Chip-makers are betting that Moore’s Law won’t matter in the internet of things

June 16, 2014 Leave a comment

Chip-makers are betting that Moore’s Law won’t matter in the internet of things

By Leo Mirani @lmirani June 10, 2014

For five decades, computing has followed one inexorable trend: that processors will double in power every 18 months. Ever since the Intel co-founder Gordon Moore first articulated this thought in a 1965 paper (pdf), pointing out that the number of transistors on every chip was multiplying, it has become a self-fulfilling prophecy, with chip-fabricators racing to make processors ever smaller, faster, and cheaper.

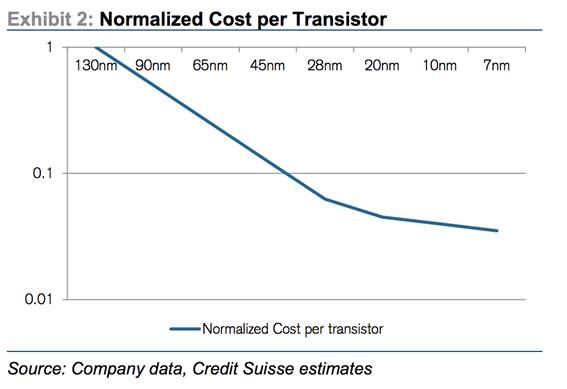

Nearly 50 years since Moore published his paper, however, the foundational trend of modern computing appears to be plateauing. A research note from the technology analysts at Credit Suisse (just returned from the 51st Annual Design Automation Conference, a show for electronics professionals) concludes that chips may be getting smaller and faster, but that the process no longer necessarily involves them getting cheaper.

Why? Big firms like Intel and Taiwan Semiconductor are having to ramp up spending on research and development to keep increasing the power of their processors and adhere to Moore’s law.

None of this is breaking news. People have predicting the end of Moore’s Law for decades now. But the reasons that companies built on the foundation of smaller, faster, cheaper chips are shifting away from that artificial goal laid out 49 years ago raise some new, interesting questions.

The Credit Suisse analysts suggest that chip-makers are paying greater attention to new markets and older designs. The new markets are in devices that stray beyond computers, phones and tablets: a new range of sensors, wearables, and smart objects that are becoming a part of the “internet of things,” as well as older machines that are increasing their computing power, such as cars. Indeed, cars are a major area of focus, with one chip research and development company cited in the report noting that “‘Safe Cars’ (cars that could prevent accidents) could be required by legislation within next 5 years—the company believes that the opportunity for safe cars is more exciting that driverless cars, as legislation could lead to fast adoption.”

Older chip designs are also receiving attention from their makers, as the computing industry turns its attention away from making dramatic leaps in processing power, and instead to making incremental improvements to chips for simpler devices that require less processing power—such as smart thermostats or wearable fitness monitors. The major chip-designer Qualcomm, for example, estimates that there will be 25 billion connected devices by 2020, many of performing basic tasks. Even without major overhauls, older chips can be made cheaper and more efficient than earlier versions (taking up to 10% less space, for example) and still make plenty of money for chip-makers.

Companies may do well to focus their energies on incremental improvements such as making chips slightly smaller, rather than the next revolutionary, Moore’s Law-extending processor. Such efforts aren’t particularly glamorous, but they fulfill a real need and perhaps broaden the ways that computing power can improve human life. Indeed, by broadening the functions of these processors and making them cheaper, rather than focusing on the rat-race of building one shiny new super-powerful processor after another when PCs are in decline, there’s a greater—and broader—impact to be made.