“Size of the exit”: Emerging markets are often easy to get into, but if history is any guide, when the elevator starts to go down and everyone is trying to get out, some people are going to get stuck

June 14, 2013 Leave a comment

Still got your money in emerging markets? Here’s what to worry about—and where

By Matt Phillips @MatthewPhillips June 13, 2013

Global riptides of investment cash are a well-established threat for developing economies. On its way in, a surge in foreign investment pushes up prices of stocks, bonds and other assets. It drives down borrowing costs. It supercharges growth. But if the wave suddenly starts to recede, countries can face nasty combinations of currency collapse, banking crises and government default. This script has repeatedly played out. There was Mexico’s “tequila crisis” in 1994. The Asian crisis in 1997. The Russian devaluation of 1998. Which brings us to the current sharp selloff in a range of emerging markets. Among the countries that have been darlings of global investors in recent years, which ones are the most vulnerable to a reversal of fortunes? Here are a few ways to think about the risks.Hot money

Just to recap the obvious, there are different kinds of foreign investment. The safest—for the country being invested in, at any rate—is foreign direct investment. Think Samsung building plants to make mobile phones in Vietnam. These are long-term bets. Once a plant is built, it’s tough to pick up and move.

So-called “portfolio investment”—basically in stocks and bonds—can be much more dangerous. Obviously, it’s a lot simpler to buy and sell a bond than a manufacturing plant. That makes it much easier for these kinds of investors to cut and run.

So if you’re looking for potential problem areas among emerging markets, looking for areas that have seen the largest “portfolio flows” is a good place to start. And when countries consistently buy more than they sell—i.e., run a current-account deficit—those financial flows are even riskier. Back in March, Barclays analysts churned out this chart showing the countries where such risks lay. (The chart uses the three-letter currency code as a shorthand for the country.)

This chart spotlights Hungary (HUF), South Africa (ZAR) and Turkey (TRY) as areas of concern.

Last in, first out

Another way you can try to pinpoint risk is to see where the wave of investor cash has lifted prices up the most. The logical implication is that when that wave pulls back, prices have the farthest to fall. This chart from Morgan Stanley’s emerging markets research team pinpoints Peru (PEN) as an area to be wary of. Turkey, South Africa and Mexico (MXN) also look to be on the riskier side.

Depending on the kindness of foreigners

Turkey also has to borrow fairly large amounts of money to pay for all that it buys. Ukraine has borrowed even more—an estimated 35% of GDP in 2013. This is especially problematic because in both cases, nearly all of that debt is denominated in foreign currency. So if the local currency starts to weaken, it becomes tougher and tougher for the country to pay back its debts. And it could start a catastrophic spiral, in which investors—increasingly leery of lending—demand higher and higher premiums to do so, making it more and more expensive for the country to continue to finance itself.

Oh, and Turkey and Ukraine need to pay off a lot of old debts pretty soon, and they don’t have have the money: Their short-term debt is bigger than their foreign-currency reserves. This JP Morgan chart tells that story.

Can’t take the pain

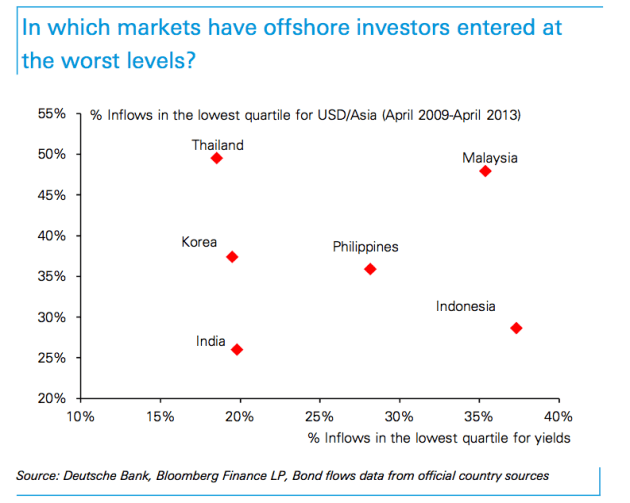

Yet another way to think about which countries are most at risk is to look at how much money investors there have made. If they bought into an emerging-market country a few years ago, they’re sitting on a lot of gains—from appreciation of both the asset and the currency it’s denominated in—that could cushion them for a while before they feel stressed enough to sell. But if they just bought in and their positions are now worth less than they paid, bar the door. Deutsche Bank Asia EM analysts make that case in this chart. The further out on the bottom axis you go, the less of a yield cushion investors have in that country. The higher up on the left axis, the more exposed they are to currency losses. The inflows into Malaysia seem vulnerable on both fronts.

Exit please

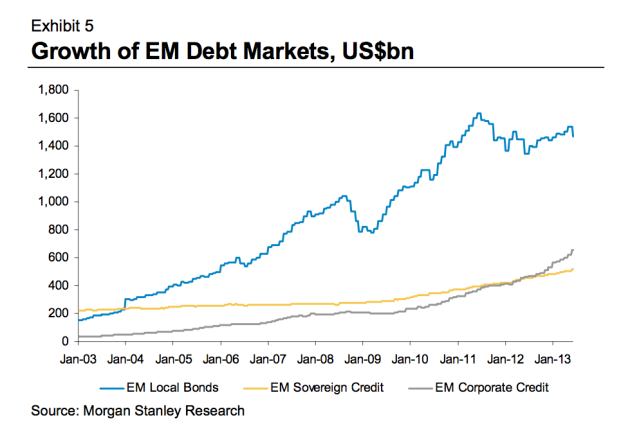

Perhaps the most important thing to remember is that over the last few years record numbers of investors have crammed into the emerging-market elevator as it’s gone up. This Morgan Stanley chart shows just how explosive the debt boom has been for these countries over the last few years, especially in local-currency-denominated debt. People that cram into these elevators should keep one thing in mind: the so-called “size of the exit.” One reason people like investing in rich countries is their financial markets are well-developed, meaning there are a lot of buyers and sellers. So it’s relatively easy to get rid of investments you don’t want any more. Emerging markets are often easy to get into, but if history is any guide, when the elevator starts to go down and everyone is trying to get out, some people are going to get stuck.