Tencent-Naspers JV Ibibo Buys Redbus To Grow Its Online Travel Empire In India

June 23, 2013 Leave a comment

Tencent, Naspers JV Ibibo Buys Redbus To Grow Its Online Travel Empire In India

posted yesterday

China’s internet giant Tencent and South Africa’s media powerhouseNaspers are doubling down on tech in India. TechCrunch has just found out that Ibibo, their domestic joint venture, has acquiredredBus.in, a Bangalore-based online bus ticketing company that has become a dominant and disruptive force in how people travel in the country.Ibibo’s CEO and founder, Ashish Kashyap, tells us that the terms of the deal are not being disclosed, but there have been rumors of an acquisition in the works for some time, with prices in the region of around $135 million. The acquisition is interesting not only because it signals more activity for Ibibo, which is 80 percent owned by Naspers and 20 percent by Tencent, but also raises questions of whether the two plan to take Redbus’s platform and business model to new markets, like China for example.

Kashyap confirmed to TechCrunch that the company will keep Redbus running independently and operating as a separate business. It plans to bring Redbus into its existing travel portfolio which includes a B2C travel aggregator, Goibibo.com, and TravelBoutiqueOnline, a B2B travel agency platform.

He also reiterated that Phanindra Sama, the co-founder and CEO of Redbus, will be staying on and running the business under the new owner. “Yes. Absolutely. He is going to continue to participate with me and continue his role as the CEO of Redbus.”

Rumors have been swirling for the past week on Redbus’ acquisition, since a NextBigWhat report quoted a source saying a buy-out was on the cards for an estimated $135 million (800 crores).

Again, we don’t have details on the final sale price, but there are a number of signs of the company growing fast. Since the company’s founding in 2006, Redbus has shot past the 2 million user mark, and last year hit 10 million in ticket sales, using a combination of online reservations with confirmations delivered via SMS, usable across handsets in this feature-phone-dominated market.

It employs more than 600 staff, and sells more than a million tickets each month, across daily listings of 228,000 seats. It takes a commission from bus operators upon successful transactions.

If the $135m figure is accurate, it looks like a healthy exit for the copany. Bangalore-based Pilani Soft Labs, the formal name of the holding company that owns Redbus, raised a Series A round from Seedfund of $1 million. A Series B from Seedfund and Inventus Capital Partners in 2009 was for $2.5 million, and in 2011, Helion Venture Partners led a Series C to raise $6.5 million. Invenus and Seedfund came in for that latest round, as well.

As Drew pointed out when he visited Redbus in February, the company has been one to watch. Its chief product officer, Alok Goel, is an ex-Googler who approaches the business of organizing how people find and pay for bus tickets to a new level of big data. You can see how this model could be subsequently applied to the same situation further afield, or to different problems altogether.

If that is a problem that ambitious Redbus—and now its ambitious owners Tencent and Naspers—want to tackle, it could be some time before that happens. “The Indian online bus market itself is under penetrated at less than 6 percent,” Kashyap told TechCrunch. That means more room to grow at home first.

There is also the case with platforms. For now the majority of Redbus busines is online; the company only really started to make a push on mobile in February. With India as one of the world’s fastest-growing smartphone markets at the moment, this could present a new spurt of growth and opportunity for the company. IDC estimated that only 2.5 percent of mobile phones in the country were smartphones in 2012.

Tencent has also been keen to get in the Indian market. In July last year, it launched its mobile messaging app, WeChat, in India through Ibibo. When I visited its offices in Shenzhen earlier this year, the company spoke about how it conquered the domestic social networking scene, and its plans on expanding to more Asian countries. It’s started releasing TV ad campaigns in some of the countries in the region, and we can expect the company to continue to push its products in India.

Ibibo is owned by Naspers’ online media arm, MIH. Last year, MIH led a Series D round of $150 million in funding in Bangalore-based e-commerce company, Flipkart. MIH also won a board seat on Flipkart as a result of the funding. Flipkart sells a wide variety of consumer products such as books and apparel. The acquisition of Redbus could have it start cross-selling bus tickets on the site to the growing numbers of Internet-connected Indians.

Naspers has also declared it will up the ante on e-commerce, as online businesses grow for it in its home country of South Africa and abroad. Naspers chairman, Ton Vosloo, said during the company’s November 2012 earnings call that it is starting to place increasing focus on selling online. Last year, it acquired a majority stake in eMag, one of the biggest e-commerce sites in Romania. It also has a minority stake in Souq.com, an e-commerce portal in the Middle East, and bought 70 percent of Turkish shopping site, markafoni, in 2011.

Ibibo, the Naspers-Tencent joint venture in India, confirms its undisclosed acquisition of RedBus

Yesterday

This week speculation that Ibibo Group – a joint venture in India between South Africa’s Naspers and China’s Tencent — would buy online bus ticketing service RedBus

has dominated the news in India, and the deal has now finally been confirmed in an announcement.

Purported confirmation of the acquisition first appeared at the weekend (via Indian tech blog Next Big What) but, since the exit represents one of the most significant from an India-based company to date, we waited to hear final confirmation which came through today.

The deal will see Ibibo Group acquire RedBus parent company Pilani Soft Labs for an undisclosed amount, which Next Big What claims is $135 million (800 crores).

Importantly, RedBus will continue to operate “independently” with its existing management team, and as a separate business to the Ibibo Group’s impressive string of companies, which include Goibibo.com, PayU.in and Tradus.com.

RedBus was founded by Phanindra Sama in 2006. RedBus is one of a number of Web-based ticketing firms — like Makemytrip – which are helping to drive the travel industry online in India. The company claims to be India’s number online bus ticking platform, saying it aggregates 228,000 seats per day with more than a million tickets sold per month. It employs more than 600 staff across India.

“We are excited to be a part of ibiboGroup,” said Sama — who is CEO and co-founder of RedBus; and pictured to the left below — in a statement. “Naspers’ strong belief in Internet industry and operating experience in multiple countries will help redBus grow into a renowned brand in the coming years.”

Ibibo Group CEO Ashish Kashyap explained the motivation behind the deal for Redbus was threefold: down to the founding team, its strong position in the market and the growth potential.

“Online penetration of the bus market is only 5.7 percent compared to 28 percent for air travel, suggesting headroom for rapid future growth,” Kashyap added.

India is increasingly becoming a focus for companies as mobile devices help bring growing numbers of the population online, and make existing Internet users more Web savvy.

Amazon rolled out its marketplace site in India this month, and will begin selling its Kindle hardware from June 27. Likewise, Google is bringing its physical Android Nation stores to the country in a bid to increase its domestic visibility and share of the market. Both will look to imitate the success of Apple which, after introducing more aggressive approach to sales, saw the sales of its phones jump a reported 400 percent in recent months.

The sum of this increase in connectivity is that the captive audience for e-commerce firms is growing, and with that it attracts the attention of international firms.

eBay invested in local e-commerce player Snapdeal earlier this year in a deal that was finally confirmed this month. Like Ibibo, eBay did not disclose the size of its investment, but it did reveal that it had partnered with the three-year-old site for local sales and a potential future expansion.

Ibobo’s parent firms Naspers and Tencent both have a strong focus on e-commerce. The South African investment giant has a history of investments, while Tencent led the $150 million Series D round that Fab.com — another company that is planning to enter India — announced this week.

Redbus Has The Hot Ticket

by Rohin Dharmakumar | Mar 5, 2012

Phanindra Sama and Charan Padmaraju built India�s biggest online bus ticketing service. Now that service is helping boost demand for bus travel

As 2010 was drawing to a close, Kadamba Transport Corporation, Goa’s state owned and perennially loss-making bus operator, saw itself in the doldrums.

Thanks to factors that infect most state-run transport corporations—decrepit buses, many unprofitable routes, low occupancy and a snowballing salary bill—it was losing anywhere from Rs 2-3 crore every month. This was on top of a cumulative financial liability of over Rs 100 crore.

Faced with very few options, Venancio Furtado, Kadamba’s managing director, decided to try his luck with online ticketing for his interstate buses. In March 2011, Kadamba went live with its own Internet ticketing portal, powered by ‘BOSS’, a software reservation system made by Redbus, a Bangalore-based company.

What happened over the next few months was a miracle, at least for Kadamba. Travellers increased, drawn by the easy and quick online experience. Occupancy rates increased across most interstate routes from Goa; like Sholapur, Bangalore, Hampi, Shirdi and Mumbai. On those routes it started seeing a concept that was almost alien—profits.

In 2006, when the cherub-faced Phanindra Sama and laconic introvert Charan Padmaraju started Redbus, they were just two 25-year-olds with an “idea” to offer bus tickets online.

Instead, what they were wading into was a cesspool of unpredictable occupancy, rickety buses and stagnant routes, all leading to dissatisfied customers and resigned bus operators.

After five years of slogging away at those problems, the picture today is quite different.

“Most of Redbus’ competitors don’t realise the power of the bus travel market,” says Parag Dhol, a director with Inventus Capital Partners and one of the investors in the company. “There’s $3 billion of inventory among just private bus operators, growing at 25 percent annually.”

Thanks to good and ever improving roads, an expanding range of modern luxury coaches, and the hassle-free booking enabled by Redbus and many of its peers like Via, TicketGoose and MakeMyTrip, demand for bus travel is growing rapidly. And as customers vote for greater comfort and speed with their wallets, operators too are upgrading—buying expensive multi-axle buses, hiring ‘customer service managers’ and investing in technology.

Inspired by the turnaround story of Goa’s Kadamba, various state-run corporations too are now approaching Redbus to sell tickets online.

Maharashtra, one of the states that is currently implementing Redbus’ reservation system, has over 19,000 daily ‘schedules’ or trips.

That’s a single state running as many schedules as all 700 private operators currently on Redbus! Another large state, Rajasthan, is also set to adopt Redbus.

The bullishness is evident on the supply side too. “Including the 800 that it sold last year, Volvo has sold a total of 5,000 coaches in India from its inception 10 years ago. But they are ramping up manufacturing capacity to produce 5,000 coaches every year from 2015!” says Phanindra Sama, 30, CEO and co-founder of Redbus.

Buoyed by Volvo’s success, a rash of international coach makers are set to launch in India this year, including Toyota, Scania, MAN and Hyundai.

Spurred by this, Redbus’ business is booming. With a self-estimated market share of over 65 percent, it did over Rs 100 crore in sales during the last quarter of 2011. Despite the fact that most of the tickets it sold were worth just a few hundred rupees, it generated a cash profit of Rs 50 lakh, its first ever.

“Redbus has done a pretty phenomenal job and I have nothing but admiration for them. They focussed on a market that was extremely underserved and fragmented,” says Hrush Bhatt, co-founder and head of products and strategy at Cleartrip.com, one of the leading travel portals in India.

The secret to that is an unrelenting focus on keeping costs low. It claims to have never run an advertising campaign, preferring to rely on word-of-mouth through its largely loyal customer base. Its offices are housed in non-descript buildings, often close to bus terminals. Most senior management, including the founders, are frequent bus travellers themselves.

Therefore most of its growth has been self-funded, unlike the typical e-commerce startup that burns venture funding to buy growth. “Almost all the funding they’ve raised (Rs 42 crore) is still in the bank,” says Sanjay Anandaram, an early investor in the company and a board member.

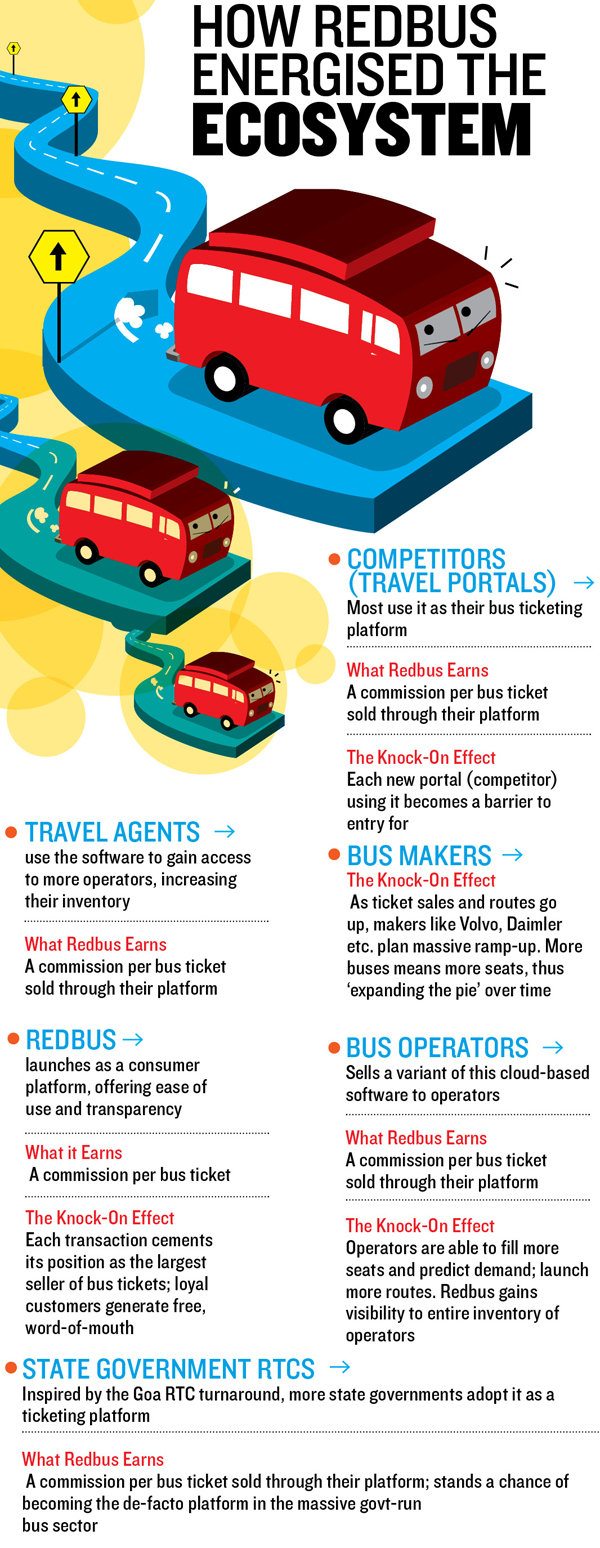

Using its significant transaction volume and loyalty among bus travellers, Redbus has gradually expanded its role with bus operators and travel agents. Through BOSS and Seat Seller, two cloud-based software services it developed and now sells to bus operators (for managing their operations), and travel agents (to aggregate and sell tickets across multiple operators), Redbus is slowly trying to establish itself as the industry’s reservation platform, like Amadeus or Sabre in airline travel.

There are other competing platforms, like Mantis (TravelYaari), AbhiBus and SimplyBus, but none with the comprehensiveness of Redbus’ offerings that combine consumers, operators and travel agents.

In the case of BOSS, Redbus charges 1 percent of every ticket sold by an operator, while for Seat Seller it charges anywhere from 1-5 percent from travel agents. Seat Seller has even been adopted by many of the travel websites who compete with Redbus on bus ticketing, like Yatra.com and Expedia.co.in.

With 600 operators on BOSS and over 10,000 travel agents on Seat Seller, the two already bring in between 10-15 percent of Redbus’ revenue and have the potential to become 20-30 percent over the next two years, says Sama.

But a subtler benefit will be access to the inventory of any bus operator or travel agent who uses BOSS or Seat Seller. “Take for instance routes like Rajahmundry-Kadapa in Andhra Pradesh which would never come into our inventory any time in the near future because they are too small for us to deliver. But through BOSS and Seat Seller, we will immediately see such inventory too,” says Sama.

That visibility could be the key to expanding in tier 2 and tier 3 towns, where an overwhelming majority of tickets are still sold manually. Consider this: Redbus, by far the largest bus ticket seller in India, offers around 18,000-20,000 tickets every day, out of an estimated total of nearly 300,000 across India.

“Through BOSS and Seat Seller, Redbus is co-opting the market. Then on, it becomes a virtuous cycle,” says Anandaram.

In 18 months we want to be Rs 1,000 crore in revenue and by 2015, Rs 3,000 crore, of which our profit should be around Rs 100 crore,” says Sama.

Considering Redbus is currently at an annualised revenue of Rs 400 crore, isn’t that a tall order?

Not really, say Redbus and its venture backers. Thanks to its no-nonsense and behind-the-scenes work over the last couple of years, it is now set to benefit from multiple cycles of adoption.

The first is its expansion into the state government-owned bus sector. Considering that Maharashtra alone runs more daily buses than all private operators on Redbus put together, the growth in volumes could be in multiples.

The rising adoption of BOSS and Seat Seller among operators and travel agents will bring on board revenue and seat inventory that will allow it to plot its future expansion.

There is its large and loyal customer base which allows it to grow organically sans expensive marketing expenses. In an era where most travel portals have to literally ‘buy’ transactions through search engine advertising (because users compare prices across sites, then choose the lowest), that is a huge advantage for Redbus. “Redbus’ organic customer base, combined with the efficiencies that come from scale, are already leading to falling costs per sale. So, while MakeMyTrip’s margins from airline tickets are coming down, Redbus’ from (much cheaper) bus tickets is going up,” says Anandaram.

And even if Redbus’ competitors were to realise the potential of this market, making money from it will be very difficult.

That’s because unlike airline ticketing where the ‘suppliers’, i.e. the airlines, are just a handful, there are over 2,000 bus operators across the country. Most of its larger competitors are also used to an operating model that works with high transaction costs and therefore, high absolute margins. “The economics of bus tickets are challenging, given you only make Rs 10-20 per transaction,” says Cleartrip’s Bhatt.

Vinay Gupta, founder and CEO of Via.com, one of the earliest bus ticketing portals in India, says there is quite simply no money because of the razor thin margins. “We entered this space in 2005, invested in creating the best of software and infrastructure, before realising by 2006 itself there wasn’t enough money in the sector to justify all those.”

But Sama, by now the battle-hardened fighter, is unperturbed. “Bangalore-Chennai used to be a loss-making route five years back with just three-four buses that ran on it. We built this route, and today there are over 150 buses on the same route,” he says.

Says Anandaram, “What are Redbus’ assets? A large customer base, a technology platform, offline networks and partnerships with a lot of backend operators. If I have these, what else can I do? Pretty much anything.”