Why ‘Boring’ Stocks Have an Edge Over ‘Exciting’ Ones

June 8, 2013 Leave a comment

June 7, 2013, 6:18 p.m. ET

BY MARK HULBERT

Why ‘Boring’ Stocks Have an Edge Over ‘Exciting’ Ones

By MARK HULBERT

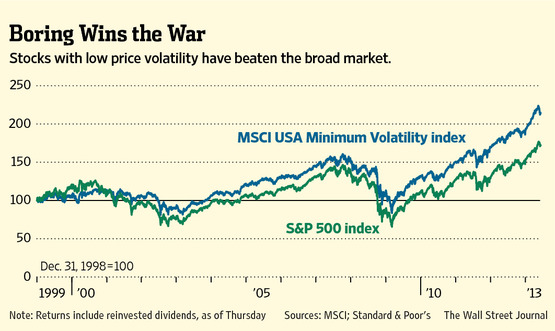

In the stock market, boring is often beautiful. That is because “boring” stocks—those that have exhibited the least historical volatility—on average outperform the most “exciting” issues—those that have been the most volatile. And not by just a small margin, either. By “historical volatility,” we mean the magnitude of a stock’s price swings over a specified period. Just take Apple, AAPL +0.76% whose stock has certainly been one of the more volatile in recent years. Its shares have lost 21% over the past 12 months, compared with a 20% gain for those stocks with the least historical volatility, as measured by the MSCI USA Minimum Volatility index. Not all volatile stocks perform as poorly as Apple has over the past year, of course, and not all boring stocks have done well. But the extent to which Apple lags behind the average boring stock over the past 12 months is right in line with historical research conducted by Nardin Baker, who manages global equity at Guggenheim Partners. The firm has $180 billion under management.Consider a portfolio that invested in the 10% of U.S. stocks that had the lowest historical volatility. According to Mr. Baker, this portfolio from 1990 through 2012 did 19 percentage points a year better than the 10% of stocks with the greatest historical volatility. He says that he found nearly identical results in each of 20 developed-country stock markets outside the U.S. and in 12 emerging markets.

Why would boring, low-volatility stocks perform so much better than those with the highest volatility? Terrance Odean, a finance professor at the University of California, Berkeley, who has researched the subject extensively, believes it in large part has to do with the natural human tendency to be drawn toward what is most exciting, one consequence of which is to cause volatile stocks to become overpriced.

“Individual investors don’t systematically search for stocks to buy. They buy the stocks that catch their attention,” Mr. Odean said in an interview. “These tend to be volatile stocks, with big price moves, about which exciting stories can be told.

“Investor buying can drive up prices, volume, and volatility,” Mr. Odean adds. “And that, in turn, often leads to even more attention getting paid to these companies, more overpricing in the short run and underperformance in the long run.”

Also fueling this vicious cycle, in the opinion of Mr. Baker, are the incentives under which Wall Street operates. “Analysts crave stocks that have big upside potential in order to benefit from significant moves,” he said in an interview, “and so naturally are drawn to the most volatile stocks.”

Another reason Wall Street shuns boring stocks, he says, is that “volatile stocks turn over more of their shares, generating more trading income for brokerage firms.”

Another explanation for why low-volatility stocks do so well comes from research conducted by Peter Hafez, director of quantitative research at RavenPack, a New York-based firm that tracks news coverage for institutional investors. In an interview, he said that low-volatility stocks tend to respond more favorably than high-volatility issues to breaking news.

The low volatility issues typically rise more than high volatility stocks when that news is good, he says, and fall less when that news is bad.

The clear investment implication is to load up your portfolio with boring stocks and shun the most volatile ones. One source of information about which stocks fit in which categories is available at LowVolatilityStocks.com, a website founded by the late Robert Haugen, who spent much of his three decades as a finance professor documenting, along with Mr. Baker, the impressive performance of boring, low-volatile stocks. A subscription costs $9.95 a month.

Current examples of low-volatility stocks, according to Mr. Baker, include two utilities,Southern Co. SO +0.02% and Dominion Resources D +0.61% ; two consumer-products companies, Kimberly-Clark KMB +0.80% and Colgate-Palmolive CL +1.83% ; and retailer Costco Wholesale COST -0.46% .

At the other end of the volatility spectrum, in addition to Apple, are Wall Street giantsGoldman Sachs Group, GS +3.96% Citigroup C +1.51% and Morgan Stanley,MS +6.26% tech stalwart Hewlett-Packard HPQ +2.31% and insurer MetLife MET +3.06% .

There also are exchange-traded funds that invest in low-volatility stocks, including thePowerShares S&P 500 Low Volatility Portfolio, SPLV +1.00% which charges annual fees of 0.25%, or $25 per $10,000 invested, and the 1½-year-old iShares MSCI USA Minimum Volatility Index Fund, USMV +0.88% which charges 0.15%.

Over the past decade, the index that the iShares fund tracks has beaten the Standard & Poor’s 500-stock index by an average of one percentage point a year, while incurring 23% less volatility, or risk. That’s a winning combination.