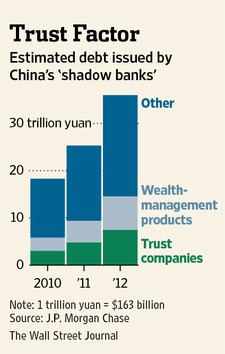

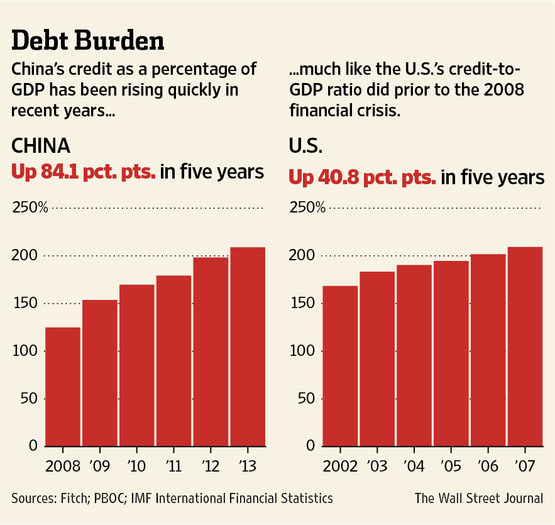

A big PBOC bluff? Alot of the FX purchase were the result of borrowed dollars coming into the Chinese system, rather than pure trade dollars, and that much of the RMB liquidity created against those dollars headed straight into the weapons of mass ponzi market instead of Chinese Treasury bills

June 25, 2013 Leave a comment

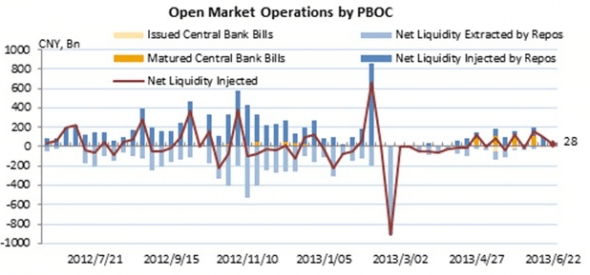

The PBOC’s “this is not the liquidity crisis you’re looking for” statement at the weekend may have drawn attention, but it didn’t really manage to reassure equity markets. The Shanghai Composite closed over 5 per cent lower on the day. The issue at hand may be linked to this: That would be the Chinese RMB weakening against the US dollar, in the context of a generally strengthening dollar index:

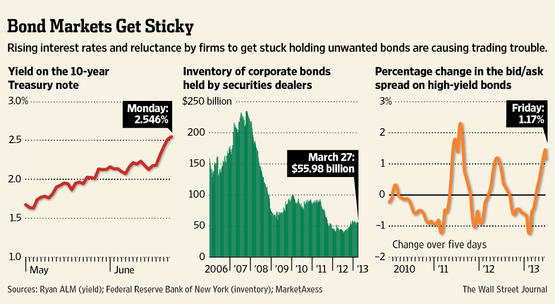

This is worth bearing in mind in light of the ‘other‘ hypothesis explaining some part of the trouble in China at the moment. This is based on the idea that the mother of all carry-trades may be being pushed to its limits by rising US bond yields, FX volatility and Fed taper speculation (if not the Chinese’ own attempt to stamp out over-invoicing practices). Read more of this post