Delaware’s corporate courts: A new judicial boss; Change is afoot in America’s leading forum for resolving business disputes

November 25, 2013 Leave a comment

Delaware’s corporate courts: A new judicial boss; Change is afoot in America’s leading forum for resolving business disputes

Nov 23rd 2013 | NEW YORK |From the print edition

IT MAY be one of America’s smallest states but in corporate law Delaware punches well above its weight. Its Court of Chancery, which hears business cases, recently stymied Carl Icahn’s attempt to disrupt a buy-out of Dell. Next month Cooper Tire will try to get another of the court’s rulings overturned by the state’s Supreme Court, so as to hold an Indian rival to the letter of a $2.3 billion merger agreement.Delaware’s courts hear many such cases each year because more than half of America’s publicly traded companies and several hundred thousand of its private firms are incorporated in the state. They choose to have disputes over takeovers and squabbles with shareholders adjudicated there because of Delaware’s well-developed body of company law and the expertise of its judges. Other attractions include a sophisticated corporate-services industry and strong, bipartisan support for business from the state legislature.

So it is only natural that speculation over who will replace Myron Steele as the state Supreme Court’s chief justice has become a popular parlour game among the nation’s corporate lawyers. Mr Steele recently decided he would step down early, on November 30th. Delaware’s governor, Jack Markell, is expected to announce his nominee for the post by January.

Four candidates have stepped forward, the two most prominent being Leo Strine, the top judge (or “chancellor”) on the Court of Chancery, and Carolyn Berger, one of the four remaining Supreme Court justices. Mr Strine, 49, is the more colourful of the two, and the front-runner. Were he to replace Mr Steele, it would cap a rapid rise: he was chief counsel to the state governor at 29 and called to the bench of the Court of Chancery at 34.

Mr Strine has a brilliant legal mind and enjoys strong support from the state’s lawyers. He has won plaudits for giving short shrift to frivolous shareholder lawsuits while also managing to avoid being labelled as pro-management, a criticism levelled at some peers and predecessors. If anything will count against him, it is what some see as a lack of judicial decorum. He peppers his courtroom comments and opinions with references to popular culture (he has name-checked Paris Hilton and David Beckham). He once described a business spat as a “drunken WASP-fest”. In an opinion clearly aimed at Mr Strine, the state Supreme Court last year called on judges to stop using rulings to “propagate their individual world views”.

Given the emphasis Delaware’s courts put on consistency, any change is likely to be one of style more than substance. But the choice of chief justice is important in another regard. He or she is expected to act as an ambassador for the state’s corporate-law brand (“the franchise”, as local lawyers call it), which faces competition as a venue for both incorporation and litigation. Judges sing the virtues of Delaware’s regime at conferences and as members of state delegations. Their help is seen as important in safeguarding what has become a cash cow: taxes and fees paid by business entities account for almost a third of the state’s revenues.

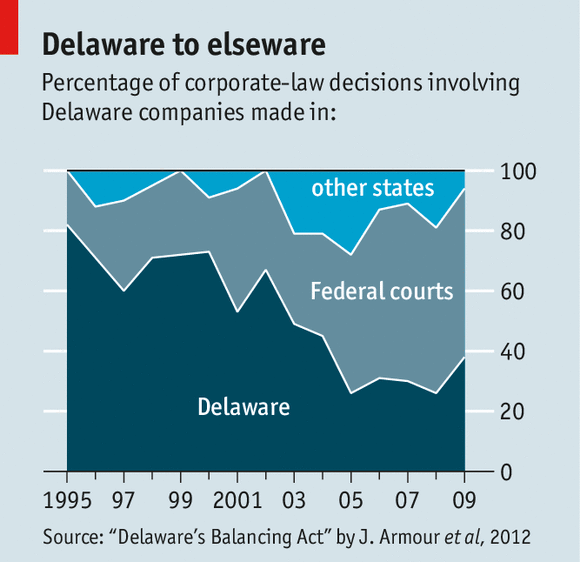

Delaware does not have much competition in attracting firms to incorporate there; but in company litigation, its courts have lost out to rivals (see chart). One reason is that plaintiffs’ lawyers have sought out friendlier jurisdictions to hear cases involving Delaware firms, as the state’s judges have pushed back against what they see as knee-jerk shareholder suits (“My shares are down? I’ll sue!”).

Delaware’s courts are engaged in a balancing act, says Bernard Black of Northwestern University’s law school. If they take too dim a view of such suits, more will be filed elsewhere, depleting the case flow that generates the precedents that are the lifeblood of Delaware’s franchise. If they accommodate such litigation too readily, firms that fear lawsuits might move.

Delaware’s market share has also been eroded by the federal government. Corporate scandals tend to prompt bouts of rulemaking by the Securities and Exchange Commission (SEC) and lawmaking by Congress—and there has been no shortage of scandals in recent years. Mark Roe of Harvard Law School points to the Sarbanes-Oxley law on corporate governance, and SEC rules on shareholders’ rights to nominate directors, as prime examples of federal interventionism.

A greater threat is the fall in the number of big public firms, because of excessive litigation and red tape. The number of business entities in Delaware has almost doubled in the past ten years, to more than 1m. But this growth has mostly consisted of small limited-liability companies, partnerships and trusts, which pay a flat fee of just $250 a year, generate less juicy litigation and put the state’s reputation at risk because they are opaque and thus open to misuse. At 270,000, the number of full-blown public and private corporations—which pay up to $180,000 a year for their charters—is 15% below its peak in 2000.

Protect and survive

Delaware is responding in several ways. One is protectionism: the Court of Chancery has softly encouraged boards to draft bylaws that stop shareholders suing anywhere but in the state of incorporation. (It is unclear if other states will enforce these rules.) In addition, the state has stepped up its marketing to firms that do want to go public, with some success: 83% of American IPOs so far this year were by firms incorporated in Delaware.

The state is also trying to attract more foreign firms. This month it launched a website to promote its business-friendly image in ten languages—an idea driven by Mr Strine. An earlier initiative, also backed by the chancellor, has run aground, however. In 2009 Delaware launched a fast-track, behind-closed-doors arbitration process in the hope of attracting international firms and joint ventures that place a premium on the quick, discreet settlement of disputes. In October a federal court ruled that this violates the public’s constitutional right of access to the courts. Delaware might appeal to the US Supreme Court.

With or without secret sessions, Delaware’s courts are hardly short of cases. But recent trends have been disquieting. Whoever he or she is, the new chief justice will be keenly aware that dominance can evaporate quickly. In the late 19th century, after all, New Jersey was the market leader in business formation. It quickly began to lose ground after Delaware enacted a corporation law modelled on New Jersey’s in 1899—and it never regained its swagger.