Oracle’s Power of Prophecy Fades; corporate customers are struggling to organize data that aren’t so easily structured but Oracle databases are suited best to information that is easily categorized in rows and columns

June 25, 2013 Leave a comment

June 24, 2013, 5:33 p.m. ET

Oracle’s Power of Prophecy Fades

Larry Ellison says his products aren’t the problem. Except that they are. What’s worse for investors, Oracle may be making imprudent investments as a result.

Explaining why his company missed its own fiscal fourth-quarter targets, Oracle’s chief executive pointed to “weakness” across each of the company’s core offerings. “So it was clearly an economic issue,” he said, “not a product competitive issue.”That isn’t clear. Just as likely, the broad-based slowdown reflects innovative rivals starting to eat Oracle’s lunch.

“Cloud” companies like Workday andSalesforce.com, for instance, offer software delivered over the Internet that is more modern, easier-to-use and cheaper to install than the legacy products that still underpin a sizable portion of Oracle’s own business. Late to the party, it is retrofitting its own products while buying other, small cloud companies.

Meanwhile, Oracle’s database offering isn’t the best option to handle new kinds of data that are flooding corporate servers. Its databases are suited best to information that is easily categorized in rows and columns. But corporate customers are struggling to organize data that aren’t so easily structured. Here, open-source software coupled with commodity hardware looks like a better answer, not least because it is significantly cheaper.

The higher cost of its products means another of Oracle’s assets, its hard-charging salesforce, may in some instances become a liability. When customers didn’t have good alternatives to Oracle’s products, it was easier to squeeze them. But a history of doing so can ultimately push them to take up new, rival products.

Oracle is actually investing more in sales, not just for newer cloud offerings but for legacy products as well. A lack of salesmen is unlikely to be the reason for flagging growth in Oracle’s legacy products. So adding to them in that business could represent doubling down on a bad hand.

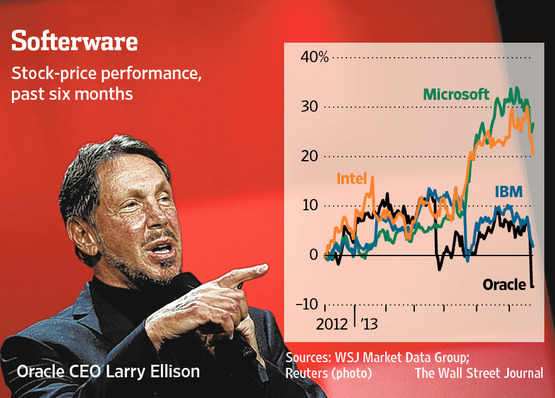

Oracle isn’t in a fundamentally worse position than its big tech peers, which face growth headwinds of their own. Oracle’s revenue in its most recent quarter were flat compared with a year earlier. But that actually stood out against revenue atInternational Business Machines, down 5%, and at Hewlett-Packard, down 10%.

Indeed, considering that IBM earnings per share are expected to grow at an average rate of 10% through 2015, compared with 9% for Oracle, it is tough to justify IBM’s premium valuation. Its cash-adjusted market capitalization is about 13 times this year’s forecast earnings, a roughly 40% premium to Oracle.

But judging a rival to be overvalued isn’t necessarily the most compelling argument for Oracle’s own shares being undervalued. One big risk is that, to protect the installed base of customers that help Oracle generate free cash flow, it will have to cut better deals on the lucrative maintenance fees it charges.

Oracle has now missed its own financial targets in four of its past nine quarters, notes Cowen analyst Peter Goldmacher. As new rivals, and competing products, spring up, it is getting harder for Oracle to see its own future prospects clearly.