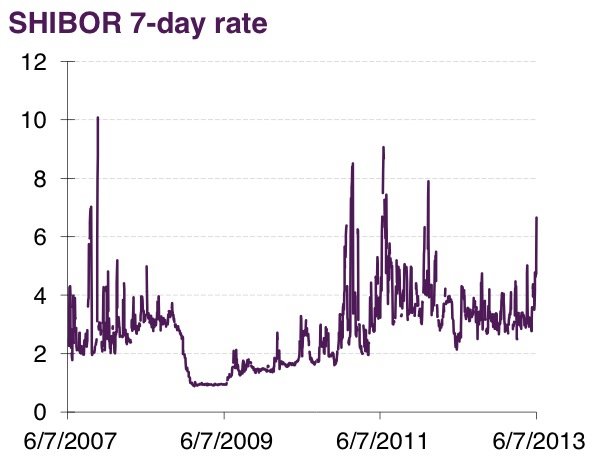

Huge Chinese Interest Rate Spike Has People Freaked Out About A Looming Credit Crisis; China Overnight Rate Rises Most in Two Years as Inflows Slow

June 8, 2013 1 Comment

Yesterday’s Huge Chinese Interest Rate Spike Has People Freaked Out About A Looming Credit Crisis

Mamta Badkar | Jun. 7, 2013, 11:32 AM | 1,953 | 1

Chinese interbank rates surged ahead of the three-day Dragon Boat festival next week.

The overnight Shibor, or the Shanghai interbank offered rate, surged to 8.29% on June 7, from 5.98% on June 6. The seven-day Shibor rose to 6.66%, from 5.14%.

This is an interest rate used among banks, and it’s considered a useful proxy for liquidity in the Chinese credit markets.What could have caused the spike in Shibor?

First, Demand for cash rises ahead of Chinese holidays like the Dragon-boat festival, New Year holiday, Golden week holiday.

Second, Bank of America’s Ting Lu doesn’t think this doesn’t suggest major problems with the financial system. “In our view, most likely the PBoC failed to anticipate and then failed to respond swiftly to a sudden fall of liquidity supply and seasonal rise of liquidity demand,” he writes.

Third, Lu argues that interbank liquidity was squeezed on account of a decline in speculative activities after the government tightened FX curbs. He also cites two other key reasons.

Fourth, one off demand for U.S. dollar, because of State Administration of Foreign Exchange (SAFE’s) regulations on foreign exchange inflows and banks’ Forex position management.

Fifth, it could be because of the crackdown on illegal bond trading. ” But because it’s not banned for the banks to trade bond between its different accounts, banks may have to find trade counterparties in the interbank market and frictions could arise resulting in rate volatilities.”

Lombard Street Research

What are the implications?

Diana Choyleva at Lombard Street Research thinks this is symptomatic of a bigger problem.

She argues that China’s current account surplus fell to 2.6% of GDP in 2012, down from 10% in 2007 and that “this means that capital flows have become a more important driver of domestic liquidity conditions in China’s managed exchange rate system.” In fact, she expects China to see more capital outflows than inflows.

If Beijing decides to go for another stimulus, which analysts say is highly unlikely, Choyleva writes that the economy will see “inflation and bubbles rather than sustainable growth” and this could cause capital and current account outflows.

And if it tries to ease capital controls further and opens up the capital account fully, “outflows in search of higher return amid weaker and more volatile Chinese growth are likely to outweigh inflows.”

Bank of America’s Ting Lu however doesn’t think that this Shibor spike and liquidity squeeze doesn’t suggest major problems with the financial system. “In our view, most likely the PBoC failed to anticipate and then failed to respond swiftly to a sudden fall of liquidity supply and seasonal rise of liquidity demand,” he writes.

The central bank injected 160 billion yuan into the system this week but he thinks it is unlikely that they will continue multiple open market operations to inject liquidity next week if the Shibor stays high.

Lu and Choyleva also differ on how the central bank might react. Lu doesn’t think reserve requirement ratio cuts are likely, because they don’t want to “send policy easing signals.” Choyleva thinks liquidity pressures could well force their hand. She also thinks they could raise deposit rates.

Societe Generale’s Wei Yao has already warned that China is approaching it’s Minsky moment.

While some argue that the government controls the state-owned banks and could intervene in case of severe stress, she does think, “the emergence of such stress tells us a lot about the state of the economy and the banks and the likely outcomes for asset markets.

China Overnight Rate Rises Most in Two Years as Inflows Slow

By Bloomberg News – Jun 7, 2013

The rate China’s lenders charge one another on overnight loans jumped the most in almost two years as shrinking capital inflows led to a cash squeeze before a three-day holiday.

Yuan positions at local financial institutions, an indication of money pouring into Asia’s largest economy, rose 294 billion yuan ($48 billion) in April and China International Capital Corp. estimates the gain slowed to around 100 billion yuan last month. While the People’s Bank of China added a net 160 billion yuan to the financial system this week, it has refrained from conducting reverse-repurchase operations that inject funds since Feb. 7. Local markets will be shut from June 10 to June 12 for the Dragon Boat Festival.

“Foreign capital inflows are probably declining,” said Wang Huane, a senior bond trader at Qilu Bank Co. in Jinan, capital of the eastern Shandong province. “The PBOC has refrained from adding more capital into the financial system, which worsens the situation.”

The one-day repurchase rate, which measures interbank funding availability, climbed 253 basis points, or 2.53 percentage points, to 8.68 percent as of 4:30 p.m. in Shanghai, the biggest jump since July 2011, according to a weighted average rate compiled by the National Interbank Funding Center. It surged 4.15 percentage points this week.

Default Report

China Everbright Bank Co. failed to repay 6 billion yuan borrowed from Industrial Bank Co. on time yesterday because of tight liquidity conditions, Market News International reported today, citing three unidentified people in the interbank market.

Industrial Bank said market speculation that Everbright Bank failed to repay it more than 100 billion yuan was “untrue and exaggerated,” according to an e-mailed statement from the lender. Everbright Bank said in an e-mailed statement that its relationship with Industrial Bank is good and that “all liquidity indicators for Everbright Bank are good.”

“Some smaller banks may be unable to cover cash openings as big banks are unwilling to lend cash,” said Chen Jianheng, a bond analyst in Beijing at CICC, the nation’s biggest investment bank. “If the central bank doesn’t inject more capital into the financial system, the cash shortage will probably last for the rest of June.”

The Open Market Operations Office of the PBOC declined to comment when reached by telephone. The media office of the central bank didn’t immediately respond to faxed questions about the surge in interbank market rates.

State Administration

The State Administration of Foreign Exchange said May 5 it would send notices to companies whose goods and capital flows don’t match, as well as those bringing large sums of cash into the country. The regulator also required Chinese lenders to limit foreign-currency loans to 75 percent of deposits by the end of June.

China’s interest-rate swaps pared gains this afternoon amid talks that the central bank injected capital into the financial system to help ease cash shortage.

The one-year swap contract, which exchanges fixed payments for the floating seven-day repurchase rate, gained three basis points to 3.54 percent, according to data compiled by Bloomberg. The rate rose as much as 13 basis points earlier today. The seven-day repo surged 153 basis points today to 6.85 percent, according to a weighted average rate compiled by the National Interbank Funding Center.

“There was rumor about the PBOC injecting capital in the afternoon,” said Chen Ying, a Shenzhen-based bond analyst at Sealand Securities Co. “But we don’t know if it’s true or not.”

Three calls to the central bank’s media office went unanswered. Weisheng He, a strategist at Citigroup Inc. in Shanghai, suggests investors pay short-term swap rates on speculation liquidity will remain tight in the next two months. “The rate will stay elevated,” He said.

To contact Bloomberg News staff for this story: Judy Chen in Shanghai at xchen45@bloomberg.net

What’s up, just wanted to say, I enjoyed this post. It was practical.

Keep on posting!