“Second-child concept stocks.”; What to Expect When You’re Expecting a Baby Boom; China’s Easing of One-Child Limit Sparks a Rally in Kid-Related Shares

November 20, 2013 Leave a comment

What to Expect When You’re Expecting a Baby Boom

China’s Easing of One-Child Limit Sparks a Rally in Kid-Related Shares

ISABELLA STEGER And LAURIE BURKITT

Nov. 18, 2013 1:55 p.m. ET

It will take at least nine months for the cooing, crying, bouncing results to appear, but the easing of China’s one-child policy has already created a frenzy of anticipation among households, businesses and the stock market for the expected baby boomlet. Shares of baby-formula producers and even piano makers jumped Monday when markets opened for the first time after news of the policy change came out late Friday. Tutoring companies’ shares rose on the assumption that urban families would expect their second children to produce the same academic excellence they demand from their first.Chinese investors have already coined a phrase to describe these companies: “second-child concept stocks.”

Meanwhile, the shares of one maker of contraceptives fell.

The changes are generating the most excitement for urban couples with one child who are young enough to have another.

“I’m already working out and taking folic-acid pills, preparing to get pregnant as soon as the details are out,” said Long Xiaolan, who has a 21/2 -year-old son. She said she wanted to spare her child from having the same “lonely childhood” that she experienced. Ms. Long, a 32-year-old business analyst in Beijing, said she originally planned to give birth in the U.S., a popular way for affluent Chinese parents to circumvent the one-child policy.

The government said last week after theThird Plenum

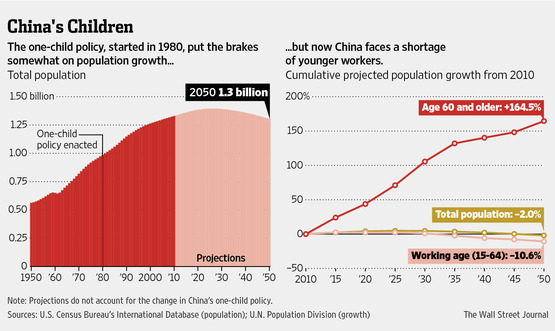

policy meetings in Beijing that it would allow married couples to have two children if at least one spouse is an only child. The change is designed to boost China’s birthrate to counter an alarming fall in young, working-age men and women and to offset China’s aging population. Millions of couples in China meet the criteria to have a second child.

A baby boomlet, if any, likely would take a while to occur, as provincial governments would need to revise their laws, and permits still would have to be granted by family-planning agents. Government officials say there would be measures in place to avoid a “pileup” of births in a short time frame, and that the change would be rolled out gradually.

Nevertheless, in the business mind-set, the prospect of more babies equals more spending.

Shares of C&S Paper Co. 002511.SZ +1.65% , which makes tissues that often are used to clean up after small children, jumped almost 10% on the Shenzhen stock market. “Right now the products we manufacture for children account for less than 10% of our total products, but we plan to increase production in children’s products in the near future,” said C&S General Manager Liu Yuwu.

Shares in two piano manufacturers, Hailun Piano Co. 300329.SZ +9.01% and Guangzhou Pearl River Piano Group Co. 002678.SZ +9.99% , each closed almost 10% higher Monday, on the theory that Chinese parents would buy more pianos if they had second children. Neither company responded to requests for comment.

The investor exuberance over pianos didn’t make sense to Dai Wenzhi, owner of the Dragon’s Dream instrument shop in the southern city of Dongguan. “Each child doesn’t need its own piano, and we already have wealthy clients who buy multiple pianos for their multiple homes,” he said.

But he predicted that sales would rise for smaller instruments, like violins or the guzheng, a Chinese string instrument.

Shares of baby-formula maker Biostime International Holdings Ltd. 1112.HK +6.61%jumped 6.6%, and those of diaper maker Hengan International Group Co. 1044.HK +6.44%rose 6.4% in Hong Kong, where many Chinese companies are listed.

But some companies that have been beneficiaries of the one-child policy couldn’t get any love. Shares of Humanwell Healthcare (Group) Co. 600079.SH -0.81% , a producer of condoms and oral contraceptives, tumbled when trading started but recouped earlier losses to close 0.8% lower in Shanghai. Humanwell couldn’t be reached for comment.

The one-child policy has been in place since 1980, but China’s leadership has been facing pressure for many years from the public and demographers, who have long argued for overhauls as China’s population has aged. Couples in urban areas are fined for having a second child, while the policy is enforced less strictly in rural areas.

Of China’s 1.3 billion people, 79 million women are of childbearing age (23 to 42), and of those, 48% could benefit from changing the one-child policy, according to a Bank of America Merrill Lynch analysis of census data. If one-quarter of those women had second children, it would mean 9.5 million extra babies over the next five years.

Shanghai United Hospital is considering adding fertility-assistance courses and counseling about risks for older parents to its prenatal classes for middle-aged women, according to Emery Brautigan, a regional manager of the hospital, which is owned by the United Family Healthcare private hospital network.

On Chinese microblogging site Weibo, writers joked that conversations grew quiet Friday night after the news broke. “Young people have gone to bed early now second babies are allowed,” one person posted.

Six-year-old Tian Jinrong of Beijing doesn’t like the idea of a new sibling on her turf. One of China’s so-called Little Emperors, Jinrong likes that her status as an only child makes her the center of attention. When her father, Tian Ye, even mentioned the possibility of a baby brother or sister, “She cried,” he said.

Mr. Tian said it was unlikely that he would have another child, even though his 32-year-old wife qualifies, having been an only child. “Our daughter just doesn’t want another one,” Mr. Tian said. “Most parents only want another child to teach a lesson to their current Little Emperors, but we don’t really see that being an issue.”