Demand For Lunch with Warren Buffett Crashes By 71% As Charity Lunch Raises Least In 6 Years

June 9, 2013 Leave a comment

Demand For Warren Buffett’s Company Crashes By 71% As Charity Lunch Raises Least In 6 Years

Tyler Durden on 06/08/2013 12:20 -0400

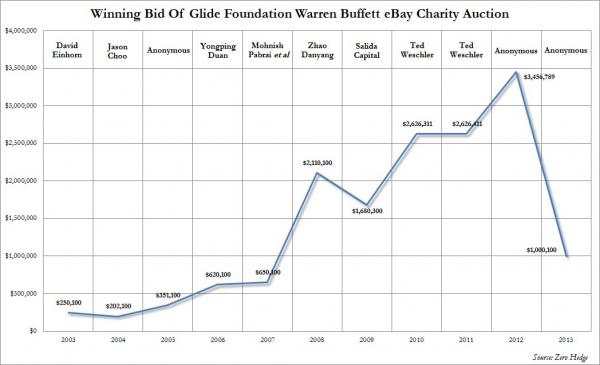

Demand for Warren Buffett, the investor, peaked in 2012 when an anonymous donor bid $3,456,789 for the annual Glide Foundation’s eBay lunch with the Octogenarian of Omaha. Demand for Warren Buffett, 82, the Obama tax and fairness advisor, however, is a mere fraction as the stunned Glide Foundation found out last night when the final bid for the “Power Lunch for 8 with Warren Buffett to Benefit GLIDE Foundation” auction closed at the lowest possible 6 digit increment, or an embarrassing $1,000,100. This was the lowest demand to have lunch with Buffett since 2007.This is a stunning result considering that with every passing year, for obvious reasons, the likelihood of many more such “power lunches” drops exponentially. We hope Buffett-demand is not a proxy leading indicator for the stock market or else a 71% plunge is coming. The San Francisco Business Times reports on the stunned response:

Glide stunned as Warren Buffett lunch raises just $1 million

The last few minutes of bidding for the annual charity lunch with Warren Buffett are normally happy ones for supporters of San Francisco’s Glide Foundation. In recent years, last-minute bidding has regularly pushed the price to record levels. Last year’s lunch for eight almost tripled in the final minute of bidding, closing at $3.46 million. With bidding nearing the $1 million mark by mid-afternoon Friday, expectations ran high that the lunch with the Berkshire Hathaway Chairman and CEO could cross $4 million for the first time. But as the auction closed at just $1,000,100, some attending the invitation-only countdown party at Restaurant Lulu in San Francisco could be heard speculating that a glitch must have occurred. At the party, I asked Alan Marks, eBay’s communications chief, about the possibility of a glitch. He defended the integrity of the auction.

As for the identity of the winning bidder, a Glide spokeswoman said late Friday, “The bidder wants to remain anonymous, at least for now.”

Glide founders, the Rev. Cecil Williams and his wife Janice Mirikitani, tried to put a brave face on the disappointing amount raised.

“A million dollars is nothing to sneeze at. Thank you very much,” Mirikitani told Glide supporters.

But shortly after the auction closed, Williams told me there will likely be budget cuts as a result of the auction. Glide’s annual budget is reportedly about $17 million, so last year’s lunch accounted for about 20 percent of the budget. Williams wasn’t sure what areas of Glide’s services providing food and shelter to the less fortunate would be cut.