Refinancings Plunge as Bond Yields Rise

June 14, 2013 Leave a comment

June 13, 2013, 11:25 p.m. ET

Refinancings Plunge as Bond Yields Rise

By NICK TIMIRAOS and ANDREW R. JOHNSON

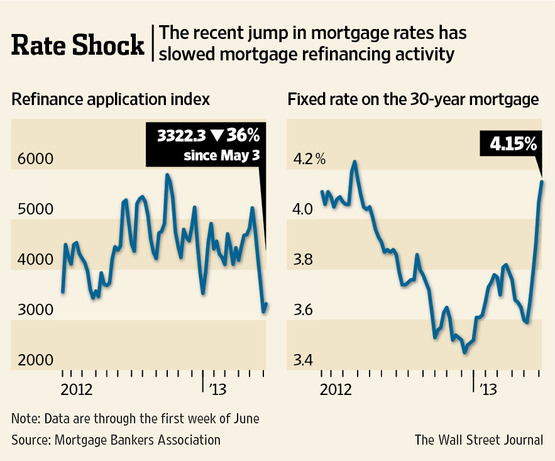

A surprise spike in mortgage rates threatens to halt a refinancing boom that has delivered strong profits for U.S. banks over the past two years.

The average rate on a 30-year mortgage rose to 4.15% last week, a 14-month high and up sharply from 3.59% in early May, according to the Mortgage Bankers Association. A separate survey released Thursday by Freddie Mac FMCC -5.56%said the rate this week was at 3.98%, up from 3.35% last month.

Refinancing applications last week were down 36% from the first week of May, before rates began climbing, according to the bankers association. Read more of this post