GungHo’s Popular ‘Puzzle & Dragons’ Is Upending the Industry Hierarchy, Challenging Leaders Such as Nintendo

June 10, 2013 Leave a comment

June 9, 2013, 8:26 p.m. ET

A Smartphone Game Breathes Fire

GungHo’s Popular ‘Puzzle & Dragons’ Is Upending the Industry Hierarchy, Challenging Leaders Such as Nintendo

When told in May that mobile-game hit “Puzzle & Dragons” had catapulted his company’s market value past that of Nintendo Co., 7974.OK +1.71% the chief executive of GungHo Online Entertainment Inc. 3765.JA +14.85% didn’t feel a burst of pride.

“It made me feel lousy. I felt embarrassed,” said Kazuki Morishita about being compared with the videogame giant, whose “Super Mario Bros.” influenced his decision to create videogames. “We haven’t even reached the level of the ground Nintendo is standing on, in terms of the ability to create.”

The rise of GungHo as a possible peer to Nintendo is emblematic of how smartphone games are fomenting a revolution in the videogame sector. Increasingly, sophisticated touch screens on smartphones have given low-cost game designers as much of a chance as established and large game makers to reach millions of new players.Rovio Mobile Ltd.’s “Angry Birds” has shown how much more intuitive and accessible a finger swipe is compared with the use of game controllers, which require users to learn combinations of controller-button actions. Meanwhile, investors’ search for the next hit mobile game creates hot spots in equity markets, upending the industry’s established hierarchy.

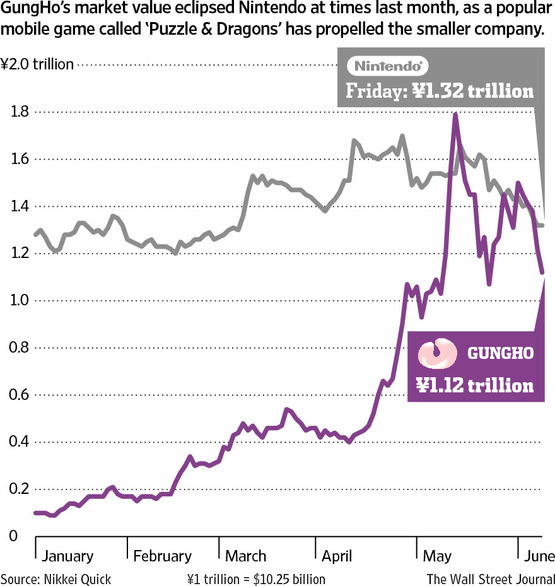

A dramatic increase in GungHo’s share price—versus the flat performance of Nintendo stock—captures both the euphoria surrounding games playable on smartphones and tablet computers and their potential to snatch away customers from dedicated game machines.

GungHo, which is based in Tokyo and 58.5%-owned by SoftBank Corp.,9984.TO +7.14% has recorded market-value growth of approximately 45-fold during the past 12 months. Its shares have pulled back in recent weeks, however, putting its market value as of Friday’s close at ¥1.117 trillion, or $11.45 billion, compared with Nintendo’s $13.5 billion valuation.

Unlike Nintendo’s three-decades-old track record of hits such as “Pokemon,” “Mario Kart” and “Legend of Zelda,” GungHo’s value is rooted almost entirely in “Puzzle & Dragons.”

The game, which combines a “Bejeweled”-like puzzle with elements of card-battle and role-playing games, is played by one in four smartphone users in Japan. It was the world’s top revenue-grossing game app in March, according to industry research firm App Annie.

“Puzzle & Dragons” is free to download, but the game encourages players to buy coins to collect monster characters, including dragons.

Ryota Hori, 21 years old, who was recently playing the game on a train in Tokyo, said he has been playing it for about two months, and likes to collect the monster characters and help them evolve. “You start to feel fond of some of them, and you want to see them bigger, stronger,” he said.

He added that he only spends a couple thousand yen a month on the game to keep playing, but that some of his friends have spent more than ¥10,000 ($100) in a month to get rare monsters.

Such features have contributed to the game’s popularity. In April, the game earned roughly $4 million a day; in January through March, the app helped GungHo’s total sales rise ninefold, while its quarterly net profit increased 54-fold.

The game didn’t become a phenomenon overnight. GungHo was established in 1998 to run SoftBank’s online auction business and then switched to online games in 2002. After GungHo’s subsequent listing in 2005, Mr. Morishita focused his attention on the management side of the company, as it expanded and acquired smaller game companies.

However, after a series of duds, Mr. Morishita decided that he needed to supervise product development more closely; now, no product makes it to any stage in development without the chief executive’s input and approval. “Puzzle & Dragons” was one of the first games after he decided to refocus on game development.

“I decide whether a game is fun,” he said. “If a game doesn’t strike me as 100%, pure fun, if there is any uncertainty, we don’t release it.”

Designed to become habit-forming among users and earn money, “Puzzle & Dragons” took five months to attract its first million downloads after its debut in February 2012. But once it hit two million users in October, the company launched a television advertising campaign, helping the game capture 14 million users in under 16 months as it rode the smartphone wave in Japan.

Mr. Morishita said he lives with a fear that people will stop playing the game and view the company as a flash in the pan amid the huge changes underway in the videogame industry.

“Boredom sets in, always,” he said. “You watch ‘Titanic’ over and over, and you will get tired.”

Fortunes can change quickly in the videogame industry. The latest evidence of that isZynga Inc., ZNGA -0.35% which last week announced plans to cut 520 jobs, as more people shift from playing games like “Farmville” on personal computers to titles for phones.

GungHo plans to launch a version of the game for Nintendo’s 3DS handheld game machine later this year, with the aim of expanding its user pool to include younger players, Mr. Morishita said. “We need to keep adapting so that the game, the characters and the brand live on 10, 20 years—beyond smartphones,” he said.

Word of the game’s success could help expand its reach. Hiroshi Naya, analyst at Ichikoshi Securities, estimates that the “Puzzle & Dragons” user pool could double to 30 million, as new smartphone users download the game after hearing of its popularity.

So far, GungHo has gained some traction in South Korea but only modest success in the U.S. The company has done little to promote “Puzzle & Dragons” overseas, arguing that a game needs an adequate user base to help sustain any momentum created by a marketing push. The company isn’t participating in this week’s Electronic Entertainment Expo in Los Angeles, the biggest annual gathering for the videogame industry.

Last week, GungHo said it was collaborating with Finland’s Supercell Oy, the maker of battle and strategy game “Clash of Clans,” in a cross-promotional effort. Mr. Naya said the move is a sign that GungHo might become more aggressive in marketing “Puzzle & Dragons” abroad.

Mr. Morishita acknowledged that luck is a factor in the success of “Puzzle & Dragons.” “We design the very best game that we can, but from there, so much depends on timing,” he said.

Since luck—and consumer tastes— can change, GungHo maintains a reserve of earnings for possible dark times. “Who’s to say that the pendulum won’t swing back? Or swing in a completely different direction altogether,” said Mr. Morishita. “We are always in crisis mode.”