The Mortgage Refinancing Gravy Train Just Ended

June 24, 2013 Leave a comment

The Mortgage Refinancing Gravy Train Just Ended

WALTER KURTZ, SOBER LOOK JUN. 23, 2013, 6:45 AM 3,136 3

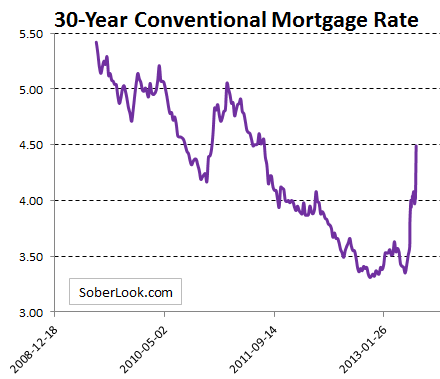

US 30yr mortgage rates spiked to a 2-year high on Friday (4.49%). In the near term this spike may actually push some potential buyers who have been on the sidelines into purchasing a home. People are concerned that rates will rise even further, which may have the effect of increasing June/July sales (see this story). The longer term effect however is less clear. While 4.5% is low by historical standards, it certainly takes a portion of the population out of the housing market. Also the speed of the rate spike may have a negative impact on consumer sentiment. Monthly payments on a new mortgage have increased by 10% from just a month ago (roughly $100/month for a median house price). One thing we can be confident of is that the wave of mortgage refinancing is over. Consumers have been putting extra cash into their pockets by refinancing multiple times in recent years. That gravy train just ended.