U.S. Icons Now Made of Chinese Steel; The Verrazano-Narrows Bridge was a feat of American engineering when it was built across New York’s harbor in the 1960s. Now, it’s being repaired with steel made in China

June 23, 2013 Leave a comment

June 19, 2013, 9:02 p.m. ET

U.S. Icons Now Made of Chinese Steel

Imports Surge While U.S. Mills Idle; Lacking Bridge Expertise at Home

By JOHN W. MILLER and CHUIN-WEI YAP

The Verrazano-Narrows Bridge was a feat of American engineering when it was built across New York’s harbor in the 1960s. Now, it’s being repaired with steel made in China. Chinese steel imports have surged so far this year, even as U.S. producers are awash with excess domestic capacity. Chinese steel was also recently used in the San Francisco-Oakland Bay Bridge. The reason is partly because Chinese-made steel is cheaper. In fact, U.S. steel companies argue its price is unfairly subsidized, and want the U.S. government to restrict imports as much as possible. China claims it is simply a more efficient producer.

Also at play, however, is the relative scarcity of American contractors with expertise in specialized projects like bridges.

Together, these two factors show why the U.S. is unlikely to completely swear off Chinese steel.

Last year, New York’s Metropolitan Transportation Authority awarded a $235.7 million contract to a California contractor to repair the Verrazano-Narrows, a towering suspension bridge that is still the longest in the U.S.

The contractor, Tutor Perini Corp., TPC -3.48% subcontracted the fabrication of steel decks for the bridge to China Railway Shanhaiguan Bridge Group, which the MTA says is using 15,000 tons of steel plate made by China’s Anshan Iron & Steel Group. The decks will replace the two-level bridge’s concrete upper roadway.

The MTA said it tried to find a contractor whose bid for the project included American steel, but there was only one such bidder, Structal-Bridges, and its bid was twice as high as Tutor Perini’s, said MTA spokeswoman Judie Glave.

MTA officials said price wasn’t their only consideration, noting that Chinese companies have become specialists in making parts for bridges across the U.S.

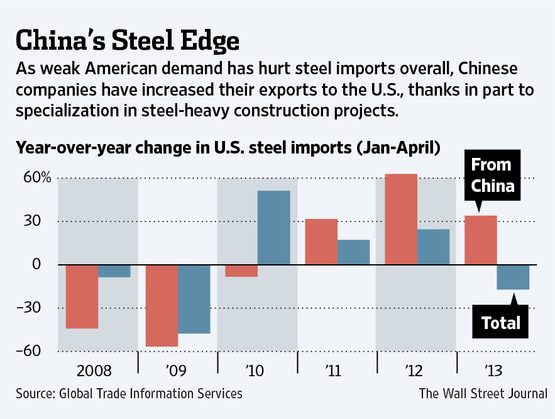

The bridge work is one of the reasons Chinese steel shipments to the U.S. have been surging. In the first four months of 2013 they jumped 33% from a year earlier to 480,095 tons. The increase is particularly striking because total U.S. steel imports for the period fell 17% to 10.6 million tons.

The China Iron and Steel Association said the growth is based on supply and demand, and suggested Chinese steel exports have been rising because they are more competitive. “Why is it that we can export more? It’s because of competitiveness on price and service,” said Li Xinchuang, the trade group’s deputy secretary-general.

U.S. steel mills, meanwhile, have been increasingly inactive. As of June 15, their production had fallen to 76.7% of their capacity from 78.8% a year earlier. The U.S. produced 88.6 million tons in 2012, 5.7% of the world’s total.

Most of the steel from China now goes into building projects like bridges and buildings, sweet spots for Nucor Corp., NUE +0.78% the No. 3 U.S. steelmaker, which makes half of its steel for the construction industry.

“Construction is essential to our business,” said Dan DiMicco, Nucor’s chairman and former chief executive. Though construction steel commands less of a premium than automotive steel, it is one of the biggest steel markets in volume terms.

It is also one that domestic steelmakers are looking to for growth in the wake of several high-profile bridge collapses and calls to boost infrastructure spending, and in anticipation of a rebound in construction of large, nonresidential buildings such as—office complexes, malls and hospitals, which consume 70% of the steel used in construction. The surge in Chinese imports is threatening those hopes.

“There’s usually a year-or-more lag,” said Daniel Meckstroth, chief economist of the Manufacturers Alliance for Productivity and Innovation, a manufacturing industry-funded research group based in Arlington, Va. Consumption of non-residential construction steel — for projects like ranging from bridges and highways to schools and hospitals — is expected to increase 1% this year and 6% in 2014, according to MAPI. New housing developments also need “more roads, highways and bridges,” he said, although that can take “several years.”

Bill McEleney of the National Steel Bridge Alliance, whose members make bridges and bridge parts, said many U.S. companies can build bridges, but not many are experienced with the flat-deck design being used these days to build or renovate heavily trafficked bridges.

In rapidly urbanizing China, such construction is booming. “The Chinese are building many more of these kinds of bridges, so they have more fabricators,” Mr. McEleney said.

Structal, a Chicago-based division of Canada’s Canam Group Inc., said it is the only U.S. company that makes decks for those type of bridges. Sales manager Tony Matutis said the company uses only American steel and can’t compete on price with China’s government-backed steelmakers.

Leo Gerard, president of the United Steelworkers union, said Chinese steel’s “supposed cost savings do not take into account the environmental price of shipping steel from hundreds of thousands of miles versus 100 miles, nor the cost to our fragile economic recovery and the loss of American jobs.”

The MTA said its bridge and tunnel repairs are funded by bonds backed by toll collections, and receive no state or federal funding. Therefore, they don’t fall under the Buy American Act, which requires government projects to use American-made products when possible.

Still, Ms. Glave said the “MTA wants to continue working with the domestic steel industry to develop American-made solutions for bridge renovations.”

Anshan Iron & Steel confirmed it and the China Railway Shanhaiguan Bridge Group were cooperating on the Verazzano-Narrows Bridge project. The companies also worked together on Alaska’s Tanana River Bridge, which the steelmaker described as China Railway Shanhaiguan’s first bridge project in the U.S.

Anshan described the New York project as a test of whether its steel bridges “can go out into the world.” Shanhaiguan couldn’t be reached for comment.

“Where there is construction activity occurring in the United States, domestic steel is often not being used,” said Alan Price, a trade attorney for Nucor. “Many construction projects are sourcing steel from overseas, including from state-owned enterprises in China.”

Wilson Huang, a manager with Shanghai-based steel-trading firm Falcon Resources isn’t surprised American companies are using Chinese steel. “U.S. production costs are high, and Chinese steel costs a lot less, so it’s natural that the U.S. is buying more,” he said.

Consultant John Packard, publisher of the Steel Market Update newsletter, recently surveyed American buyers of steel used in construction and found that prices for Chinese-made steel were 25% lower.

The U.S. government currently collects duties on Chinese steel products, including steel bars, plats and pipes, all used in construction. Last week,, mainly imposed during the Bush administration, currently the U.S. renewed tariffs on bars for five more years.

Earlier this month, the American Iron and Steel Institute, which represents U.S. steelmakers, called on President Barack Obama to extend the tariffs on other steel products.

Beijing has warned in the past that any U.S. effort to roll back Chinese steel exports would hurt broader bilateral economic ties with Washington.