M&A Mystery: Why Are Takeover Prices Plummeting?

November 26, 2013 Leave a comment

M&A Mystery: Why Are Takeover Prices Plummeting?

VIPAL MONGA

Nov. 25, 2013 8:26 p.m. ET

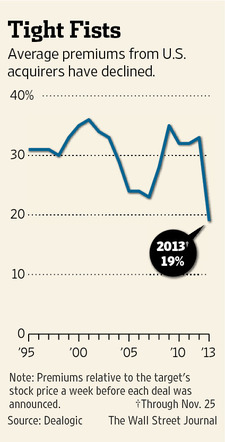

Mergers and acquisitions have been dominated by cheapskates this year. U.S. companies are paying just 19% more, on average, than their acquisition target’s trading price one week before the deal was announced. That’s the lowest takeover premium since at least 1995, as far back as records go at Dealogic, which analyzed the data for The Wall Street Journal. Historically, the premiums have averaged 30%.Companies such as Thermo Fisher Scientific Inc.,TMO +0.47% Applied Materials Inc.AMAT +0.12% and Perrigo Co. PRGO +0.75%have all signed acquisition deals this year with premiums below traditional averages.

The tightfisted terms reflect the cautious stance of corporate boards. Executives must make calculations based on political uncertainty, industry cycles, a tepid economic recovery and expectations that the Federal Reserve may soon reverse policies that have kept interest rates near historic lows.

“Companies think it’s too uncertain a time to do major deals,” said Robert Kindler, global head of mergers and acquisitions at Morgan Stanley.MS +0.64%

That hesitancy is outweighing conditions that normally spur deals: a rising stock market that is rewarding acquirers, wide-open credit markets and a tough economic environment that makes it difficult to expand without acquisitions.

U.S. acquirers have announced 9,347 deals so far this year, off about 16% from the same point last year, and the lowest year-to-date level in four years.

Some of the shrinkage in this year’s premiums has had to do with a surging stock market. The S&P 500 index has climbed more than 26% this year. Escalating stock prices can complicate negotiations by shrinking a premium daily.

R.R. Donnelley & Sons Co. RRD +3.18%paid a 3% premium in its $620 million acquisition of Consolidated Graphics Inc.CGX +0.80% Donnelley CEO Thomas Quinlan said buyers are finding it easier to persuade sellers to accept lower premiums because their valuations already are high, though he declined to discuss specifics of his deal.

Shares of R.R. Donnelley and Consolidated Graphics were up more than 80% for the year when the deal was announced in late October.

“Sometimes the seller has already seen its stock run up,” Mr. Quinlan said.

In some cases, industry cycles affect valuations. Concerns about the long-term health of Dell Inc.’s personal-computer business, for example, kept private-equity firm Silver Lake and company founder Michael Dell from putting more money on the table. It also discouraged other bidders from getting aggressive.

“Getting their arms around what happens to the PC business was difficult,” said one person close to the discussions.

That uncertainty allowed Mr. Dell and Silver Lake to avoid any substantial increase in their bid for the company, even though Dell’s shareholders were clamoring for a big bump from the initial $13.65 a share, which represented a 4.8% premium to the stock’s week-earlier price.

In the end, Mr. Dell and Silver Lake raised the price by a dime a share.

While premiums are an important selling point to the target’s shareholders, they rank low on the list of factors that buyers consider.

“It’s a big psychological factor for the company being acquired. It’s an easy expression of value,” said Sean Aggarwal, chief financial officer of real-estate website Trulia Inc.,TRLA -3.38% which bought software company Market Leader Inc. at a 21% premium. But, he added, “The premium is the crudest measure of all.”

Instead, to determine the value of the deal, Trulia’s management focused on how the deal would improve cash flow, and examined how much revenue and profits the combined company would create, although it also looked at multiples paid in other similar deals, and gauged the trading multiples of Market Leader’s peers.

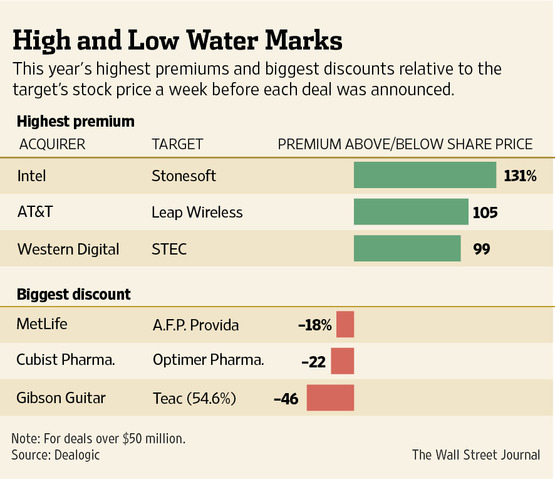

Perrigo’s pending $8.6 billion acquisition of Irish biotechnology company Elan Corp.DRX.DB +0.30% carried a 16% premium when it was announced at the end of July. That was lower than the average 18.4% premium paid in all health-care deals by U.S. buyers this year, and less than half the 35.9% average premium last year.

Judy Brown, Perrigo’s CFO, said the company calculated the return on invested capital, for the next three years when assessing the price it paid for Elan. She also said that Elan had been subject to a hostile takeover effort by Royalty Pharma AG, which pushed up the stock price and affected Perrigo’s ultimate bid.

“It’s very challenging to just go in willy-nilly and pay an enormous premium,” she said. “Whether you call it discipline or stinginess, we’re always being careful.”

But takeover battles are relatively rare these days, preventing sellers from playing competing bidders off against each other to push up prices.

So far this year, just 15 takeovers involved rival bids. That’s less than the 27 a year earlier and the lowest since 2004, according to Dealogic.

“The highest premiums tend to be on deals that are contested, with multiple bidders involved,” said Anil Shivdasani, a finance professor at the University of North Carolina’s Kenan-Flagler Business School.

The lack of overall takeover activity is leaving some puzzled, particularly because the market seems to be rewarding companies that seal deals, said Jim Woolery, deputy chairman of Cadwalader Wickersham & Taft LLP.

Advance Auto Parts Inc. AAP +0.02% ‘s stock jumped as much as 19% last month after it agreed to buy General Parts International Inc. for just over $2 billion in cash.

Dealogic’s data show that the stock prices of acquirers have increased an average 2.4% between the day before and the day after a deal’s announcement. That’s the largest average increase since 2006.

“The market is voting in favor of the deals,” Mr. Woolery said. “The fact that we’re not seeing more folks trying to capture that is a bit of a mystery.”