For Fred Wilson, Twitter is the Beatles and Tumblr a solo act

June 14, 2013 Leave a comment

For Fred Wilson, Twitter is the Beatles and Tumblr a solo act

BY ADAM L. PENENBERG

ON JUNE 13, 2013

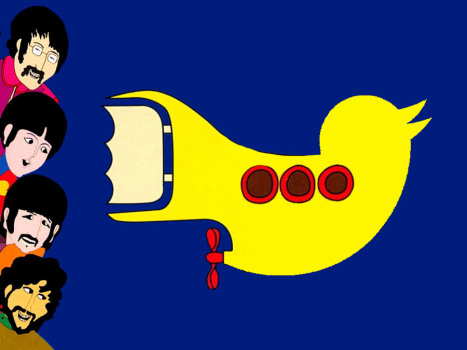

At tonight’s PandoMonthly in New York, Fred Wilson, partner at Union Square Ventures, compared two of his most successful investments by employing a musical analogy. Tumblr’s founder, David Karp, is a one-man band, while he likes to think of Twitter “as the Beatles.”

Wilson cited a well-read blog post by Marco Arment, the well-known developer who helped David Karp build Tumblr, which he published on the day of Yahoo’s billion-dollar acquisition, calling Tumblr “the one-person product.”

“Even though Tumblr was never a one-person company, it usually felt like a one-person product,” Arment wrote. “David always had a vision for where he wanted to go next. Karp would come in with concepts for product features and Arment would tell him what was feasible and what wasn’t. “The ideas were usually David’s, and the product roadmap was always David’s.”Wilson was so touched when he read the post, his eyes welled up with tears. “What [Arment] meant was that Tumblr was David,” he said.

Meanwhile, he likes to think of Twitter as the Beatles. He views founder Jack Dorsey as either Paul McCartney or John Lennon and Ev Williams as John or Paul. In this rockin’ analogy, Biz Stone is George Harrison. Then there’s a fourth member of the Fab Tech Four, Jason Goldman, who may not be a founder, at least officially, but he still had great influence. He’s Ringo.

“You can imagine Twitter without Jack,” Williams said, because you had Ev Williams, and you could imagine Twitter without Ev Williams, since you had Jack Dorsey. There’s “a lot of Ev and Jack and Biz and Jason in Twitter.”

“Some bands have had interchangeable parts,” he added, like the Grateful Dead. “I’m rambling” (like the Grateful Dead). “With Tumblr, it’s very hard to imagine it without David.”

While aware that some have reported having trouble working with Karp, Wilson doesn’t see that as a detriment. “Probably some people found Picasso hard to work with,” he said.

He views Yahoo’s acquisition as a way to free Karp from having to focus on aspects of the business he doesn’t have an innate interest in, such as revenue and marketing. “He can focus on the things he wants to focus on,” Wilson says.

It has “potential to be a great acquisition” like “YouTube was for Google.”