Gold Drop Uncovers Miners’ Debt Woes; No gold miner took on more debt than the world’s largest, Barrick Gold

June 29, 2013 Leave a comment

Updated June 28, 2013, 7:52 p.m. ET

Gold Drop Uncovers Miners’ Debt Woes

Barrick said it is postponing production at its Pascua Lama mine in Chile, where costs have ballooned to $8.5 billion from $5 billion.

The recent plunge in the price of gold is exposing the large debt loads that big gold miners, such as Barrick Gold Corp., ABX.T +6.62% took on during the boom years.

Gold miners are scrambling to cut costs, sell assets and shore up finances, as credit-rating services talk of debt downgrades that threaten to add to the already increasing costs of future borrowing.

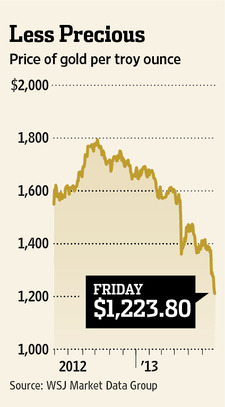

In the second quarter, the price of gold posted its largest quarterly decline since the start of modern gold trading. Gold fell 23% in the period to close at $1,223.80 a troy ounce on Friday. Already, the price of gold doesn’t cover the overall costs of many gold miners. Plummeting share prices have made financing the shortfall through equity markets hard.

“If prices below $1,300 are sustained for more than two quarters, without significant changes to spending, I would expect we could see ratings downgrades,” said Donald Marleau, an analyst at Standard & Poor’s Ratings Services.

Gold miners had typically steered clear of leverage, but in recent years miners such as Barrick Gold and Newmont Mining Corp. NEM +8.08% took on debt to finance big new projects and takeovers at prices that have often proved overvalued.

In the past 10 years, the 55 gold and silver companies analyzed by BMO Capital Markets have increased their net debt, or debt minus cash, from less than $2 billion to a record of $21 billion. Interest rates were low, but rising costs amid a global commodities boom became a drag on share prices. That made debt, rather than equity, a more attractive option as these companies embarked on a massive industry consolidation drive.On top of falling metals prices, miners face rising costs. The cost of mining an ounce of gold rose to $775 in 2012 from $280 in 2005, according to BMO. That has left many miners spending more money than they are earning. The shortfall was addressed by raising funds with bonds and shares, but those markets are getting increasingly harder to access.

In recent weeks, credit markets have seen broad selling as investors worry over the stability of China’s financial system and the withdrawal of central-bank-injected liquidity. But investors have turned against miner’s bonds more than most. Spreads to benchmarks on the Bank of America BAC -1.15% Merrill Lynch Metals, Mining and Steel Index have moved out to 274 basis points, or 2.74 percentage points, from 205 basis points in mid-May. On the Bank of America Merrill Lynch U.S. Corporate Index, spreads moved to 168 basis points from 142 basis points over the same time period.

No gold miner took on more debt than the world’s largest, Barrick Gold. In 2008, Barrick had $4.5 billion in debt outstanding. Now, it has $14.8 billion, after borrowing to pay for its $7.65 billion takeover of Equinox Minerals Ltd. in 2011. That deal diversified Barrick into something other than gold—copper—just as copper prices were tanking.

On Friday, Barrick announced more bad news, postponing its flagship Pascua Lama mine, whose cost estimate has gone up to $8.5 billion from around $5 billion. Barrick said it would delay production by at least a year and a half and warned of an impairment charge that could be up to $5.5 billion on the project in Chile and Argentina.

“In light of the challenging business environment we are facing today, and taking into consideration existing construction delays, the company is advancing the project in a prudent manner by extending the construction schedule over a longer period,” Barrick’s CEO Jamie Sokalsky said.

Currently Barrick is spending more money that it is making. Deutsche BankDBK.XE -2.97% has estimated that with the gold price at $1,300 per ounce, it will cost Barrick $513 more this year, given its overall costs, to mine an ounce of gold than it gets back through selling it. Depending on the amount it mines, that would mean a funding gap of $3.4 billion in 2013, not taking into account any cost-cutting or cash-raising measures.

“They [Barrick] probably have a more challenging time right now,” said Carol Cowan, senior credit officer at Moody’s Investors Service. Ms. Cowan sees a gold price below $1,300 through this and next year as “problematic” for the industry’s credit quality.

Trading of Barrick’s outstanding debt shows that credit markets are now more expensive for the firm. In November last year, a $1.3 billion bond, maturing in 2021, traded at 111.35 cents to the dollar. It now trades at 91.86 cents to the dollar.

“Our debt repayment obligations in the next few years are modest, with the majority maturing beyond 2023,” a Barrick spokesman said.

Other miners have seen similar selloffs, including fellow North American giants Newmont and Kinross Gold Corp. K.T +10.91% A 30-year bond issued last year by Newmont, for instance, is now trading at around 76.8 cents to the dollar.

A spokesman for Newmont said that the company has “substantial flexibility on its balance sheet” and plans $100 million in capital-expenditure cuts this year among other cost-saving measures.

Kinross has reduced debt by 20% in the first quarter of 2013 and has “many options” to reduce costs and preserve capital, a spokesman said.

To be sure, nobody is predicting an imminent liquidity crisis for Barrick. It has $2 billion on its balance sheet. The Toronto-based firm says it is cutting costs: It recently shed about a third of its corporate-headquarters staff, and it is rethinking big projects. Last week it sold part of its energy business, having said it is looking to shed assets.

At the same time, Barrick is promising shareholders it will refresh its board, amid complaints about longtime Chairman Peter Munk’s grip on the company.

Some bankers say, though, the increasing cost of debt for miners makes acquisitions more expensive for buyers of assets in that industry and so thins the potential audience for Barrick and others trying to sell assets.