Tipping Point Analysis in Value Investing

Saturday, 31 August 2013 from 09:00 to 17:00 (SGT)

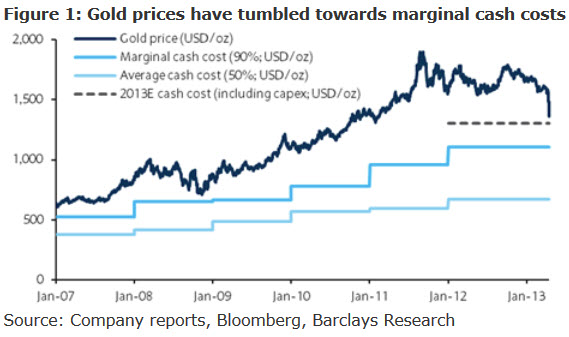

Waiting is the main drawback in value investing. Investors often lose patience with their stocks when they don’t perform in the short-term to produce a feel-good comfort that we are right in our stock calls. That’s why fund managers under pressure to deliver short-term results always ask, “Any upcoming catalysts?” This cannot be more misleading when there is an insufficient understanding in the scalability and resilience of the underlying business model.

When iPod was introduced on November 10, 2001, Apple’s share price was US$9.40 per share and had jumped to US$12 by year end. Those who had loaded up on the “iPod effect” or “new product” catalyst suffered for the next year-and-a-half as the shares plunged to US$6.70 in April 2003. Disappointed, momentum traders cloaked under the label of fund managers sell the stock. Then a “tipping point” moment happened in April 2003 to bring about the extraordinary 60-fold returns in the next decade to US$428 per share, or US$400 billion in market cap. What was this “tipping point” event? One such “tipping point” event is the launch of the iTunes Store on April 28, 2003.

Serious institutional investors spend most of their time not in looking at stock price screens or gaining “insider” knowledge of “catalysts” to generate alpha or excess returns, but in analyzing the interaction of business model dynamics with “tipping point” events so that they literally hear and see the “clicking” sound when they occur to produce a resilient compounder. It is our task to have a systematic framework to understand and identify “tipping point” events when they occur to stay ahead of the momentum traders and colluding insiders (庄家) on the investing curve.

Course Highlights:

– Mr Kee, one of the few Asian fund manager being invited to speak at a number of top banking & finance conferences around the world alongside with renowned speakers such as Praveen Kadle, Chief Executive Officer of Tata Capital & Lauren Templeton, President of Lauren Templeton Capital Management

– Learn from an experienced & qualified instructor who has taught in local Universities

Program Outline and Key Learning Points:

- UNDERSTAND the stock market reactions to a wide-range of “catalysts”:

– “Post-earnings announcement drift (PEAD)”,

– “Capital management programs” (e.g. dividends, capital reduction, share buybacks, bonus issue, rights, splits, share/debt placement) and “Financial structure changes”,

– “Analyst coverage and recommendations”,

– and many more.

- GAIN the surprising insight to why certain positive catalyst signals can be misleading noise, for instance, insider purchase can be negative. And also why overreaction to certain negative catalyst signals can be an opportunity.

- DEVELOP the ability to distinguish between “catalysts” with unsustainable short-term effects and “tipping point” with long-term value relevance.

- LEARN where M&A pays and where it strays and the pitfalls.

- DISSECT a wide range of real-world cases of Asian and global Bamboo Innovators in various industries and understand the tipping point in their business models.

- UNIFY at the end of the day all the previously disparate loose-hanging concepts, descriptive facts and “checklists” you have learnt from various sources into the practical Bamboo Innovator mental model when it comes to real investment decision-making.

Understand more about the Instructor’s investment approach with the following published articles:

About the Instructor:

Koon Boon is the founder and managing director of the Singapore-based Bamboo Innovator Institute to establish the thought leadership of resilient value creators around the world. KB has been rooted in the principles of value investing for over a decade as a fund manager and analyst in the Asian capital markets. He was a fund manager and head of research/analyst at a Singapore-based investment management organization dedicated to the craft of value investing in Asia. He had been with the firm since 2002 and was also part of the core investment committee in significantly outperforming the index in the 10-year-plus flagship Asian fund. He was previously the portfolio manager for Asia-Pacific equities at Korea’s largest mutual fund company. He received his Masters in Finance (magna cum laude) and double degree in Accountancy and Business Management (both summa cum laude) from the Singapore Management University (SMU). He had taught accounting at his alma mater in SMU and at SIM University. He had published research in the Special Issue of Istanbul Stock Exchange 25th Year Anniversary of the Boğaziçi Journal, Review of Social and Economic Studies, as well as wrote articles about value investing and corporate governance in the media. He had also presented in top banking and finance conferences in Sydney, Cape Town, HK, Beijing and in the recent Emerging Value Summit 2013. He had trained CEOs, entrepreneurs, CFOs, management executives in business strategy, macroeconomic and industry trends in Singapore, HK and China.