Forget Revolution. More Like Renovation. At many U.S. manufacturing plants, the winds of change have barely caused a ripple

June 11, 2013 Leave a comment

Updated June 10, 2013, 12:18 p.m. ET

Forget Revolution. More Like Renovation.

At many U.S. manufacturing plants, the winds of change have barely caused a ripple

CLEVELAND—As part of reparations exacted after World War II, U.S. authorities confiscated a metal-forging press made in Germany during the 1930s. The 62-foot-tall machine was taken apart, shipped across the Atlantic and reassembled at a plant operated here by Alcoa Inc. AA +0.36% More than 60 years later, Alcoa is still using that press to squeeze hot aluminum alloys into dies for aircraft wheels and brakes. Computerized controls have been added and many parts updated, but the basic iron structure and other original parts remain. “It was very well-designed by the Germans,” says Eric Roegner, a senior Alcoa executive whose duties include overseeing the plant Alcoa’s cavernous Cleveland Works forging plant is a reminder that manufacturers often choose to make do with equipment that is decades old, instead of rushing to buy the latest technology. They find it can make more economic sense to renovate old machinery than risk investing in something entirely new—especially in a slow-growing market like the U.S. “In manufacturing, people won’t spend money unless there’s a guaranteed return on investment,” says Craig Resnick, a vice president at ARC Advisory Group, a Dedham, Mass., consulting firm that specializes in industrial automation. Often, he says, it is difficult to know precisely how much will be gained by installing new equipment. And there is a nagging worry: What if the new stuff doesn’t work?Focus Is Overseas

That doesn’t mean U.S. factories are stuck in the Iron Age. Most large plants today contain sophisticated electronics, and many are brighter and cleaner than most people imagine. But some still use machinery that could qualify for inclusion in a museum. Alongside another Alcoa forging press still in daily use at the Cleveland plant is a plaque noting that it was declared a historical “landmark” by the American Society of Mechanical Engineers—in 1981. The press was refurbished beginning in 2009 to meet Alcoa’s present needs.

It is a different story, however, at Alcoa plants in Mexico and Hungary, where new presses have been installed in the past decade.

Indeed, some of the most state-of-the art machinery can be found in fast-growing markets such as Asia and Latin America. While global manufacturers often have excess capacity at their older plants in the U.S. and Western Europe, they are still expanding in places with better long-term growth prospects. Just as Japan and Germany gained an advantage after World War II because they were forced to rebuild shattered industries from scratch, emerging markets now are getting an edge from heavy investment in new equipment.

“When you build a greenfield plant, you’re going to put modern equipment into it,” says Dan Meckstroth, chief economist for the Manufacturers Alliance for Productivity and Innovation, a research group based in Arlington, Va.

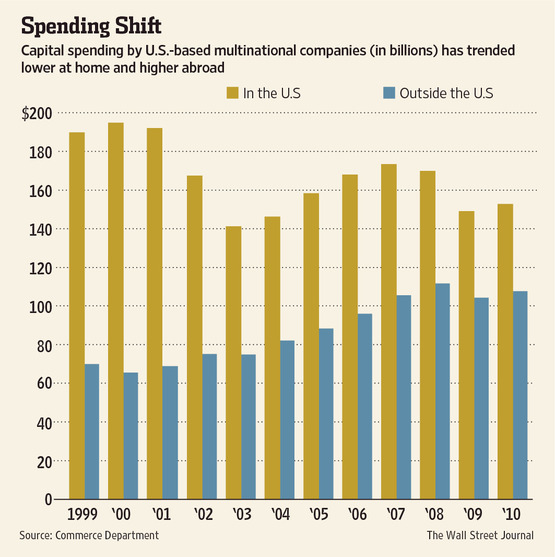

By contrast, U.S.-based multinational manufacturers have become less willing to invest heavily in older plants in their home market. Their capital spending in the U.S. totaled $152 billion in 2010, the latest year for which data are available, down 22% from 10 years earlier. Capital spending outside the U.S. over the same period jumped 64% to $107.3 billion.

As a result, many factories in the U.S. are making do with less-than-optimal equipment. Some still use electronic controls dating to the 1970s or 1980s to run their factories. ARC estimates it would cost $40 billion to replace all of the outmoded electronic control systems being used in North American factories.

Built to Last

“In many cases these systems were designed to last forever, and in many cases they do,” says ARC’s Mr. Resnick. But the companies clinging to them are missing out on opportunities to run their plants more efficiently, he says. Newer computers, electronic controls and software could help them adapt products more quickly to changes in customer preferences, analyze more data from the factory floor, and save energy by slowing motors when full power isn’t needed, he says.

Such arguments are unlikely to sway Dennis Doyle, the owner of B&D Thread Rolling Inc., a Taylor, Mich., maker of bolts for vehicles and construction equipment. Some of his company’s production equipment dates from the 1940s. “They’re just old clunkers that keep on running,” says Mr. Doyle, who typically buys used equipment, though he did recently purchase a new automated packaging line.

At an International Paper Co. IP -0.13% mill in Ticonderoga, N.Y., the steam age—which peaked in the 19th century—isn’t entirely over. Some of the pumps are directly powered by steam-driven turbines rather than more efficient electric motors. To regulate the speed of these steam-driven pumps, a worker twists a knob regulating air pressure to pneumatically controlled valves. (More modern machines use electronic controls.) One of the mill’s two papermaking machines, a hulk of cast iron the length of a football field, dates from the 1950s.

Because the maker of the machine is now defunct, it can be hard to find parts for it. Recently, the plant needed a new gear. “The best delivery we could get was, like, 14 weeks,” says Steven Braun, a business-unit manager at International Paper.

‘Not Enough Return’

The plant has some very modern features, including computers that control much of the machinery and software that makes it easier for managers to analyze the performance of the equipment. So why hasn’t International Paper brought the mill entirely up to today’s standards? “There’s not enough return to justify that kind of investment,” says Tommy Joseph, a senior vice president in charge of manufacturing and technology.

Paper demand in the U.S. is shrinking, and some of today’s plants may not be needed in 20 or 30 years. At its newer plants in Russia, Brazil and China, where demand is still growing fast, International Paper generally uses state-of-the-art equipment.

Updated June 10, 2013, 12:42 p.m. ET

What’s Hot in Manufacturing Technology

Cold spraying, factories in the dark, biomanufacturing—and other high-tech research to keep your eye on

By JOHN KOTEN

Additive manufacturing, popularly known as 3D printing, has become the standard bearer of the next industrial revolution. It’s clearly different, it’s already available to both professionals and hobbyists, and it’s sexy in a geeky, “Star Trek” sort of way. An item is made, layer by thin layer, until it appears almost magically from seeming thin air. Remember the replicator aboard the starship Enterprise?

Yet additive manufacturing is just one of a number of emerging technologies that are likely to produce major changes in the way many things are made in the years to come. And even additive manufacturing isn’t limited to 3D printing. One still-emerging process, called cold spraying, involves blasting metallic particles through a nozzle at such high speeds that they bind to each other to form shapes. By precisely controlling the nozzle, machine operators can build up a three-dimensional metal object like a gear much the same way a 3D printer does. It’s as though the object as been painted into existence, and it can be done with even exotic metals like titanium.

What else is in store? The Advanced Manufacturing Partnership offers one glimpse into the future. The group, created by President Obama, has identified 11 areas of technology that it believes will play a crucial role in determining competitiveness in manufacturing—and that it believes should be the focus of national research-and-development efforts.

Here’s a quick primer to some of the things it highlighted:

Sensing, measurement and process control: Virtually all advanced manufacturing techniques have one thing in common: They’re driven by computers working with vast amounts of data. That’s why the things that capture and record data, such as sensors that monitor humidity, GPS trackers that fix location or calipers that measure a material’s thickness, are so crucial. Just as these types of devices increasingly are what help make smartphones smart, they also enable intelligent, flexible, reliable and highly efficient manufacturing techniques. In a modern factory, sensors not only help guide increasingly nimble machines, but also provide the information necessary to manage the operation of the factory as a whole. Products can be tracked from inception to the point of delivery and, in some cases, even beyond. The moment anything goes wrong in the process—i.e., the humidity inside a spray booth isn’t optimum for a paint—a sensor can detect it and issue an alert to the machine operator or even to the plant manager’s cellphone.

Materials design, synthesis and processing: New machines will require new materials, and new materials will enable the creation of entirely new machines. The development of coatings, composites and other materials is being accelerated through advances that break materials down to an atomic or molecular level and allow them to be manipulated virtually without the need for lengthy laboratory procedures. Borrowing a page from the widely acknowledged success of the Human Genome Initiative, the Department of Energy and other U.S. agencies launched a Materials Genome Initiative last year. The goal: halve the time it takes to identify a new material and bring it to market, a process that currently can span decades. The technology for lithium-ion batteries, for instance, was first conceived of by an Exxon employee in the 1970s, but it wasn’t introduced commercially until the 1990s. Part of the effort involves getting the widely dispersed and cloistered researchers in the field to share ideas and innovations.

Digital manufacturing technologies: Engineers and designers have been using computer-aided modeling tools for years not only to design products, but to test, modify and improve them digitally, often bypassing more costly and slower physical testing. Cloud computing and inexpensive 3D scanners (it’s now possible to do a simple 3D scan with an iPhone) are transporting these methods out of sophisticated facilities and into the mainstream where they can be used by entrepreneurs. AutodeskADSK -1.86% makes a fully operational CAD software program called 123 Design that’s free and allows individuals to do things that auto makers once required mainframe computers to accomplish.

Sustainable manufacturing: The goal is a straightforward, if not easy one: maximize each atom of matter and joule of energy used in production and waste as little as possible. Energy-efficient manufacturing is a major area of focus here. Manufacturing engineers, for instance, talk about the potential for “lights out” factories that operate continuously in the dark and don’t need to be heated or cooled because they’re largely run by robots and other machines. Remanufacturing and recycling may also become more important as smaller, highly automated local factories become more common, and there’s more of a priority placed on locally available materials.

Nanomanufacturing: A nanometer is one-billionth of a meter, so nanomanufacturing means being able to manipulate materials on a molecular and even atomic scale. Nanomaterials are expected to play a future role in the production of things like high-efficiency solar cells and batteries, and even in biosystem-based medical applications, such as a sensor inside your body that could tell your doctor that your cancer is gone. Future generations of electronics and computing devices may also rely heavily on nanomanufacturing.

Flexible electronics manufacturing: Tablet computers that bend when you sit on them. Clothing wired to your body temperature so it can cool you off when you need it. Already working their way into the mainstream, these flexible technologies are expected to define the next generation of consumer and computing devices, and are expected to be among the fastest-growing product categories over the next decade. But they require highly advanced manufacturing processes.

Biomanufacturing: This field uses a biological organism, or part of one, in an artificial manner to produce a product—like developing drugs and medical compounds. (Cheese making doesn’t count.) But it has applications in a wide range of areas, including improvements in energy efficiency and in the creation of new methods of nanomanufacturing.

Additive manufacturing: Three-dimensional printers not only hold the promise of achieving high quality at volumes as low as a single unit, but also of opening the door to entirely new designs and material structures and combinations. Printers have been developed that can print over 1,000 materials, including hard plastic, flexible plastic, ceramics and metals. One German manufacturer has developed a process that deposits layers of wood pulp; a San Diego company called Organovo is 3D printing human tissue for use in labs. Some printers can now layer more than one material and can enable smart components to be fabricated with embedded sensors and circuitry, such as hearing aids or motion-sensing gloves. There even is something called a Replicator on the market. It’s a system made by Cybaman Technologies, a British firm, that starts by layering a basic shape and then machines the rough object into its final precise and polished form.

Industrial robotics: Industrial robots can operate 24 hours a day, seven days a week, with repeatable and increasingly fine precision—to hundredths of a second and in less space than is detectable by the human eye. They report accurately on their progress, improve when their performance is tested for efficiency and become more dextrous when they’re fitted with advanced sensor systems. (They also rarely complain.) As robots become ever more widespread, they’re becoming more economical, too: The expense associated with industrial robots has fallen as much as 50% compared with human labor since 1990, according to a report by the McKinsey Global Institute. And, with advances in biotechnology and nanotechology, robots are expected to become capable of doing ever more intricate things, like drug processing and growing full-blown human organs.

Advanced forming and joining technologies: Most current mechanical manufacturing processes continue to depend largely on traditional technologies, mainly for metals, such as casting, forging, machining and welding. But experts believe this area is ripe for innovation and new ways of joining a wider variety of materials with greater energy and resource efficiency. Cold forming, for instance, may play a major role as a repair or advanced welding technique.