There Are 199,235 “Ultra High Net Worth” People In The World With Over $30 Million In Assets

November 30, 2013 Leave a comment

There Are 199,235 “Ultra High Net Worth” People In The World With Over $30 Million In Assets

Tyler Durden on 11/29/2013 10:39 -0500

It is no secret that the bulk of “very rich people” in recent years has been created in Asia (where some $15 trillion in liquidity has entered broad circulation in just the past five years). As the FT reports, “Asia is producing more new wealth than any other part of the world at any point in history. Over the past five years, the assets of rich individuals have grown at triple the rate of the wealthy elsewhere, while the number of rich people has increased by twice that of other regions. Their number grew by almost 10 per cent to reach 3.7m last year, according to the survey, while their wealth expanded by 12 per cent to $12tn.” However, to find the truly ultra-high-net-worthy (UHNW), those with over $30 million in net assets, one has to go to the US and Europe – the places where Ben’s print baby print policy has most aggressively inflated the latest asset bubble, making the richest richester. “More people from the US and Europe entered this club in the past year than from anywhere else – the population in China and Brazil actually declined slightly.” So how many ultra-high-net-worth individuals are there? The answer: 199,235.Some observations on how the UHNW allocate their wealth:

They will often have $20m tied in a business, with $5m in property and $5m to play with, says Mykolas Rambus, chief executive of Wealth-X.

…

For those with $30m or more, the first thing they want to buy once they hit that bracket is an aircraft, according to Bassam Salem, chief executive of Citi’s private bank in Asia.

“The newly rich are a bit more exuberant in terms of showing their wealth initially,” he says. “But it takes a little while to become ultra-wealthy for most. The richer you are, the less you want to show it in many countries.”

The exception to this is mainland China, where more people have become vastly rich in a much shorter time because of the explosive pace of growth in recent years. The average age of Citi’s ultra-rich clients in Asia excluding Japan is about 70, according to Mr Salem, whereas in China it is 35.

Another stunning age-related detail: “the average age of millionaires in China is about 33, but that of the world’s ultra-wealthy is 52.”

Naturally, the ultra wealthy – especially those from China – are the target audience of the UHNW advisors of the world.

“The reason this market is so lucrative is that a lot of the wealth is not very liquid yet,” he says. “They are likely to have a monetising event within a couple of years, like a listing, and they tend to spread their wealth around among a number of banks.”

There are many more potential clients among those with $5m or less, but they might only have liquid assets of $250,000 or less. “You cannot make money out of that in today’s high cost regimes,” Mr Rambus adds.

The newly rich can be much more demanding clients for private banks and other wealth managers, partly because they can take some convincing that a service they have never used or thought about is worth paying for. On top of this, as they are normally still tied in with their businesses, their investment expectations are for much higher returns than those who have been wealthier for longer and are more interested in preservation.

Sigh – the hard life of advising those for whom money is no object what to invest in…

Finally, if one moves beyond the merely UHNW set, and focuses squarely on the world’s billioanires, of which there are roughly 2170 as we observed previously, the story is a little different.

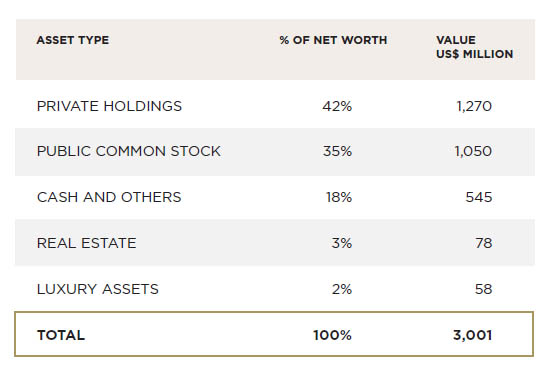

As Wealth-X reports, the average billionaire is worth US$3.0 billion with a liquidity of 18 percent, equal to US$545 million in cash and other liquid assets per person. This liquidity cushion of over half a billion dollars is higher than it was before the global financial crisis of five years ago, suggesting that the old mantra of “cash is king” remains as relevant as ever.

Private holdings still form the largest component of a typical billionaire’s wealth, with an average of over a US$1 billion in publicly-held companies on top of this.

The breakdown of the average billionaire’s wealth can be seen below:

Ah, the New Normal: $3 billion in assets for some, Wal-Mart stampedes for everyone else.