst for higher returns.

Managers of collateralised loan obligations, which package up corporate loans and slice them into different tranches, have increased the proportion of riskier loans that their investment vehicles are allowed to buy to the highest levels on record.

CLO managers select the loans that underpin the structured products, walking a fine line between generating decent returns for investors and avoiding loans that will end up defaulting.

But as “covenant-lite” loans have this year become the norm in the US, CLO managers have been forced to relax the limits on the percentage of the loans that can go into their deals.

Already, 55 per cent of new leveraged loans come in “cov-lite” form, eclipsing the 29 per cent reached at the height of the leveraged buyout boom just before the financial crisis.

“The increased prevalence of cov-lite in the primary market has quickly translated into a similar market-wide increase,” Brad Rogoff, head of US credit strategy at Barclays, said in a recent note.

“CLO managers have clearly taken notice of this trend, and structures have come with more relaxed caps on cov-lites this year.”

While the majority of CLOs sold last year had a 40 per cent limit on the amount of cov-lite loans that could be bought by the vehicles, a 50 per cent cap has become the industry standard in 2013, according to data from S&P Capital IQ.

At least three deals have come to market this year with a 70 per cent limit.

In 2011 – the earliest data available from S&P – about 67 per cent of new CLOs came with a 30-40 per cent limit on the amount of cov-lite loans that were allowed to be placed into the deals. Limits of 70 per cent were unheard of.

While market participants have for years debated whether cov-lite loans are riskier than normal loans, the inclusion of an increasing number of them in CLOs marks a sea-change for the structured products.

“It will be increasingly difficult for new structures to come to market with highly restrictive cov-lite caps due to the changing nature of the loan universe,” said Mr Rogoff.

In addition to officially increasing the percentage of cov-lite loans allowed into their deals, some CLO managers have also been easing their definition of cov-lite in deal documentation, thereby allowing more of the loans into their products.

“There’s more doubt about the definition of cov-lite,” said one manager.

More than $64bn worth of CLOs have been sold in the US this year, though sales are expected to taper in the coming months as issuers digest new regulations and as theeconomics that underpin the deals start to shift.

In Europe, most CLOs are sold without restrictions on cov-lite, according to analysts at Bank of America Merrill Lynch.

But at 11 per cent of total leveraged loans, cov-lite issuance in Europe has so far lagged far behind US sales.

…

“CLO managers have clearly taken notice of this trend, and structures have come with more relaxed caps on cov-lites this year.”

While the majority of CLOs sold last year had a 40 per cent limit on the amount of cov-lite loans that could be bought by the vehicles, a 50 per cent cap has become the industry standard in 2013, according to data from S&P Capital IQ.

At least three deals have come to market this year with a 70 per cent limit.

So wondering where the leverage is building this time? Well, record high margin debt in stocks and record high exposure to the riskiest (and least protected) credit structures once again… but it’s different this time (as Moodys told us).