FSS to monitor Samsung shares to see whether there has been any manipulative activity involved in recent price swings

June 14, 2013 Leave a comment

2013-06-12 17:29

FSS to monitor Samsung shares

By Kim Rahn

Financial authorities said Wednesday that they will keep a close eye on movements of shares in Samsung Electronics to see whether there has been any manipulative activity involved in recent price swings.

The move came after suspicions of manipulation because of a selling spree led by foreign investors that is considered unusual.The rush of selling started last Friday after JPMorgan Chase cut its target price for Samsung’s shares from 2.1 million won to 1.9 million won, as well as decreasing its 2013 earnings estimate by 9 percent, as it expected poor sales of Galaxy S4, Samsung’s latest flagship smartphone.

Morgan Stanley also lowered its target price by 50,000 won to 1.75 million won, forecasting that the orders for the smartphone would be smaller than initially expected.

Officials of the Korea Exchange (KRX) said they have intensified monitoring on Samsung Electronics-related trades.

“Samsung Electronics is one of highest priced, largest traded stocks. A price decrease of that stock is having an impact to the whole stock market, so we are closely watching the trade,” KRX director Cho Byeong-hwan said.

They are watching any unusual trading patterns such as: whether the sales have been made through specific accounts; and whether specific investors have enjoyed huge gains through the price dipping.

Some types of future or put option trade, which investors can have gains when stock price falls, are especially under scrutiny.

If they find something suspected of being illegal, they refer the case to the Financial Services Commission.

The Financial Supervisory Service is also watching the situation. “We are monitoring any unusual issues. We haven’t launched an official inspection yet,” an official said.

Since Samsung’s stock price began plummeting, analysts have said that the amount of shares sold by foreign investors and some sales patterns were unusual.

Last Friday, a day after the JPMorgan report came out, Samsung’s shares worth 1.5 trillion won were traded, a 278.7 percent rise from the previous business day.

Of them, 114 billion won was from short stock selling, which is usually made by foreign investors. This amount was up by 588.6 percent from the previous business day.

Following such massive selling, the ratio of Samsung Electronics’ shares held by foreign investors was lowered from 50.4 percent at the beginning of this year to 48.8 percent Tuesday.

“There had been similar cases that foreign investors sell Samsung Electronics’ stock after a foreign investment bank presents negative outlooks,” researcher Byeon Han-jun of KB Investment & Securities said. “But still, the selling streak this time is too extreme. Rumors are that a huge amount of shares are still on the waiting list for additional sales.”

Jeon Sung-hoon, researcher at the Hana Daetoo Securities, said the outlook on the JPMorgan report, which forecast a weak demand of smartphones, was not new but foreign investors are reacting to it now.

“Korean analysts had already presented similar reports since last September, saying the high-end handset markets were saturated. The market all knew that, and the JPMorgan and Morgan Stanley reports are fussing around belatedly. And foreign investors are reacting to the reports. I don’t know why,” he said.

2013-06-11 17:13

‘Concerns over Samsung overblown’

By Kim Rahn

Securities firms said Tuesday the recent sharp drop in Samsung Electronics’ stock price was the consequence of inflated concerns over the firm’s smartphone sales.

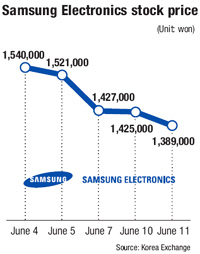

These views come as the electronics company’s share plummeted 6.18 percent last Friday to 1.42 million won from the previous business day’s 1.52 million won. It fell more this week, dropping to 1.38 million won Tuesday.

The decrease is attributable to a market outlook by JP Morgan Chase, which cut Samsung’s profit estimates.

In a June 6 report, JP Morgan said orders for the Galaxy S4, Samsung’s latest flagship smartphone, are slowing due to weak demand in Europe. It expected shipments of the phone to be 60 million this year, down from the previous estimate of 80 million.

“Compared to the S3, the S4 had stronger momentum in the first quarter following the launch,” the report said. “But the following quarter’s shipments are expected to be disappointing and its peak-quarter number seems way below our previous estimate.”

It decreased its target price for Samsung’s shares from 2.1 million won to 1.9 million won, as well as lowering its 2013 earnings estimate by 9 percent.

Following the report, foreign investors sold off the smartphone maker’s shares, selling 860,000 shares worth 14 trillion won in one day last Friday.

Morgan Stanley also cut its target price by 50,000 won to 1.75 million won, lowering sales expectation for the Galaxy S4 from 71 million to 61 million.

However, other foreign and domestic brokerages maintained their target price for Samsung’s shares, saying such concerns are overblown.

Credit Suisse said there needs to be “sanity checks” on insane price actions. “We concluded Friday’s sharp selloff was overdone, and in hindsight it should prove to be another buying opportunity for the long run,” the firm said Monday.

“We believe a lack of quantifiable metrics for Galaxy S4 sales and the unknown fear factor of what the expectation adjustment means led to the sharp selloff,” it said, retaining an “outperform” rating for Samsung and its target price at 1.9 million won.

Several other brokerages, such as UBS and Deutsche Bank, also maintained their target prices, saying the weaker demand for the handset has already been reflected in the stock price.

KB Investment & Securities researcher Byeon Han-jun said the selling streak has gone too extremes. “Samsung’s profitability from smartphones may fall, but that has already been considered by the market. And there’s no other smartphone maker that can threaten Samsung’s position. Samsung’s value is not that bad,” he said.

Researcher Park Kang-ho of Daishin Securities said the lackluster sales of the Galaxy S4 could mean a weak demand for high-end handsets.

“However, the price drop is for sentimental reasons. Samsung’s second quarter performance is expected to be good, and its competitiveness and brand power in the smartphone industry is still very high,” Park said.

Hana Daetoo Securities researcher Jeon Sung-hoon said the price would return to the previous level in early July when Samsung announces its second quarter earnings.

“Foreign investors had bad experiences when Apple’s earnings dropped following poor sales of the iPhone5. They now think Samsung’s earnings will decline, too, following the poor sales of the Galaxy S4. Samsung’s second quarter performance should wipe out the sentiment,” he said

2013-06-12 16:57

Samsung cool on share price fall

By Kim Yoo-chu

The CEO of Samsung Electronics rebutted, Wednesday, a JPMorgan report that predicted significant setbacks in Galaxy S4 sales which triggered a selloff of the tech firm’s stocks.

Meanwhile, Samsung said it has no plans to sign a peace treaty with Apple over the 50 ongoing patent disputes on four continents.

“I can say sales of the Galaxy S4 smartphone are fine. It’s been selling well,” Shin Jong-kyun told reporters after Wednesday’s regular meeting with presidents of Samsung affiliates at the group’s main office in Seocho-dong, southern Seoul.

“The report (by JPMorgan) was based on its own analysis. Probably, the bank may have corrected its previous bullish estimate about the S4 sales,” he said.

Shin is responsible for the global unveiling of the Samsung smartphones and tablets.

His comment marked a rare occasion for the company to specifically mention a market report.

Referring to slow demand for the flagship S4 smartphone, JPMorgan cut its share-price estimate for Samsung by 9.5 percent and lowered its 2013 earnings estimates by 9 percent.

JPMorgan insisted Samsung was expected to ship 7 to 8 million phones per month from July. Samsung is aiming to move 100 million in total; however, analysts now expect this figure to be closer to 60 million

Morgan Stanley, another major U.S.-based investment bank, also lowered its target on Samsung shares, citing less-than-expected S4 sales.

Thanks to the JPMorgan report, Samsung shares fell as much as 6.2 percent by the end of Seoul trading, recently, a four-month low and the largest single-day drop in nine months.

Shin’s comments came as part of Samsung’s quick response to cut down on the impact. The company’s investor relations team contacted major local brokerages and provided them with background information about sales of the S4, according to Samsung officials.

Samsung said it shipped 10 million S4s globally in the month since the device was released.

Shin also confirmed a plan to release a sequel of the Galaxy Camera — the Galaxy Camera2 — at an event in London set for June 20.

“Samsung will release our latest mirrorless camera that runs on Google’s Android software,” he told reporters.

Samsung is investing heavily in mirrorless cameras as it thinks increased corporate awareness and undisputable leverage in manufacturing will help it get a bigger stake in the lucrative and promising market.

The CEO confirmed Samsung has no intention of ending the patent disputes with Apple. “Patent disputes against Apple will be continue,” Shin said.

The comments are the first since the U.S. International Trade Commission recently ordered the Cupertino-based outfit not to sell some old versions of its iPhones and iPads in the United States as those devices infringed on Samsung patents.

U.S. President Barack Obama has 60 days to decide whether to accept the final ruling by the trade panel or reject it.