Singapore Bonds Decline to Become Second-Worst Debt Market in the World

June 12, 2013 Leave a comment

Singapore Bonds Decline to Become Second-Worst Debt Market

By Kenneth Foo – Jun 12, 2013

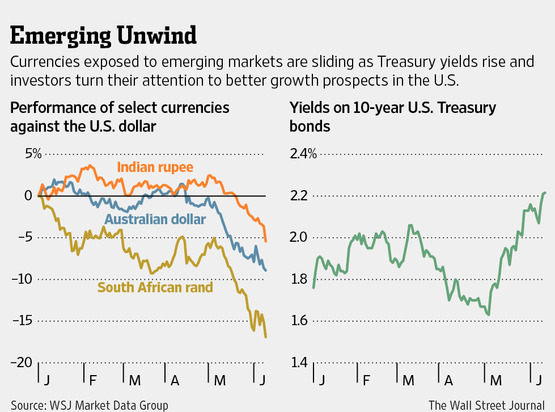

Singapore bonds fell for a fourth day, making their loss for the past three months the second-biggest in the world, as investors gird for the possibility that the U.S. Federal Reserve could slow bond purchases. The price of Singapore’s 3.125 percent note due in September 2022 tumbled to S$107.30 as of 3:27 p.m. local time from S$108.24 yesterday, based on data compiled by Bloomberg and the Monetary Authority of Singapore. The yield rose 10 basis points, or 0.1 percentage point, to 2.24 percent, a level not seen since July 2011. “The only reason for this is the speculation of Fed tapering,” said Michael Wan, an economist at Credit Suisse Group AG in Singapore. “There’s pretty much a sell-off across all countries and markets.” The Bloomberg Singapore Sovereign Bond Index (BSIN) has declined 2.4 percent over three months. The only other sovereign index among 33 tracked by Bloomberg that fell more was Slovenia’s with a 4.3 percent decline. The Bloomberg U.S. Treasury Bond Index fell 0.2 percent. The Fed buys $85 billion of Treasuries and mortgage-backed securities each month to support the economy by putting downward pressure on borrowing costs. It will probably reduce its purchases to $65 billion a month at its Oct. 29-30 meeting, according to the median estimate in a Bloomberg survey of 59 economists last week. To contact the reporter on this story: Kenneth Foo in Singapore at kfoo23@bloomberg.net