Volatile Loan Securities Are Luring Fund Managers Again

November 27, 2013 Leave a comment

Volatile Loan Securities Are Luring Fund Managers Again

Collateralized Loan Obligations Offer High Returns—And Risk

MATT WIRZ

Updated Nov. 26, 2013 7:30 p.m. ET

Investment funds aimed at individual investors are barreling into collateralized loan obligations, a complex and volatile type of security that was shaken by the financial crisis. Lured by annual returns of as high as 20%, some mutual-fund managers are buying CLOs through investment funds that purchase stakes in loans to companies with low credit ratings. Another type of loan investment fund, business-development companies, also have begun buying CLOs, according to securities filings.The biggest buyers of these securities usually are hedge funds, insurers and banks. But mutual funds and business-development companies, which pitch themselves to individual, or retail, investors, have collected more than $60 billion in money from clients this year, according to Keefe, Bruyette & Woods, Inc. and fund-data provider Lipper.

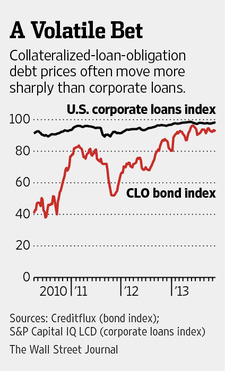

CLO returns are higher than on corporate bonds and other loans, but CLO prices could plunge if the risk rises that companies will run into trouble repaying their loans.

That happened in 2011, and some fund managers say retail investors are mostly unaware that the firms they invest in are buying CLOs.

“The retail broker community doesn’t know to ask those questions,” says Carlynn Finn, vice president for investor relations at Prospect Capital Corp. “They are focused on dividend and yield.”

A business-development company run by Prospect had 18% of its $4.6 billion portfolio in CLOs as of Sept. 30, up from zero in 2011. The CLO stakes helped fuel Prospect’s overall return of 15% so far this year, according to Keefe, Bruyette & Woods.

Prospect President Grier Eliasek says the firm carefully vets CLO managers and helps choose the loans bought by those managers so that they steer clear of the riskiest corporate loans.

Other investment firms following a similar strategy include Highland Capital Management of Dallas and Guggenheim Partners LLC, based in New York.

CLOs use money borrowed from investors to buy corporate loans. In return, the investors earn income derived from principal and interest payments made by companies.

Securities filings reviewed by The Wall Street Journal show that nine loan funds with unusually large chunks of their overall assets in CLOs and similar securities hold about $1.5 billion of such debt, up from about $280 million in early 2012.

Retail investors increasingly are seeking loan funds, including those owning CLOs, because of widespread expectations that long-term interest rates will climb once the Federal Reserve pares back its $85 billion-a-month bond-buying program. Interest payments on loans fluctuate with interest rates, meaning higher rates should boost returns on corporate loans.

Buyers of CLOs can invest in different pieces of a deal, with the safest slices offering the lowest returns on the underlying corporate loans but the highest assurance of repayment. Investors on the lowest rung of a CLO collect the highest yields. Some fund managers have been buying up the riskiest types of CLO debt.

When fears about Europe’s debt crisis shook global markets in 2011, average prices of riskier CLO slices fell by 31% to 52%, according to data provider Creditflux. In comparison, junk-rated corporate loans fell by 8% in the same period, according to S&P Capital IQ LCD.

Some financial advisers are steering investors away from loan-fund managers that buy into CLOs.

“We’ve seen people try to juice their returns, and in general we’re not participating in those funds,” says David Bailin, who oversees $58 billion of investments for wealthy individuals at Citi Private Bank, a unit of Citigroup Inc.

Still, CLOs suffered few defaults during the financial crisis compared with securities that pooled mortgage loans and other consumer loans.

Defenders of the strategy say that vetted CLO investments can help add to a portfolio’s return without adding undue risk.

“We’ve been very proactive about educating investors about what they’re buying,” says Highland’s chief investment officer, Mark Okada. Highland limits its CLO debt investments to a small portion of the mutual-fund portfolio.

Highland and Guggenheim have about 10% of their loan mutual funds invested in CLO bonds and similar securities, filings show. Highland is the top-performing loan mutual fund this year, with a 15% return, according to Lipper.

Guggenheim’s return of 6.3% this year is fifth-highest among loan-fund managers. A spokeswoman for Guggenheim declined to comment.

Loan mutual funds had $138 billion in assets as of Nov. 22, almost twice the amount they had at the start of the year. So far this year, the average return by such funds is 5%, and the typical loan mutual fund has less than 1% of its total assets in CLOs and similar securities, according to Morningstar.