Nike Earnings May Be Tripped Up by China

June 27, 2013 Leave a comment

Updated June 26, 2013, 7:57 p.m. ET

Nike Earnings May Be Tripped Up by China

SPENCER JAKAB

With LeBron, Tiger and Federer on the payroll, clutch performances should be business as usual for Nike Inc.

Looking back at a decade of quarterly earnings reports, that has been the case with 36 “beats” of the analyst consensus out of 40 opportunities. The company’s performance against the point spread was less impressive, with the stock rising on just 27 occasions.

Although Nike shares fall on earnings day only a third of the time, Thursday’s fiscal fourth-quarter report runs a higher risk than most. Forecast earnings of $2.68 a share for the year through May, up from $2.37 a year earlier, look achievable.

But investors care more about “futures”—anticipated future shipments—and those have the potential to disappoint. It was last June that Nike saw its sharpest one-day share-price drop in years after unveiling weak fourth-quarter earnings and a sharp cut in futures. The culprit that time, “Greater China,” looks shaky again.

The region is important, having made up a 10th of brand revenue and nearly a fifth of operating earnings through the first three fiscal quarters. Operating earnings there fell 15% year over year in that period, compared with a 23% rise in the North America market. Management made cautious comments in March about reducing inventory in Greater China and efforts to “reset the marketplace.”

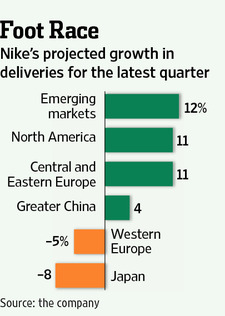

The stumbles of local rivals Li Ning 2331.HK 0.00% and Anta 2020.HK +0.75% may have taken some pressure off Nike, the top sportswear brand in China by sales. ButAdidas AG ADS.XE +1.18% is breathing down its neck and hasn’t reported the same problems with excess inventory. Nike’s futures for China were positive 4% at the last quarterly update—still far better than minus-8% for Japan and minus-5% for Western Europe, but worse than positive 11% for North America. Management cautioned, though, that revenue in China may be lower than those forward orders indicate.

Nike isn’t priced for perfection but, at nearly 24 times trailing earnings, looks expensive compared to its 10-year average of 20 times. The stock has returned 40% since its sharp stumble a year ago following the China warnings and has retreated only slightly more than the broad market from its spring high.

Though the odds are poor when betting against Nike, the time seems ripe for an upset.