The slow boat to China is what gives FedEx executives nightmares

June 22, 2013 Leave a comment

June 18, 2013, 5:58 p.m. ET

FedEx Down, Not Out, on Express Slump

By SPENCER JAKAB

The slow boat to China is what gives FedEx Corp. executives nightmares.

Though it still dominates in express delivery, its customers are feeling less urgency these days—particularly those shipping packages internationally. The world’s largest air-freight company by volume is furiously cutting costs to accommodate those customers who don’t absolutely, positively have to get it there overnight. The slowdown in international trade and an even sharper one in time-sensitive deliveries loom over FedEx as it unveils results for fiscal 2013 Wednesday.A year ago, analysts polled by FactSet projected that FedEx would earn $7.35 a share in the 12 months through May, on an adjusted basis. By December, that had dropped to $6.40. Now they expect just $6.03, on the low-end of the $6-to-$6.20 range management outlined back in March after lousy fiscal third-quarter results.

The deterioration in reported earnings, which includes the cost of restructuring, is uglier still: a 20% drop from last year to $5.11 a share, the midpoint of the range outlined by management. Despite the gloom over its express segment, though, FedEx shares are up 13% in the past year and trade at 19.6 times estimated fiscal 2013 earnings, compared with just 12.1 times a year ago.

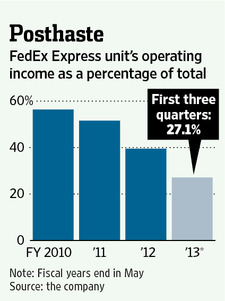

That looks worse than it is. Back in 2010, over 56% of FedEx’s operating income came from Express delivery. So far this fiscal year, it was less than half of that amount.

But that change was a result of a much more modest shift in volume and customer preferences. For example, international priority volume was 3.7% lower in the first three quarters of the most recent fiscal year, compared with that period 12 months earlier. Meanwhile, international economy volume rose over 10%.

A high overhead business will experience an exaggerated change in earnings at such times, but usually not a permanent one. If the current fiscal year’s earnings estimates are at all credible, then the financial community is probably right to be sanguine. FedEx trades at 13.7 times estimated fiscal 2014 earnings versus an average forward multiple of 16.1 times over the past 20 years.

A long-term view makes sense for an economically sensitive, superbly run company. Occasionally the bearer of bad news, FedEx delivers in the end.