This Is The Year That China Becomes The World’s Top E-Commerce Market; China’s Luxury E-Commerce Market to Be Worth $27 Billion in 2013

June 27, 2013 Leave a comment

This Is The Year That China Becomes The World’s Top E-Commerce Market (CHARTS)

June 27, 2013

With China’s e-commerce market set to be worth nearly $300 billion this year, 2013 will mark the watershed moment when China surpasses the US to become the world’s top e-shopping market. Looking at data from Forrester Research and iResearch for the two nations, Chinese netizens will collectively spend an estimated $296 billion in the whole of 2013, while US e-shoppers will spend $252 billion. Here’s the pattern of growth: The chart is from a new report on luxury e-commerce in China by Washington-based Observer Solutions. Of course, China’s succession is an inevitable progression as China’s realistic, addressable e-commerce market grows to the point of nearly exceeding the entire population of the US. Indeed, the same report states that the penetration of online shopping in China hit 42.9 percent in 2012 so that the country had 242 million e-shoppers last year. America’s whole population is 314 million. Check out the number China will have by 2015:

In 2012, the average Chinese online consumer spent RMB 5,203 ($840), up 25 percent from 2011. By 2015 that average spend per online shopper is estimated to reach $1,134. China’s e-shoppers are not shy about buying big-ticket items online, as seen with successful experiments such as the way Jingdong (formerly called 360Buy) sold 300 Smart cars in just 90 minutes on its site. If you can afford to spend a lot more on a set of wheels, you can even buy a Lamborghini on Tmall. Looking at the luxury e-commerce sector, that’s set to be worth $27 billion this year. It covers everything from global brands like Hugo Boss selling online in China, Net-A-Porter’s China venture, or homegrown luxury e-stores such as Jingdong’s 360Top. Though luxury online sales will grow well, they’ll likely remain stymied by middle- and upper-income Chinese preferring to purchase overseas where shopping taxes are lower. Despite that, online sales of luxury goods represent a good way for major high-end brands of all types to expand to smaller cities in China where there’s a growing amount of middle-class demand for such items. As for mobile commerce, the Chinese m-commerce sector will have to wait until 2014 to surpass the US.

China’s Luxury E-Commerce Market to Be Worth $27 Billion in 2013 (INFOGRAPHIC)

June 27, 2013

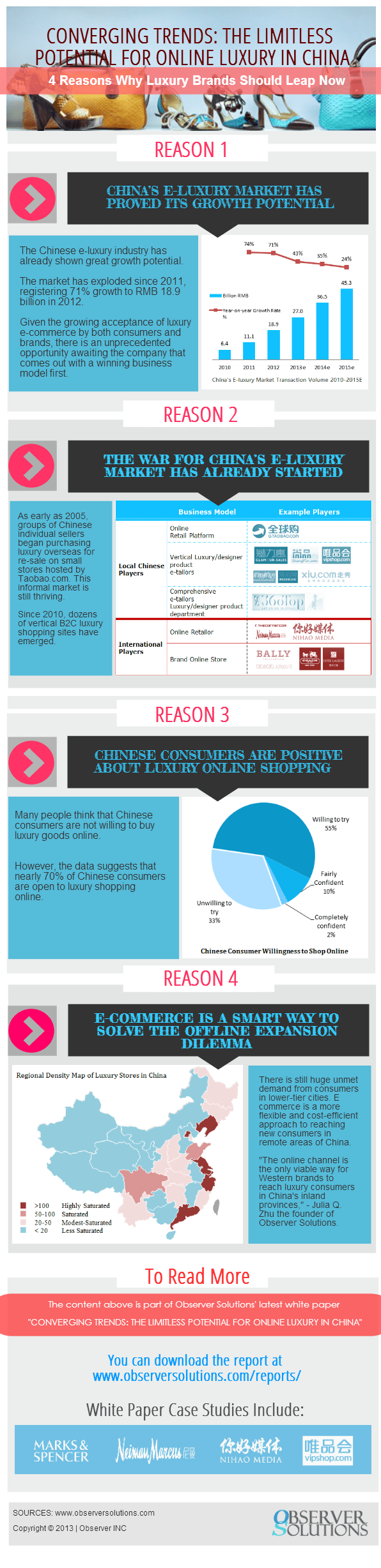

by Steven MillwardAs we wrote earlier today, China’s e-commerce market looks set to be worth $296 billion in 2013 as China surpasses America to be the world’s top e-commerce market. In that industry, one of the most interesting and international segments is Chinese luxury e-commerce. According to a new report by Washington-based Observer Solutionstoday, the country’s online luxury sales will be worth an estimated $27 billion this year. The report’s authors also made an infographic (see below) that outlines the numbers and key players in this high-end sector in China. It’s structured around four reasons why luxury brands should leap into China right now if they haven’t done already. As we’ve chronicled on this blog over the years, China’s priciest and most prestigious e-stores are a diverse bunch of excellent businesses, from global haute couture brands like Net-A-Porter, to homegrown startups prospering in fine wine e-commerce, to high-end flash sales site VipShop.