Bundled Cable TV Withstands Consumer Opposition

November 20, 2013 Leave a comment

Bundled Cable TV Withstands Consumer Opposition

By Alex Sherman November 14, 2013

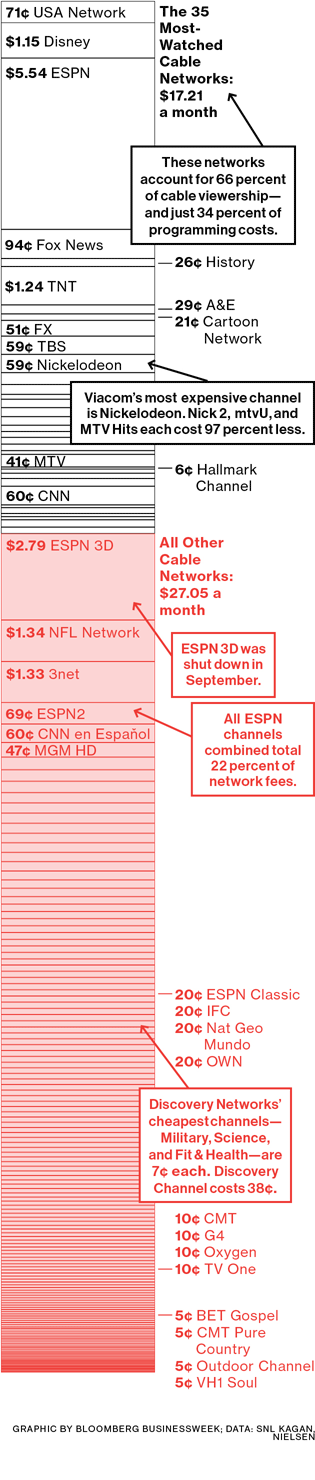

Many Americans don’t understand why they’re paying about $80 a month on average for cable or satellite television when they only watch a few of the networks. But their anger toward their pay-TV operator may be misplaced. Sure, Comcast (CMCSA),DirecTV (DTV), and Time Warner Cable (TWC), who charge their customers nearly double the cost they pay for programming, make a healthy profit margin on their cable bundles. But they’d likely be willing to get that same hefty return on smaller bundles of channels and charge less for the package. The challenge comes in convincing programmers—the companies that crank out must-see shows such as Duck Dynasty orThe Walking Dead—to let them offer some but not all of their channels.Viacom (VIA), for example, owns popular networks, including Comedy Central and Nickelodeon. But it also owns MTV2, Palladia, and one spelled Tr3s that supposedly has an English pronunciation. Don’t want your MTV2? Too bad. That’s because Viacom, which gets advertising revenue and creates a valuable asset by launching networks, makes it difficult for pay-TV operators to obtain the right to carry popular networks without taking the unpopular ones. One result: About 81 million U.S. homes get MTV2—71 percent of all pay-TV households, according to Nielsen. And they pay for the privilege—about 6¢ of a typical bill goes to Viacom for MTV2, figures researcher SNL Kagan. That doesn’t sound like much, but it’s 6¢ every month, times 81 million households. There are about 100 networks getting pennies each month for their programming from pay-TV operators. Pretty soon that adds up to about $10 a month you probably wish you had in your wallet.

If pay-TV operators resist buying the little-known channels, programmers can balk at signing a distribution contract for their entire family of networks. That can lead to a blackout until a deal is struck, as happened with the nine-day shuttering of Viacom channels on DirecTV last year and when CBS programming went dark in some Time Warner Cable markets for three weeks in August. Or programmers can simply make the price so expensive to get just the popular networks that it would be bad business not to take the cheaper ones. They call this a volume discount. Cablevision Systems (CVC), the fifth-largest U.S. cable company, calls it illegal bundling. The cable operator’s antitrust suit filed in February against Viacom over the practice is snaking through the U.S. court system. Viacom said in a statement that Cablevision’s suit is “misguided” and “without legal merit.”

Even if the number of fee-charging networks can be culled, cable rates will remain high because of another big cost driver: sports programming. ESPN, the most expensive network, charges pay-TV operators about $5.54 per subscriber per month. Regional sports networks also typically command several dollars per month, and they’re almost always on basic cable. Customers who don’t watch sports subsidize those who do, and that’s unlikely to change.