You break it, you own it: America should give global banking rules—and Europe’s dilatory regulators—one last chance

November 25, 2013 Leave a comment

You break it, you own it: America should give global banking rules—and Europe’s dilatory regulators—one last chance

Nov 23rd 2013 |From the print edition

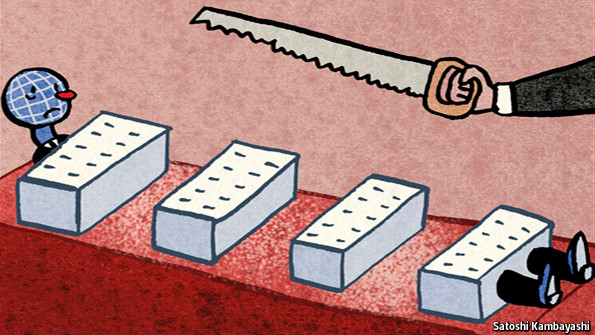

SOME wounds go on hurting for years after they were inflicted. For bank regulators, the trauma of the collapse little more than five years ago of Lehman Brothers is as raw as if it had just happened. Lehman had spanned the world, and was run as a single entity largely overseen in America. Its disintegration caused rancour almost everywhere. Britain complained that it had been allowed to snatch $5 billion in cash from its London operation just days before the bankruptcy. Germany fumed that the Bundesbank had been saddled with defaults on about €8 billion-worth ($11 billion) of loans the central bank had made to Lehman’s German subsidiary.Since then regulators around the world have done much to avoid a repeat. Many of their actions, such as making banks hold more capital, have been sensible. But the rulemakers have also been quietly carving up the global financial system.

Britain is forcing the local operations of foreign banks to hold more capital. In Germany regulators have told the subsidiaries of Dutch and Italian banks not to send cash out of the country. But the biggest move could come in America, where the Federal Reserve will soon publish rules governing the operations of big foreign banks that will, in effect, throw up a wall around America’s financial markets (see article).

This rush to reduce the risks posed by the collapse of big foreign banks is understandable. Regulators are accountable to taxpayers at home. And, given Europe’s tardiness in cleaning up its own banking system, who can blame the Americans for wanting to insulate themselves from its troubles? European banks are still undercapitalised compared with their American peers. In an ideal scenario, forcing Barclays or Deutsche Bank (let alone shakier local German lenders) to put up more capital would make the whole system safer everywhere.

But reality is not that simple. To begin with the Europeans may well retaliate. France’s big banks are already lobbying the European Commission to impose retaliatory restrictions that will keep JPMorgan and Goldman Sachs out of French bond markets (even though the American banks are better capitalised). That will fragment global finance.

Walling off banking systems will increase the costs of borrowing, especially in small or fast-growing economies that need to import capital. It will cut returns to savers in countries with excess saving. McKinsey, a consultancy, reckons that fragmented banking systems could trim global growth by almost 0.5 percentage points a year. And a more fragmented system, even with better-capitalised local banks, is not necessarily safer. Risk will be more concentrated if banks cannot spread it around the world, and failures more common if they cannot move capital to bail out ailing units.

Hurry up and wait

The Fed’s impatience with Europe is understandable. America has cleaned up its banks and Europe has not. European regulators need to use the European Central Bank’s forthcoming asset-quality review to show they are serious about doing so.

But even the Americans admit that the best system, for big banks, is a global one—and there are ways of making a global system safer. Banks could be forced into structures that would push losses from their subsidiaries up to the parent and send capital down to struggling subsidiaries. Big cushions of equity and “bail-in” debt held centrally could reassure regulators.

For that to happen, there need to be formal deals between the main financial centres. The Financial Stability Board (FSB), a club of supervisors and central banks, is championing these ideas, but neither the Americans nor the Europeans have done enough to push them. If the Europeans get serious about cleaning up their banks, the Americans should make one final, genuine attempt to get the FSB’s global rules to work.