Jumping off the REIT bandwagon; Bond Investors Head for the Hills; As interest rates rise, banks face new stress tests

June 22, 2013 Leave a comment

Jumping off the REIT bandwagon

Garry Marr | 13/06/18 | Last Updated: 13/06/18 6:32 PM ET

That pop you heard might have been the bubble finally bursting — at least for real estate investment trusts if not housing.

Reader wonders if his $100,000 should be invested in a private REIT. ‘That’s like going to the roulette table and putting all your money on red,’ says Jason Heath

Rising bond yields have brought down the publicly traded real estate sector since it hit an all-time high at the end of April. The iShares S&P/TSX Capped REIT Index Fund dropped about 12% before recovering about two percentage points off that fall in the past week or so.Now the question is whether it’s time to plough back into the REIT sector or get out for good.

“We’ve always said the biggest risk for the real estate sector is interest rates rising and investors looking for more upside elsewhere,” said Michael Smith, an analyst with Macquarie Equities Research, adding rates are rising as world economies improve. “This is not because REITs are bad, but others look better on a relative basis.”

The market overshot itself and now it’s coming back

Mr. Smith thinks the U.S. recovery has “some legs” to it, which will have an impact on REITs, but that doesn’t mean it’s time to abandon Canadian REITs.

He thinks the REIT market will be protected by the desire for yield that investors continue to crave. “While this outlook may not seem overly attractive, investors can continue to earn yields of 4% to 5%. This may seem low, but is quite favourable compared to the S&P/TSX’s flat performance over the last seven years,” Mr. Smith said in a recent report.

Tom Hofstedter, chief executive of H&R REIT, the country’s second largest, said the knee-jerk reaction, after a rise in rates, is for a sharp decline in valuations.

“Then it claws its way back, which is what it is doing. The market overshot itself and now it’s coming back,” said Mr. Hofstedter.

He says long-term players looking for yield are still in the market but other investors who were speculating on REITs seem to have abandoned Canada.

“The U.S. institutional investor is gone. It’s not an interest game for them, they’ve been gone a few months ago. They think Canada has gone high enough and there are opportunities elsewhere. They think Canada has done what it’s going to do,” said Mr. Hofstedter. “They are a little freaked out by what the housing market is doing and what it might do, as they get their information from the press.”

The impact on REITs really depends on high interest rates ultimately go. The higher they go, the more damage. But a small half percentage point increase shouldn’t unduly impact operations and growth, says the chief executive.

Michael Missaghie, portfolio manager Sentry Investments, runs a dedicated real estate fund so he has to be in the sector. A decline has created an opportunity for him and others looking for higher quality REITS.

“With this pullback, you are going to see investors like us making sure the quality of our portfolio is at the higher end,” said Mr. Missaghie. “There is more value in higher quality business, you can get a better risk adjusted return.”

He says REITs are trading slightly above historical free cash flow multiples which makes sense in an environment of low interest rates and low economic growth.

But the latest pullback has REITs trading at 5% to 7% discount to net asset value while the sector usually trades at premium to NAV — creating room for growth.

“We expect the yields to be solid and in place,” said Mr. Missaghie, who can see a total return of 10% to 12% annually. “We don’t see the Fed raising interest rates any time soon either.”

The other issue for investors is where else are you going to get the yield that REITs continue to offer. The iShares index continues to offer about a 4.5% yield — a lofty level compared to bonds and GICs if you feel confident about your capital.

Updated June 19, 2013, 12:08 a.m. ET

Bond Investors Head for the Hills

Fears of Higher Rates, Stronger Economy Cause Funds Exodus in Sums Last Seen in Financial Crisis

By MIKE CHERNEY, KATY BURNE and MATT WIRZ

Signs of a stronger U.S. economy are rippling through the bond markets, sending investors and corporate leaders racing to prepare for higher interest rates.

Investors have pulled money out of assets ranging from lower-rated corporate bonds to ultrasafe U.S. Treasurys in sums unseen since the financial crisis. Investors yanked $17.672 billion from funds that invest in bonds in the two weeks ended June 12, according to data company Lipper, a unit of Thomson Reuters.

Trading has been volatile, and some investors have lost money after a long rally in many debt markets.

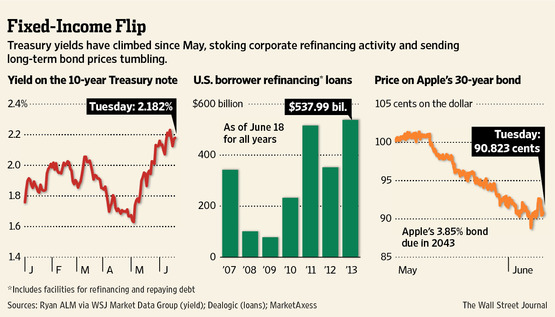

Some lower-rated companies such as Yankee Candle Co. scrapped plans to sell bonds, while some others had to pay more to get their money. Others, like highly rated Wal-Mart Stores Inc.,WMT +1.04% locked in funding at low rates. Some of the bonds issued byApple Inc. AAPL -0.05% in its record-setting $17 billion April deal have seen prices decline more than 8%, according to MarketAxess.

The recent moves show how comments by Federal Reserve Chairman Ben Bernanke and other Fed officials about tapering the central bank’s bond-buying programs already have had a huge impact on the markets. Investors are on tenterhooks hoping for clarity from Mr. Bernanke when he speaks Wednesday at a news conference concluding the two-day meeting of the Federal Open Market Committee. Many investors are looking to his words to determine the scale of further retreats or a rush back into bonds.

It is “Bernanke’s Rubicon day,” said David Kotok, chairman and chief investment officer at Cumberland Advisors, which oversees more than $2 billion.

If the Fed is clear about its intentions, “we’ll go about the business of this slow but steady recovery,” Mr. Kotok said. “If the Fed fails on Wednesday, you’re in for a shock and more volatility.”

The U.S. economy added 175,000 jobs in May, slightly higher than economists had expected. In the housing market, sales of previously owned homes were up 9.7% in April from a year earlier, according to the National Association of Realtors.

Buyers of U.S. Treasury debt since bonds began selling off at the beginning of May have lost 1.89% as of June 17 closing prices, according to Barclays BARC.LN +0.13% . Investors in high-yield bonds have lost 1.83%.

The yield on the 10-year Treasury note, which drives the rates on U.S. home mortgage loans and other consumer debt, has risen to 2.18% from its low point on May 2 of 1.62%, according to Tradeweb.

Bracing for the turmoil, investors are protecting their portfolios more against interest-rate changes by hedging with derivatives.

Thus far in June, the average daily volume of interest-rate futures and options contracts traded at CME GroupInc. CME +1.17% was 7.7 million, up from a daily average of 4.27 million in the whole month of April, according to exchange data.

People “are opening up their May statements and seeing their supposedly safe money in bonds losing money, so people are happy just shifting to the sidelines,” said Robert Laura, president of Synergos Financial Group, which advises retirees and other investors with $500,000 or more to invest.

Investors may be stashing their cash in money-market funds for now. Investors pulled money out of stock funds in the week ending June 12, according to Lipper. Money-market funds catering to individual investors took in $11.04 billion, according to the Investment Company Institute in the same week. That is the largest week of money put into such funds since $13.99 billion in the week ended Jan. 2, according to ICI data.

The sharp movements in the bond market have caused some companies to change their borrowing plans. Supermarket-chain operator Ingles Markets Inc. IMKTA +4.85%sold $700 million of high-yield bonds earlier in June at an annual interest rate of 5.75%, above the earlier suggested pricing of 5.5%. “Junk”-rated Warren ResourcesInc. WRES +1.29% and Yankee Candle pulled their deals altogether.

Yankee Candle wanted to borrow money to pay a dividend to its private-equity owners, a type of deal considered risky by investors because it increases a company’s debt load to provide returns to its owners.

“We didn’t hit it at its absolute bottom,” said Ron Freeman, chief financial officer at Ingles Markets. But “we felt like, even with the pricing coming in a little wider, that the market was going to continue to move away from us, and we were very glad we went ahead and got our deal done.”

Others are scrambling to get deals done while conditions are favorable. Wal-Mart recently refinanced $17.3 billion worth of bank credit lines, the largest refinancing of a syndicated loan this year, according to data provider Dealogic.

Wal-Mart is among a host of U.S. companies that have refinanced $538 billion in such loans this year, 53% more than $352 billion refinanced in the same period last year. The companies are putting new start dates on one- to five-year loans, allowing them low-cost cushions to ride out bumpy conditions.

Some highly rated companies have waded back into the U.S. market with sales tailored to investors’ preference for debt that matures in short time frames. Longer-dated debt is more sensitive to rising interest rates. Bond yields rise when prices fall.

A finance unit of mining giant Rio Tinto Group sold $3 billion of bonds on Friday, with maturities of five and a half years or shorter, and Chevron Corp. CVX +0.25% sold $6 billion Monday with maturities no longer than 10 years.

A handful of bond market selloffs this year were prompted by strong economic data or other central bank actions, but they usually reversed with signs from the Federal Reserve that it wouldn’t remove support. Recently, Fed officials have also said tapering its bond buying is not tantamount to embarking on rising benchmark interest rates or tightening the reins on the economy.

Some investors say this round of angst is no different than prior selloffs. Many are looking for bargains.

Mark MacQueen, co-founder and portfolio manager at Sage Advisory Services Ltd., has no regrets over buying Apple Inc.’s 30-year bonds near the top of the market in April. He has watched them fall about 8.6% from their issue price at 99.418 cents on the dollar to 90.823 cents on the dollar Tuesday, according to MarketAxess.

“I don’t think it’s practical to be able to be making every turn” with the market, said Mr. MacQueen, whose firm manages $11 billion.

The Federal Reserve may be trying to wean the markets off of its stimulus in part because investors had turned to risky corners of the credit markets for high returns, said investors.

Just by mentioning tapering the bond buying programs, Mr. Bernanke “can let a little air out of the market,” said Matt Pallai, co-manager of the $1.9 billion JPMorganJPM +0.48% Multi-Sector Income Fund.Elaine Stokes, a co-manager of a $23 billion fund at Loomis Sayles & Co., has been buying up the bonds of highly-rated emerging market companies such as Brazilian oil and gas concern Petroleo BrasileiroPETR4.BR -1.44% SA. Emerging market bond prices also fell sharply over the past two weeks.

“We have been sitting around rooting for a downward move,” said Matthew Philo, a portfolio manager at MacKay Shields. He has been buying high-yield bonds after the recent decline.

Bernanke Says Fed on Course to End Asset Buying in 2014

By Joshua Zumbrun and Jeff Kearns – Jun 19, 2013

Federal Reserve Chairman Ben S. Bernanke said the central bank may start dialing down its unprecedented bond-buying program this year and end it entirely in mid-2014 if the economy finally achieves the sustainable growth the Fed has sought since the recession ended in 2009.

The Federal Open Market Committee today left the monthly pace of bond purchases unchanged at $85 billion, while saying that “downside risks to the outlook for the economy and the labor market” have diminished. Policy makers raised their growth forecasts for next year to a range of 3 percent to 3.5 percent and reduced their outlook for unemployment to as low as 6.5 percent.

“If the incoming data are broadly consistent with this forecast, the committee currently anticipates that it would be appropriate to moderate the pace of purchases later this year,” Bernanke said in a press conference in Washington. If later reports meet the Fed’s expectations, “we will continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around mid-year.”

Stocks and Treasuries slid as Bernanke’s comments raised the prospect of an end to the quantitative easing that has fueled a rally in financial markets and helped keep the world’s largest economy expanding in the face of federal budget cuts, a slowdown in China and a recession in the euro area.

Connecting Dots

“The Fed is out of the closet,” said Ward McCarthy, chief financial economist at Jefferies Group LLC in New York and a former Richmond Fed economist. “They expect to end these QE purchases. Bernanke wasn’t more specific than later this year, but connecting all the dots suggests he is thinking in the fourth quarter.”

The Standard & Poor’s 500 Index declined 1.4 percent to 1,628.93. The yield on the 10-year Treasury note jumped to 2.36 percent, the highest since March 2012, from 2.19 percent late yesterday.

Still, Bernanke tried to temper his message by saying that the Fed has “no deterministic or fixed plan” to end asset purchases.

“If you draw the conclusion that I just said that our policies — that our purchases will end in the middle of next year, you’ve drawn the wrong conclusion, because our purchases are tied to what happens in the economy,” he said. “If the economy does not improve along the lines that we expect, we will provide additional support.”

Open-Ended

Bernanke is expanding the Fed’s balance sheet toward $4 trillion as he seeks to reduce a jobless rate that stands at 7.6 percent after four years of economic growth. The Fed’s open-ended purchases, started last September and expanded in December, are unprecedented. In two previous rounds, it specified total purchases in advance.

“I’m surprised at how badly the Fed wants to taper” to a slower pace of purchases, said Julia Coronado, the chief economist for North America at BNP Paribas SA in New York and a former Fed economist. The Fed has “greater confidence than the average private sector forecaster in the outlook.”

The economy will grow 1.9 percent in 2013 and 2.7 percent in 2014, according to the median estimates in a Bloomberg survey. The economy has not grown more than 3 percent over the course of 12 months since the four quarters ending in June 2006.

The Fed also left unchanged its statement that it plans to hold its target interest rate near zero as long as unemployment remains above 6.5 percent and the outlook for inflation doesn’t exceed 2.5 percent.

Unemployment Threshold

Bernanke said policy makers might aim for a lower unemployment threshold before considering an increase in short-term interest rates.

“In terms of adjusting the threshold, I think that’s something that might happen,” he said in response to a question. “If it did happen, it would be to lower it, I’m sure, not to raise it.” He said an interest-rate increase is still “far in the future.”

Fed officials lowered their forecasts for the unemployment and inflation rates this year.

They now see a jobless rate of 7.2 percent to 7.3 percent, compared with 7.3 percent to 7.5 percent in their March forecasts. They predict the jobless rate will fall to 6.5 percent to 6.8 percent in 2014.

“Labor market conditions have shown further improvement in recent months, on balance, but the unemployment rate remains elevated,” the FOMC said in its statement. “Partly reflecting transitory influences, inflation has been running below the committee’s longer-run objective, but longer term inflation expectations have remained stable.”

Target Rate

Fifteen of 19 policy makers expect no increase in the federal funds rate before 2015, according to today’s forecasts. In March, 14 policy makers had that expectation.

The Fed repeated that it will keep buying assets “until the outlook for the labor market has improved substantially.” Bond purchases will remain divided between $40 billion a month of mortgage-backed securities and $45 billion a month of Treasury securities. The central bank also will continue reinvesting securities as they mature.

St. Louis Fed President James Bullard dissented for the first time in his tenure on the FOMC, saying the committee should “signal more strongly its willingness to defend its inflation goal in light of recent low inflation readings.”

Kansas City Fed President Esther George dissented for the fourth meeting in a row, continuing to cite concern that keeping the benchmark interest rate near zero risks creating “economic and financial imbalances,” including asset price bubbles.

Economists’ Forecasts

No change in policy was expected at today’s meeting. Fifty-eight of 59 economists in a June 4-5 Bloomberg Survey predicted the central bank would maintain the pace of purchases.

Inflation is providing little impetus for a tapering in bond purchases. A gauge of consumer prices excluding food and energy that is watched by the Fed rose 1.1 percent in the year through April, matching the smallest gain since records started in 1960. Officials expect inflation to slowly rise in coming years, with core prices climbing to 1.5 percent to 1.8 percent in 2014 and 1.7 percent to 2 percent in 2015.

Speculation that an improving economy will prompt Fed policy makers to reduce bond buying last month triggered the biggest jump in 10-year Treasury yields since December 2010.

About $2 trillion has been erased from the value of global equities since Bernanke told U.S. lawmakers on May 22 that the FOMC “could” consider reducing bond purchases within “the next few meetings” if officials see signs of improvement in the labor market and are convinced the gains can be sustained.

Mortgage Rates

Mortgage rates have soared the most in a decade on speculation the Fed’s purchases may slow. The interest rate on a 30-year fixed home loan climbed to a 14-month high of 3.98 percent last week, according to data compiled by Freddie Mac.

Bernanke is nearing the end of his second four-year term, a period marked by unprecedented measures to battle the deepest recession since the 1930s and then to keep the economy growing at a pace that’s brisk enough to put millions of unemployed Americans back to work.

The former Princeton professor cut the Fed’s target interest rate almost to zero in December 2008 and has led the central bank in three rounds of large-scale asset purchases that have swelled the Fed’s balance sheet to a record $3.41 trillion.

President Barack Obama, in an interview on PBS this week, provided one of the clearest signals yet that Bernanke may not remain beyond the end of his term on Jan. 31. Bernanke “already stayed a lot longer than he wanted or he was supposed to,” Obama said.

Bernanke declined to discuss his future at today’s press conference.

“We just spent two days working on monetary policy issues and I would like to keep the debate, discussion, questions here on policy,” he said in response to a question. “I don’t have anything for you on my personal plans.”

To contact the reporters on this story: Joshua Zumbrun in Washington at jzumbrun@bloomberg.net; Jeff Kearns in Washington atjkearns3@bloomberg.net

Updated June 19, 2013, 6:58 p.m. ET

Bond Markets Sell Off

By KATY BURNE And MIKE CHERNEY

Bond prices slumped, sending the yield on the 10-year Treasury note to its highest level in 15 months, as the Federal Reserve upgraded its growth projections for the U.S. economy.

The selloff came as Fed Chairman Ben Bernanke said the central bank’s stimulus measures could be pared back this year. Stronger U.S. growth is widely perceived in the market as heralding an earlier end to the Fed’s program of purchasing $85 billion in bonds each month, an effort that is viewed by many investors as key to the broad rally in asset prices this year.

At the news conference following the Federal Open Market Committee’s policy meeting Wednesday, Mr. Bernanke said it would be “appropriate to moderate the monthly pace of purchases later this year.”

Yields on 10-year Treasurys jumped, closing at 2.308%, according to Tradeweb, from a low point on the day of 2.167%. Later in the afternoon, the yield on the 10-year Treasury note reached 2.360%. When bond yields rise, prices fall.

Mortgage-backed-securities prices also dropped, pushing the yield on bonds comprising loans backed by government-controlled company Fannie MaeFNMA -3.16% higher by 0.22 percentage point, to 3.20%, the highest level since March 20, 2012, according to Credit Suisse CSGN.VX +0.23% .

The CDX North America Investment Grade index, a proxy for corporate debt run by Markit, weakened 7%, the largest intraday drop since November 2011, and its below-investment-grade counterpart fell 1.6%. Highly rated corporate bonds are more sensitive to sharp interest-rate moves as they are tethered more tightly to Treasury yields. When rates go up, the prices of existing, lower-yielding bonds fall.

Chevron Corp. CVX -0.84% bonds due in December 2017 traded at 97.647 cents on the dollar, down from 98.253 cents earlier in the session, for a yield of 1.655%, up from 1.512%. Ball Corp. BLL +0.07% bonds due 2023 traded at 94 cents on the dollar for a yield of 4.737%, compared with 95 cents earlier in the session for a yield of 4.611%, according to MarketAxess.

“There’s been no place to hide, everything is wider,” said Gary Herbert, global high-yield portfolio manager at Brandywine Global Investment Management LLC, which oversees $40 billion in fixed-income assets. “You’ve had unorthodox policy, and it’s time to remove it.”

Corporate-bond exchange-traded funds also showed losses after the Fed statement was released. The iShares iBoxx $ Investment Grade Corporate Bond Fund fell 1.42% on the day.

John Majoros, managing director at Wasmer, Schroeder & Co., said the corporate-bond market felt weaker, but there wasn’t a sense of panic. “This would not be among the top 50 bad days that I’ve seen,” he said.

Meanwhile, futures prices on CME Group Inc.’s CME -1.71% 30-day fed-funds futures contract showed that just after the Fed’s statement, the market was expecting a 67% probability of a rate increase in January 2015, compared with 51% a few minutes before the statement.

Frank Friedman, the chief financial officer of Deloitte LLP, said: “I think most companies would trade off moderate rate increases for a better economy.”

Mary Talbutt, portfolio manager and trader at the Bryn Mawr Trust Co., which manages more than $6.5 billion, said the market selloff was “an overreaction, so I went out and spent some money.” Ms. Talbutt said she bought five- and 10-year Treasurys.

As interest rates rise, banks face new stress tests

By Stephen Gandel, senior editor June 17, 2013: 7:04 AM ET

Banks are starting to come clean about their rate risks.

FORTUNE — Banks have mostly been tight-lipped about what rising interest rates would mean for their bottom lines. They will soon have to open up a little more to regulators and investors.

For the first time this year, the Federal Reserve is requiring the nation’s 18 largest banks to submit mid-year stress tests, showing how they would perform if they were hit with a negative economic shock, like a spike in unemployment or interest rates. The results are due to the Fed by July 5th. Unlike the bank stress tests conducted at the beginning of the year, though, the Fed will not run its own test, or publicly critique the results. However, the banks will be required to make the results public at the end of September.

Bankers are meeting with Fed officials behind closed doors next week in Boston to discuss the stress tests. There has been some contention over the process in the past. Bank executives have expressed frustration that the Fed won’t say how it gets its results. At a similar conference last year, Wells Fargo’s (WFC) treasurer, Paul Ackerman, reportedly drew applause from bankers when he said he still didn’t get how the Fed’s loss estimates could be so different than his bank’s.

On the list of topics for this year’s meeting are residential loans, corporate loans, and so-called counterparty credit risk, which is how much money a bank could lose if one of its trading partners goes bust. Putting a figure on that is one of the fuzziest parts of stress testing. In the past few months, regulators have stepped up scrutiny of corporate lending, questioning whether banks have made too many “covenant-light” and leverage loans.

But rising interest rates are sure to come up. The yield on the 10-year Treasury bond has been rising recently, after being stuck near historic lows ever since the recession. The Fed included a sharp rise in interest rates as one of the shocks banks could face when it calculated potential trading losses in the stress tests that were released in March. That was the first time the Fed had done that.

What’s more, bankers say the Office of the Comptroller of the Currency has recently been questioning banks about interest rate risk. Last year, the OCC included rising interest rates in its report of top risks for banks.

It’s hard to know how much banks would lose. Generally, banks have stuck to positives. Higher interest rates would allow the banks to charge more for loans. That could boost lending revenue and profits. But at the same time higher interest rates, and falling debt prices have, in the past, caused big losses for the banks in their bond and loan portfolios. Banks have been less outspoken about that part of the rising interest rate story. But that might be changing.

At an investor conference last week, Bank of America CFO Bruce Thompson indicated that the bank could lose as much as $11 billion in its bond and loan portfolio if interest rates were to rise 1%. He said that was as much as three times what Bank of America (BAC) would gain from higher rates in its lending business. But the bank might not have to realize those losses immediately, or ever, if it holds the debt and borrowers end up paying. Still, the bank’s capital could fall, which is something both investors and regulators have watched closely since the financial crisis, and something that would show up on the bank’s stress test.

The best of times, worst of times story banks are telling about rising interest rates could end up being the other way around.

US Fed outlines plan to withdraw stimulus

June 20, 2013 – 6:27AM

The Federal Reserve will start to withdraw a key part of its support for the US economy later this year and bring it to a halt around mid-2014, but only if the recovery continues at its current pace.

Federal Reserve chairman Ben Bernanke said the Fed expected moderate growth to lead to continuing healing in the job market as headwinds facing the economy ease, which could allow the central bank to begin winding back its bond-buying program. He also said policymakers expect inflation to move back up toward their long-term 2 per cent goal.

The committee currently anticipates that it will be appropriate to moderate the monthly pace of purchases later this year.

The Australian dollar dived on the comments. The local currency was trading at 95.5 US cents prior to the remarks by Federal Reserve chairman Ben Bernanke, but slumped to 92.30 US cents, its lowest point since early October 2010. It was trading at 103 US cents in early May.

‘‘The committee currently anticipates that it will be appropriate to moderate the monthly pace of purchases later this year, and if the subsequent data remain broadly aligned with our current expectations for the economy, we will continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around mid-year,’’ Bernanke said.

He made the statement at a news conference on the Fed’s decision, announced earlier, to continue buying $US85 billion in bonds per month given still-high unemployment.

After a two-day meeting, the Fed’s policy-setting panel offered a more upbeat assessment of the risks facing the economy than they had after they last met in May.

‘‘The committee sees the downside risks to the outlook for the economy and the labor market as having diminished since the fall,’’ it said.

US stocks fell sharply, the dollar rose and US bond prices fell, lifting the yield on the benchmark 10-year Treasury note to levels not seen since March 2012, as traders saw Bernanke’s remarks and the policy panel’s statement as a clear step toward a reduction in the central bank’s bond buying.

‘‘The statement contained a notable pat on the back, saying the downside risks to the outlook for the economy and the labor market have diminished since the fall, which is a necessary precursor if they are going to get to the point where they do start to taper,’’ said Greg McBride, senior financial analyst at Bankrate.com in New York.

Kansas City Fed President Esther George again dissented against the Fed’s expansion of its support for the economy, expressing concern it could fuel financial imbalances and hurt the central bank’s goal of keeping inflation contained.

But in a surprise, St. Louis Fed chief James Bullard also dissented, arguing the Fed should signal more strongly its willingness to defend its 2 per cent goal for inflation, although the statement did not indicate whether he pushed for stepping up the pace of bond purchases.

Rate rise not seen until 2015

The Fed has held overnight interest rates near zero since December 2008 while more than tripling its balance sheet to around $US3.3 trillion with its bond buying. In its current and third installment of so-called quantitative easing, it is purchasing $US40 billion in mortgage-backed securities and $US45 billion in longer-term US government securities each month.

Economists expect rates to stay on hold until 2015, but the view in financial markets of the lift-off date had shifted forward since Fed Chairman Ben Bernanke fired up speculation last month that the central bank could soon curb its asset buying.

The Fed repeated on Wednesday that it will not raise interest rates until unemployment hits 6.5 per cent or lower, provided that the outlook for inflation stays under 2.5 per cent.

The jobless rate was 7.6 per cent in May.

In his news conference, Bernanke made clear that threshold was merely for considering a rate hike, not a trigger for necessarily making one. In fresh quarterly projections, 14 of the 19 members of the Fed’s policy panel said they did not think it would be appropriate to raise rates until some time in 2015.

In a sharp downgrade, the Fed forecast the PCE price index, its preferred gauge of the price pressures facing consumers, would rise just 0.8 to 1.2 per cent this year. However, it saw inflation heading back to 1.4 to 2.0 per cent in 2014 and 1.6 to 2.0 per cent in 2015.

Low inflation could allow the Fed to keep rates lower for longer.

Furthermore, in a slight upgrade to their projections, officials forecast unemployment to average 6.5 to 6.8 per cent in the fourth quarter of next year, and 5.8 to 6.2 per cent in the final three months of 2015. They forecast US economic growth of between 3.0 and 3.5 per cent next year and 2.9 to 3.6 per cent in 2015.

Analysts think U.S growth slowed a bit in the second quarter of this year in the face of fiscal drag from government spending cuts and higher taxes, and recent readings from the economy have been mixed.

The labor market, a central focus of Fed efforts to boost growth, has notched steady improvement with 175,000 new jobs added in May. But US manufacturers have been hurt by softer overseas demand, and inflation has fallen even further beneath the Fed’s goal.

The consumer price index was up 1.4 per cent in May from a year ago. But the PCE price index rose just 0.7 per cent in the 12 months through April, the most recent reading.

BlackRock Corporate Bond ETF Plunges Most in Almost Two Years

A $21 billion BlackRock Inc. (BLK) exchange-traded fund that owns investment-grade corporate bonds plunged the most in almost two years after the Federal Reserve signaled it may slow unprecedented stimulus supporting the market.

The iShares iBoxx Investment Grade Corporate Bond ETF (LQD) dropped 1.4 percent to $114.72, the biggest decline since August 2011. Investors have redeemed about $3.4 billion of the fund’s shares this year, data compiled by Bloomberg show.

The central bank may “moderate” the pace of its buying later this year and end the purchases around the middle of 2014 if data on economic growth is “broadly consistent” with its forecast, Fed Chairman Ben S. Bernanke said at a news conference today. Fed policy makers said in a statement today that risks to the economy have decreased.

Investors are cooling enthusiasm for the highest-rated debt as they prepare for a pullback from stimulus efforts that have pumped more than $2.5 trillion into the financial system since 2008. Yields on 10-year U.S. Treasuries, a benchmark for corporate debt, climbed 17 basis points to 2.35 percent as of 4:45 p.m. in New York, the highest level since March 2012.

ETFs, with shares that trade like stocks, allow investors from retirees to hedge funds to slip in and out of the bond market quicker than investments in the actual debt, which typically trades off exchanges in privately negotiated transactions.

Since BlackRock’s fund was created as the first fixed-income ETF in 2002, the U.S. debt funds have amassed $249.3 billion of assets, according to data from State Street Corp. (STT)

To contact the reporter on this story: Lisa Abramowicz in New York at labramowicz@bloomberg.net

June 20, 2013 4:35 pm

Fasten your seat belts for a turbulent QE exit

By Gillian Tett

A few weeks ago I had the pleasure of dining with two former luminaries of American economic policy. Unsurprisingly, the issue of quantitative easing provoked heated debate – not so much over the question of whether QE had been a correct policy to implement (they both backed its introduction), but whether the Federal Reserve could ever find a smooth exit.

The argument was illuminating, since it split along two lines. One of the dinner guests – who I shall call “Mr O”, or Optimist – argued that it was entirely possible for theFederal Reserve to achieve a smooth exit from QE. After all, he declared, the Fed did not necessarily need to actively do anything to find that exit, such as sell securities; instead, it merely needed to stop buying anything more. For if it duly sat on its hands, the two trillion-dollars worth of assets it has recently accumulated on its balance sheet would automatically roll off (ie come to maturity), enabling the Fed balance sheet to return to pre-crisis levels over the course of the next seven or eight years.

Or to use a memorable image, what the Fed is essentially now doing – in the eyes of Mr O – is akin to a pilot stealthily landing a plane: once it powers down the motors, gravity will take hold, putting the balance sheet on a steady downward glide path. “There will be plenty of time to adjust, and even if it’s a bit bumpy sometimes, that can be handled,” Mr O insisted. After all, Ben Bernanke, Fed chairman, has already told everyone well ahead of time to start fastening their seat belts to avoid any element of surprise. Hence this week’s statements.

So far, so reassuring, at least as an image. But there is catch. As we sat around the dinner table that night, another former Washington luminary – who I shall called Mr P, or Pessimist – was distinctly unconvinced. For Mr P’s own experience of sitting on the flight deck of America’s economy leaves him dubious about whether policy makers can ever deliver such smooth glide paths, particularly over seven years.

Never mind the fact that the proposed glide path, between now and 2021, say, would cut across two American election cycles (or four if you count the mid-terms too); and ignore the potential for geopolitical shocks (say Iran, North Korea or from the eurozone). Another risk is that other central banks could also be seeking their own descent paths at the same time as the Fed, creating additional turbulence. After all, G7 central banks have collectively put some $10,000bn of additional liquidity into the system since 2008, according to JPMorgan and Deutsche estimates. That means that there has been an unprecedented level of simultaneous monetary stimulus – and prospective future tightening.

And then, of course, there is the nasty tendency of investors to over-react and panic; and this danger is doubly severe given how addicted global markets have become to cheap money – and the carry trade – in recent years. “Markets don’t adjust smoothly,” muttered Mr P, who pointed out that while asset price increases often build steadily over several years, declines can be brutal.

Of course, the counter argument to this – as Mr O pointed out – is that almost exactly a decade ago the Fed did manage to tighten policy fairly smooth; unlike 1994, the turning point in 2004 did not cause turbulence. And in practical terms it is the pessimists who have often been wrongfooted in the last couple of years. A few years ago, Cassandras were forecasting a dollar collapse, a bond market bloodbath, and massive losses as a result of the American banking bailout. However, the dollar has remained strong(ish), bonds have outperformed, and the Tarp programme has recouped its money. Indeed, if you want to find tangible evidence of how a “taper” policy can work, just look at how the Fed has been exiting from its holdings of AIG assets and other 2008 financial measures.

But it is one thing to sell a few AIG assets; it is quite another to unwind several trillion dollars of monetary stimulus when the global financial system is addicted to the carry trade. And it could be doubly hard to land that plane given that the pilot is operating in a thick financial fog, with incomplete data dials and a volatile market compass.

So, personally, I agree with Mr Bernanke that it is time to start preparing for an exit. I also laud the efforts that the Fed is making to tell markets to prepare. Indeed, in that vein, I would argue that the market whiplash we have seen in the last 24 hours is actually a thoroughly good thing, since it will force investors to shift their mindsets and portfolios – and unwind their carry trades – as that American policy “tanker” starts to turn, to use the image Gavyn Davies presented in an FT blog. But I (like Mr P) fear the exit will be so more turbulent than most policy makers want to admit – or hope – that the pilots could struggle to stay in control. Fasten those seat belts tightly.

Biggest Muni ETF Lowest Since 2011 After Bernanke Rattles Market

The largest exchange-traded fund tracking the U.S. municipal-bond market fell to the lowest price in almost two years and the week’s two biggest sales were delayed as the Federal Reserve said it may stop buying debt.

The $3.6 billion iShares S&P National AMT-Free Municipal Bond Fund, known as MUB, fell to $104.10 (MUB) at 2:26 p.m. in New York today, the lowest since August 2011 and the biggest one-day price drop since February 2012, data compiled by Bloomberg show.

The price decline mirrored changes in the $3.7 trillion municipal market, where tax-exempt yields rose along with those on Treasuries, said David Manges, muni trading manager at BNY Mellon Capital Markets LLC in Pittsburgh. Yields move in the opposite direction of prices.

“The muni market is in a free-fall today,” Manges said. “It’s tough to get a sense of value or benchmark spreads because prices are so fluid.”

Fed Chairman Ben S. Bernanke yesterday said the central bank plans to slow its bond-buying program this year and end its monthly purchases of federal debt and mortgage securities in mid-2014, if the economy continues to improve. Yields on 10-year Treasuries climbed to 2.43 percent, the highest since August 2011, Bloomberg data show.

Mutual funds and other institutional buyers of munis put about $900 million of state and local debt up for sale yesterday, Bloomberg data show. That compares with a one-year daily average of $548 million.

Deals Delayed

Yields on benchmark 30-year municipals increased to about 3.68 percent at 2 p.m. in New York, the highest since Jan. 9, 2012.

The California Health Facilities Financing Authority postponed a $764 million sale for St. Joseph Health System, the biggest muni sale of the week, Bloomberg data show.

Brian Greene, a spokesman for St. Joseph Health System, said he wasn’t able to immediately comment on the sale. Bill Ainsworth, a spokesman for California Treasurer Bill Lockyer and the authority, didn’t immediately respond to a request for comment on the postponement.

New York’s Metropolitan Transportation Authority, which operates the biggest U.S. transit system, delayed a $350 million bond sale because of “market volatility,” Aaron Donovan, a spokesman, said in an e-mail. The transit authority plans to sell the bonds in the next two to three weeks, Donovan said.

To contact the reporter on this story: Michelle Kaske in New York at mkaske@bloomberg.net

Published: Friday June 21, 2013 MYT 8:06:00 AM

Stock market has been put on notice by Fed: from here on in, you’re on your own

NEW YORK: The stock market has been put on notice by the Federal Reserve: from here on in, you’re on your own.

Stock markets worldwide have fallen sharply since comments on Wednesday by Fed Chairman Ben Bernanke laying out the U.S. central bank’s plans to pull back on its $85 billion in monthly asset purchases. U.S. stocks endured their worst two-day selloff since November 2011, and the Dow Jones industrials fell 354 points on Thursday. <.N>

The declines, should they continue, would justify the fears of those who believed the rally that sent the S&P 500 <.SPX> to record highs last month was only due to Fed intervention.

“We are going to continue to see volatility until we get to a point where the markets come to terms with the fact that we have a sustainable recovery in our hands, that it is not in need of life support,” said Peter Kenny, chief market strategist at Knight Capital in Jersey City, New Jersey.

Even though the move theoretically means market fundamentals will rise in importance, the selloff shows the process is going to be a tricky one for traders and investors to navigate as they encounter economic data likely to give off contradictory signals.

ADJUSTING TO REALITY

Many expect wild swings in the coming months as the market adjusts to this new reality. Investors are likely to worry that surprisingly strong economic figures will hasten the Fed’s exit from markets – ironically putting the market in the position of rooting for good-but-not-great economic figures.

Just the same, if the Fed is bent on reducing its bond-buying program absent a calamity, signs of mediocre economic growth won’t inspire buying, either.

So far this year “it was a matter of ‘good data is good and bad data is good,'” said Brian Jacobsen, chief portfolio strategist at Wells Fargo Funds Management in Menomonee Falls, Wisconsin.

“You can’t take bad data any more as an excuse for a rally in the market,” he said.

Investors are almost evenly split on whether the Federal Reserve will be able to manage the transition to higher interest rates without doing serious harm to the economy, according to the Wells Fargo/Gallup Investor and Retirement Optimism Index, released on Thursday. Forty-six percent of those surveyed said the Fed will be successful, while 43 percent said the economy will suffer great harm when policy changes.

Market participants are struggling with this right now. The CBOE Volatility Index <.VIX>, a gauge of anxiety on Wall Street, jumped 23 percent on Thursday to 20.49, the first time this year it has exceeded 20, an often-used line of demarcation between calm and stressed markets.

Along with the VIX, there were other indicators showing increased concern about declines. The S&P’s one-month “skew,” which measures the difference between buying downside put options and upside call options, surged to a one-year high, according to Credit Suisse. That means downside protection has gotten very expensive.

In addition, on a day when less than 5 percent of the S&P 500’s components ended higher, shares of CME Group hit a 52-week high in a sign investors expect trading in derivatives to rise as traders protect against losses. More than 20 million options contracts traded on Wednesday, according to OCC, formerly Options Clearing Corp, the busiest day since May 22.

LOOKING AT VALUATION

For some, the selling is not justified, as Bernanke made it that clear that only when the economy is healthy enough to thrive on its own will the Fed take away “the punchbowl,” – a reference to the statement by former Fed Chairman William McChesney Martin that the Fed’s job is “to take away the punch bowl just as the party gets going.”

In addition, for all of the recent volatility, the U.S. markets have been a relative oasis compared with stock markets around the world, which have been hit harder since Ben Bernanke first broached the reduction of stimulus on May 22.

Japan’s Nikkei 225 <.N225> has lost nearly 17 percent since May 21; Brazil’s Bovespa <.BVSP> is down 15 percent in that time, and the MSCI All-World Index <.MIWD00000PUS> has lost 7.1 percent. The S&P is down just 4.9 percent, a signal that investors believe the U.S. outlook is stronger.

“If you look at the fundamentals of U.S. equities, not only in a stand-alone basis but relative to the rest of the world, in both those categories it is really hard to find a more attractive asset right now than U.S. equities,” said Stephen Sachs, head of capital markets at ProShares in Bethesda, Maryland.

That thesis will be tested as the summer wears on, and as earnings season approaches. The relatively attractive valuations currently seen in markets have to take into account low borrowing costs that have helped companies secure cheap funding.

With the back-up in Treasury yields, the 10-year Treasury rate at 2.42 percent is more attractive than the S&P 500’s dividend yield of 2.13 percent, notes Andrew Wilkinson, chief economic strategist at Miller Tabak. That could portend more selling in stocks.

Still, at 14.4, the forward price to earnings ratio of the S&P 500 is slightly below the historic norm. A pullback could be a shallow one if valuations become more attractive, depending on the corporate earnings outlook.

“There has to be a rotation towards more compelling, compressed valuations,” said Knight’s Kenny. “That should be welcome, but that doesn’t mean it’s going to feel good.” – Reuters

Published: Friday June 21, 2013 MYT 8:46:00 AM

Bernanke suddenly no friend to big bond funds

NEW YORK: Ben Bernanke, the central bank chief whose massive stimulus program drove bond yields to historical lows and minted a mountain of profit for fixed-income funds along the way, is now the arch nemesis of bond mavens.

It doesn’t matter whether it’s a “govvies” guy focused on Treasury debt or a junk bond junkie devoted to high-yield corporate bonds. The losses inflicted across all fixed-income assets since Bernanke signaled on May 22 that the Fed could soon dial back its $85 billion a month in bond purchases have been deep: $406 billion of cumulative losses, according to Bank of America/Merrill Lynch Fixed Income Indexes data.

“It has been a tough month after a rough May for a lot of investors, but mostly for the bond crowd,” said John Brynjolfsson, chief investment officer of hedge fund Armored Wolf.

The downward spiral accelerated on Wednesday when Bernanke said the Fed now views the U.S. economy as strong enough to consider reducing bond purchases by year end and ending them entirely by the middle of next year.

The 10-year Treasury note yield climbed 46 basis points during May and has risen another 28 basis points so far in June. The yield hit 2.47 percent in overnight trading Thursday, its highest level since August 2011. Yields move inversely to the price of bonds.

The sell-off comes after investors have piled into bond funds. Investors added $257.8 billion to bond funds in 2012, according to Lipper, and have invested another $102.8 billion since the start of the year, dwarfing the roughly $33 billion invested in bond funds in 2008.

“The big question is: Is this a short-term or a whole re-pricing?” saidMarc Lasry, co-founder of the $12 billion distressed debt firm Avenue Capital. “Right now it is too early to tell. We need to wait a little while, about two weeks” to get a better picture of whether the sell-off is a more permanent correction.

BOND KING’S ‘GUT FEELING’

Funds with large exposures to interest rates and emerging markets have been hit the hardest.

The $265 million Pimco Extended Duration Fund , for instance, has fallen 12.3 percent since the end of April, according to Lipper data. The $495 million TCW Emerging Markets Local Currency Fund has dropped 9.3 percent over the same time, while the $3.2 billion Vanguard Long-term Treasury Fund has lost 8 percent.

By comparison, the Barclays Aggregate Index, a measure of the total U.S. bond market, lost approximately 2.58 percent over the same time frame.

Bond managers have been well aware of the risks. Bill Gross, who is often referred to as the “bond king” for his role as manager of the Pimco Total Return Fund , the world’s largest bond fund, set the Wall Street Twittersphere alight several weeks ago with this 62-character missive: “The secular 30-yr bull market in bonds likely ended 4/29/2013.”

The “price peak refers not to Treasuries but to all bonds, including a weighted amount of high-yield debt. Thus the 4/29 date will not exactly correspond to a bottom in 10-year Treasury yields, for instance,” Gross said in an email response to Reuters. The Pimco Total Return fund is down 3.25 percent since the end of April.

YIELD CHASING

In early May, Bernanke began what appeared to be a campaign of jaw-boning investors to stop dangerously chasing yield.

“In light of the current low interest-rate environment, we are watching particularly closely for instances of ‘reaching for yield’ and other forms of excessive risk-taking, which may affect asset prices and their relationships with fundamentals,” Bernanke said.

Top U.S. money managers also raised concerns at an informal discussion with the president of the New York Federal Reserve Bank, William Dudley, in April about the large inflow of dollars from mom-and-pop investors into fixed-income funds over the past few years.

The minutes from the group’s meeting of the Investor Advisory Committee on Financial Markets said the managers discussed how the Fed’s efforts to keep interest rates low in order to spark economic growth had created a “larger footprint of retail accounts in credit markets” and “fixed income instruments.”

The Financial Industry Regulation Authority, Wall Street’s industry-funded watchdog, meanwhile, has warned investors and brokers alike about the risk rising interest rates pose to bond funds, an attempt to stave off lawsuits filed by jilted clients down the line.

Even so, Gross and Doubleline Capital’s chief executive officer, Jeffrey Gundlach, are still fans of Treasuries.

Gundlach told Reuters on Thursday: “Not only do Treasuries look attractive, but they have been outperforming everything. ‘Down a little’ is the new ‘up’, for now anyway.” – Reuters

Analysis: Anxiety grows as stock market learns to walk on its own

Thu, Jun 20 2013

NEW YORK (Reuters) – The stock market has been put on notice by the Federal Reserve: from here on in, you’re on your own.

Stock markets worldwide have fallen sharply since comments on Wednesday by Fed Chairman Ben Bernanke laying out the U.S. central bank’s plans to pull back on its $85 billion in monthly asset purchases. U.S. stocks endured their worst two-day selloff since November 2011, and the Dow Jones industrials fell 354 points on Thursday. .N

The declines, should they continue, would justify the fears of those who believed the rally that sent the S&P 500 .SPX to record highs last month was only due to Fed intervention.

“We are going to continue to see volatility until we get to a point where the markets come to terms with the fact that we have a sustainable recovery in our hands, that it is not in need of life support,” said Peter Kenny, chief market strategist at Knight Capital in Jersey City, New Jersey.

Even though the move theoretically means market fundamentals will rise in importance, the selloff shows the process is going to be a tricky one for traders and investors to navigate as they encounter economic data likely to give off contradictory signals.

ADJUSTING TO REALITY

Many expect wild swings in the coming months as the market adjusts to this new reality. Investors are likely to worry that surprisingly strong economic figures will hasten the Fed’s exit from markets – ironically putting the market in the position of rooting for good-but-not-great economic figures.

Just the same, if the Fed is bent on reducing its bond-buying program absent a calamity, signs of mediocre economic growth won’t inspire buying, either.

So far this year “it was a matter of ‘good data is good and bad data is good,'” said Brian Jacobsen, chief portfolio strategist at Wells Fargo Funds Management in Menomonee Falls, Wisconsin.

“You can’t take bad data any more as an excuse for a rally in the market,” he said.

Investors are almost evenly split on whether the Federal Reserve will be able to manage the transition to higher interest rates without doing serious harm to the economy, according to the Wells Fargo/Gallup Investor and Retirement Optimism Index, released on Thursday. Forty-six percent of those surveyed said the Fed will be successful, while 43 percent said the economy will suffer great harm when policy changes.

Market participants are struggling with this right now. The CBOE Volatility Index , a gauge of anxiety on Wall Street, jumped 23 percent on Thursday to 20.49, the first time this year it has exceeded 20, an often-used line of demarcation between calm and stressed markets.

Along with the VIX, there were other indicators showing increased concern about declines. The S&P’s one-month “skew,” which measures the difference between buying downside put options and upside call options, surged to a one-year high, according to Credit Suisse. That means downside protection has gotten very expensive.

In addition, on a day when less than 5 percent of the S&P 500’s components ended higher, shares of CME Group (CME.O: Quote, Profile, Research, Stock Buzz) hit a 52-week high in a sign investors expect trading in derivatives to rise as traders protect against losses. More than 20 million options contracts traded on Wednesday, according to OCC, formerly Options Clearing Corp, the busiest day since May 22.

LOOKING AT VALUATION

For some, the selling is not justified, as Bernanke made it that clear that only when the economy is healthy enough to thrive on its own will the Fed take away “the punchbowl,” – a reference to the statement by former Fed Chairman William McChesney Martin that the Fed’s job is “to take away the punch bowl just as the party gets going.”

In addition, for all of the recent volatility, the U.S. markets have been a relative oasis compared with stock markets around the world, which have been hit harder since Ben Bernanke first broached the reduction of stimulus on May 22.

Japan’s Nikkei 225 .N225 has lost nearly 17 percent since May 21; Brazil’s Bovespa .BVSP is down 15 percent in that time, and the MSCI All-World Index .MIWD00000PUS has lost 7.1 percent. The S&P is down just 4.9 percent, a signal that investors believe the U.S. outlook is stronger.

“If you look at the fundamentals of U.S. equities, not only in a stand-alone basis but relative to the rest of the world, in both those categories it is really hard to find a more attractive asset right now than U.S. equities,” said Stephen Sachs, head of capital markets at ProShares in Bethesda, Maryland.

That thesis will be tested as the summer wears on, and as earnings season approaches. The relatively attractive valuations currently seen in markets have to take into account low borrowing costs that have helped companies secure cheap funding.

With the back-up in Treasury yields, the 10-year Treasury rate at 2.42 percent is more attractive than the S&P 500’s dividend yield of 2.13 percent, notes Andrew Wilkinson, chief economic strategist at Miller Tabak. That could portend more selling in stocks.

Still, at 14.4, the forward price to earnings ratio of the S&P 500 is slightly below the historic norm. A pullback could be a shallow one if valuations become more attractive, depending on the corporate earnings outlook.

“There has to be a rotation towards more compelling, compressed valuations,” said Knight’s Kenny. “That should be welcome, but that doesn’t mean it’s going to feel good.”