US Bonds In “Panic” Mode

June 14, 2013 Leave a comment

US Bonds In “Panic” Mode

Tyler Durden on 06/13/2013 21:40 -0400

Based on Credit-Suisse’s Panic-Euphoria model of risk appetite, US bond markets are on the verge of the short-term capitulative “Panic” mode.Each time we have reached this level of ‘selling’ in the last 6 years, Treasury yields have compressed significantly. At the same time, equity risk appetite remains bearish and US credit risk appetite has resumed its decline (but relative to Treasuries they are significantly over-sold). Not a pretty picture… Bonds hit “Panic” levels of risk appetite…

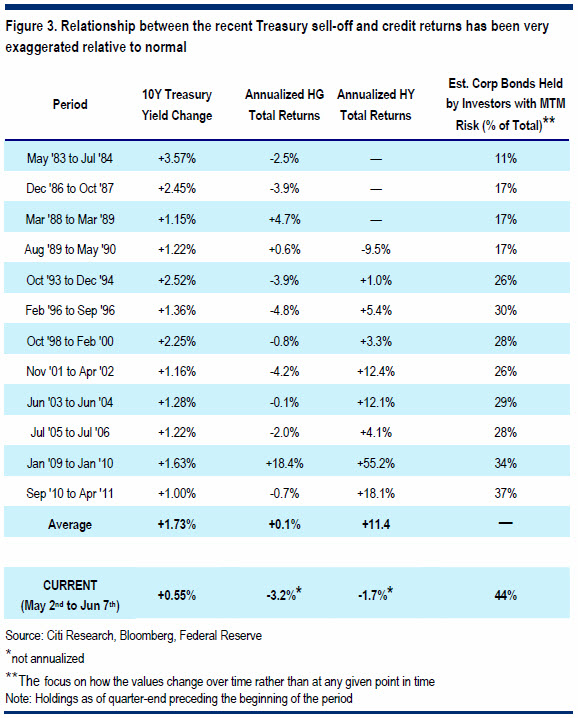

As Citi notes, Investors fear the 1994 redux trade, are looking at ways to short markets that may be vulnerable to rising rates, including credit. But in total return terms the credit space has already suffered quite dramatically. The chart below shows that the high-grade and high-yield markets are down 3.2% and 1.7%, respectively, since the Treasury backup began in early May, which is far more severe than what normally occurs when rates rise (annualized long-term average of +0.1% and +11.4%, respectively).