Inflation Prospect Changes Japan Stock Strategies; Some Investors Look for Companies Putting Their Cash Hoards to Work

June 5, 2014 Leave a comment

Inflation Prospect Changes Japan Stock Strategies

Some Investors Look for Companies Putting Their Cash Hoards to Work

KOSAKU NARIOKA

June 2, 2014 7:31 a.m. ET

Some long-term investors are capitalizing on the recent weakness in Japanese stocks to scoop up shares of companies they believe will be winners in an emerging inflationary environment.

These investors are buying shares in companies that are positioning themselves for growth by ramping up capital spending, or putting cash in shareholders’ hands, because merely sitting on funds will no longer be a viable strategy if steady inflation returns to the economy.

The demand has helped the Nikkei Stock Average reach a nearly two-month high, although it is still down 8% since the start of the year. The average gained 2.1% Monday.

Government data released Friday showed consumer prices in April were up 1.5% from a year earlier, after stripping out the effects of an increase in the national sales tax at the start of the month. Generally speaking, signs of inflation are good news for Japan’s economy because they suggest stronger demand—consumers are less likely to hoard cash—after a deflationary spell dating to the 1990s.

They are especially good for companies with pricing power and room to grow.

Japanese companies are sitting on some $2.2 trillion in cash, which is vulnerable to erosion with the return of inflation.

“We have been using the [market] weakness this year to build positions in some of the companies that we really like,” said Simon Webber, who manages a $1 billion global equity fund at Schroders SDR.LN -0.27%PLC in London. The fund’s allocation to Japan rose to 8.6% at the end of April, from 7.1% in December.

He likes companies such as Hitachi Ltd.6501.TO +3.51% that hold competitive positions and can charge higher prices as inflation increases, taking advantage of growing demand without having their profit margins harmed by rising costs.

Hiromitsu Kamata, who manages about $370 million at the Japan unit of asset manager Amundi, said he has invested in Kyoei SteelLtd. 5440.TO +0.77% , an electric-furnace steelmaker with about $340 million in cash on its balance sheet—equal to nearly half its market capitalization.

Kyoei Steel plans to spend some of its cash hoard and borrow more to expand in Southeast Asia and make acquisitions to consolidate the overcrowded domestic electric-furnace steel industry, said Kosei Kawakami, head of corporate planning. Emerging inflation is prompting Kyoei Steel to “invest more aggressively,” he said.

“We think companies can change, and we want to buy the companies that can change,” said Amundi’s Mr. Kamata.

That inflation is coming is far from a consensus view. Many economists worry that Japan will lift itself from deflation at most temporarily, only to be dragged down again by what they perceive as Prime Minister Shinzo Abe’s reluctance to undertake broader structural changes to the economy. The Nikkei remains among the worst performers in developed nations this year.

Even if inflation returns for good, some companies might suffer. Their margins could shrink if they don’t have the market power to pass on the higher cost of labor and goods. Daiji Ozawa, who manages $3.8 billion as head of Japanese-equity investments at Invesco Asset Management (Japan), said producers of basic materials for manufacturing will likely struggle because their customers have left Japan and can obtain cheaper materials elsewhere in Asia.

Japanese companies plan to increase capital spending by about 7% in the coming year, according to the Duke/CFO Magazine Global Business Outlook Survey for March. That exceeds the planned increases in the U.S., Europe, and the rest of Asia. Nearly half of corporate finance executives surveyed said they planned to acquire businesses in the coming year.

In April, information-technology company Fujitsu Ltd. 6702.TO +1.89% said it plans to increase capital investment in the current fiscal year to the highest level in six years. Last week, it disclosed plans to ramp up spending on cloud infrastructure and medical care. Helped by solid earnings, Fujitsu shares have nearly doubled since October.

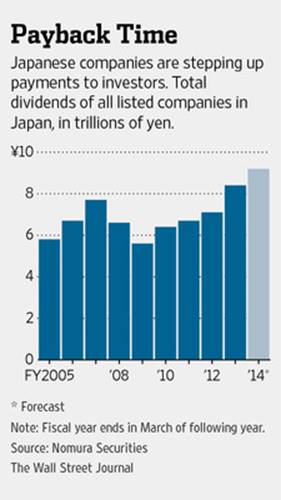

In addition to investing more aggressively, some companies are trimming excess cash through buybacks and dividends.

Earlier this year, trading giant Mitsui 8031.TO -0.06% & Co. bought back its own shares for the first time since the birth of the company in its current form after World War II. On the day Mitsui announced the repurchase plan, along with solid results for the preceding quarter, the shares gained 7%, the biggest rise in nearly five years.

In May, Amada Co. 6113.TO +4.05% , a machine-tool maker, said it would return all net profit to shareholders for the next two years—half through dividends and half through share buybacks. Amada’s shares rose 24% in two days.

More than half of the companies listed on the first tier of the Tokyo Stock Exchange announced dividend increases for the fiscal year ended in March—a larger percentage than in the previous two years, according to Nomura Securities. Hidehiro Fujiwara, head of equity management at Daiwa SB Investments, said his firm is demanding that companies without debt distribute at least half their net profits to shareholders. Otherwise, Daiwa SB votes against dividend proposals at shareholder meetings, he said.

“We keep the bar high because otherwise no Japanese companies would act,” he said.