Governments Losing Full Faith and Credit

November 25, 2013 Leave a comment

Governments Losing Full Faith and Credit

RICHARD BARLEY

Nov. 24, 2013 1:58 p.m. ET

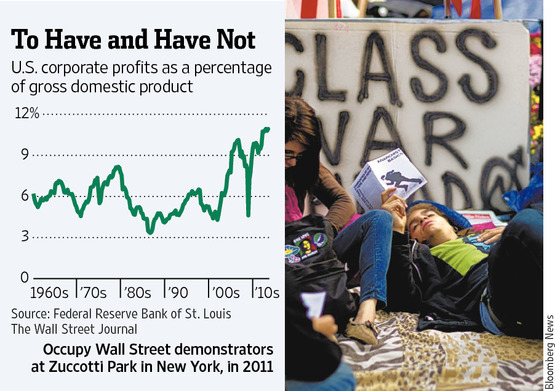

Investing is inherently risky. But in the postcrisis world, old notions about what is and isn’t safe are in doubt. Political risk, as governments juggle strained finances and social tensions over rising wealth and income inequality, is increasingly in focus. The outcome is that traditionally “risky” instruments, such as nonfinancial corporate bonds and stocks, may actually be among the places investors feel more comfortable. Conversely, government securities, traditionally a haven, may now be a source of unease.The euro-zone crisis highlighted this. Greece defaulted on its bonds; the credit quality of southern European governments has plummeted. But it isn’t just Europe. Even faith in U.S. Treasurys has been shaken amid political wrangling over the debt ceiling.

Meanwhile, corporate bonds and stocks haven’t undergone a sea change in perception. This is partly because they have always been risky. Additionally, corporate balance sheets generally weren’t a source of systemic risk in the crisis, and many companies today sit on enormous cash hoards.

Political risk can influence investment decisions and valuations. Investors in emerging markets appear to shy away from government involvement. Of the 100 biggest stocks in emerging markets, the top 20 most highly valued are private-sector firms, while the bottom 20 are dominated by companies in which governments or related entities own stakes of 40% or more, Bank of America Merrill Lynch strategists note.

In some developed markets, some corporate instruments are priced as being safer than sovereigns. That is clearest in the euro zone, despite a cooling of its crisis. Even now, a bond due January 2023 from telecom operator Telefónica

SA TEF.MC +0.82% yields 0.3 percentage point less than comparable Spanish-government debt, according to Tradeweb. In the U.S., investors charge less to insure the debt of major corporations such as McDonald’s Corp., Wal-Mart Stores Inc. WMT +1.20% and Pfizer Inc. PFE +0.47% than that of the government.

Another reason to think corporate assets may be safer than government ones: Many countries still face conflicting pressures to keep financial promises to investors while also honoring social contracts. Even defaulting on debt doesn’t offer an escape route. While Greece restructured its bonds, that hasn’t kept it from having to cut government spending and raise taxes.

And tensions are increasing. Despite ultraloose monetary policy, rising asset prices and a recovery in some big economies, many are finding life tougher. In the U.K., 3.5 million households are struggling to pay bills, 800,000 more than a year ago, a survey by insurer Legal & General shows.

For companies, choices are more clear-cut. Their obligations are largely financial, a clear benefit to bondholders and shareholders. Companies aren’t immune to political risk, but it is less of a direct threat.

And corporate strength may exacerbate political risk. While U.S. companies’ profit margins are at record levels, this partly reflects a low share of revenue going to wages. With global growth slower than in the past, the pressure to maintain and increase profits may prompt further consolidation and cost cutting.

That could strain government finances even more if it leads unemployment to stay high. Alternatively, flush companies may face pressure to borrow and return cash to shareholders rather than invest it, a short-term boost to shareholders but one that may damp economic growth.

Investors are rightly becoming more attuned to political risks and issues of inequality and wealth distribution. A session at Hermes Fund Managers’ September investment conference in London was titled “Labour’s Uprising” and featured references to Luddites and Karl Marx.

The political and social situation may not be revolutionary. But the revolution in risk perception is something investors should pay attention to.