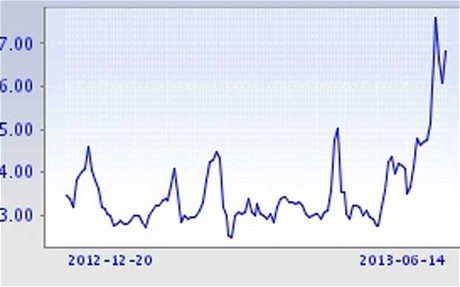

China braces for capital flight and debt stress as Fed tightens; There have been signs of serious stress in China’s interbank lending markets, with short-term SHIBOR rates spiking violently. Bank Everbright missed an interbank payment last week in a technical default

June 14, 2013 Leave a comment

China braces for capital flight and debt stress as Fed tightens

China appears increasingly worried that monetary tightening by the US Federal Reserve could trigger capital flight from the People’s Republic and set off a Chinese corporate debt crisis.

There have been signs of serious stress in China’s interbank lending markets, with short-term SHIBOR rates spiking violently. Photo: Alamy

1:50PM BST 14 Jun 2013

A front-page editorial on Friday in China Securities Journal – an arm of the regulatory authorities – warned that capital inflows have slowed sharply and may have begun to reverse as investors grow wary of emerging markets. “China will face large-scale capital outflows if there is an exit from quantitative easing and the dollar strengthens.” it wrote. The journal said foreign exodus from Chinese equity funds were the highest since early 2008 in the week up to June 5, and the withdrawal Hong Kong funds were the most in a decade.

It also warned that total credit in Chinese financial system may have reached 221pc of GDP, jumping almost eightfold over the last decade. Companies will have to fork out $1 trillion in interest payments alone this year. “Chinese corporate debt burdens are much higher than those of other economies and much of the liquidity is being used to repay debt and not to finance output,” it said.

There have been signs of serious stress in China’s interbank lending markets, with short-term SHIBOR rates spiking violently. Bank Everbright missed an interbank payment last week in a technical default.

“Liquidity conditions have tightened severely due to the crackdown on shadow banking activities,” said Zhiwei Zhang from Nomura. “We believe the series of policy tightening measures in the past three months have reached critical mass, such that deleveraging in the banking sector is happening. Liquidity tightening can be very damaging to a highly leveraged economy,” he said, warning that local government finance vehicles may have trouble rolling over debts.

China Securities Journal hinted that the authorities fear they have gone too far in their efforts to curb property speculation and off-books lending, and may have to turn the liquidity spigot back on.

“There is room to cut interest rates and the reserve ratio in the second half. A rate cut can help ease company debt burdens. A reserve cut can help cushion the monetary environment,” it said. The central bank has already cut the reserve ratio requirement (RRR) to 20pc for big banks, but this could go much lower.

Premier Li Keqiang has until now vowed to press ahead with loan curbs, insisting that the economy is strong enough to withstand the strain. The editorial is a clear sign that the Communist Party is preparing a volte-face, discovering that it is harder to manage a calibrated soft-landing than originally assumed.

Citigroup warned in a new report that surging SHIBOR rates will cascade through the banks and damage growth later this year, with knock-on effects for commodity prices and emerging markets worldwide.