Sensitivity of asset prices to Fed balance sheet expansion

June 14, 2013 Leave a comment

Fed tapering

Jun 11th 2013, 12:09 by Economist.com

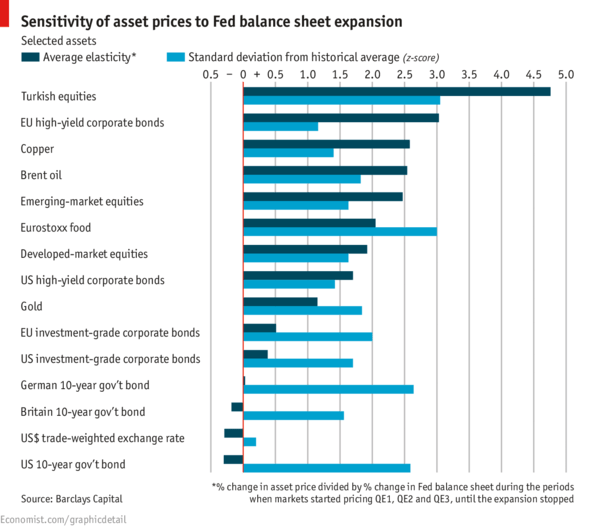

WITH short term interest rates at record lows, America’s Federal Reserve has sought to boost its economy by purchasing bonds with newly created money, thereby pushing down bond yields. In November 2008 the central bank announced it would buy up to $600 billion in agency mortgage-backed securities (MBS) and agency debt. The programme was extended in March 2009 by an additional $850 billion, and $300 billion in purchases of Treasury securities. This first episode of this so called quantitative easing, later known as QE1, was followed by two more rounds; QE2 in November 2010 ($600 billion) and QE3 in September last year ($40 billion of MBS and $45 billion of Treasuries each month). QE3, the Fed said, would continue until the outlook for jobs had improved substantially. America’s jobs market has improved, and markets are now reckoning the Fed will start to taper its bond purchases in coming months. According to EPFR Global, a data provider, this has put pressure on bond prices and investors have fled riskier assets; bond fund outflows reached a record in the week ending June 5th. Researchers at Barclays Capital have looked at which assets are most sensitive to the Fed’s balance sheet, by dividing the change in the asset prices over periods of QE, by the change in the size of the Fed’s balance sheet. At present, markets are adjusting to the Fed’s balance sheet merely expanding more slowly than expected. At some point they will have to adjust to its outright shrinkage. Since emerging-market equities and European and American high-yield bonds showed the greatest sensitivity to Fed balance sheet expansion, they could be expected to also fall most when it shrinks. Judged by how an asset deviated from its historical value during QE, Turkish equities and “defensive” stocks (those that do not move with the business cycle, like food) are most vulnerable.